Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that OT Logistics S.A. (WSE:OTS) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for OT Logistics

What Is OT Logistics's Net Debt?

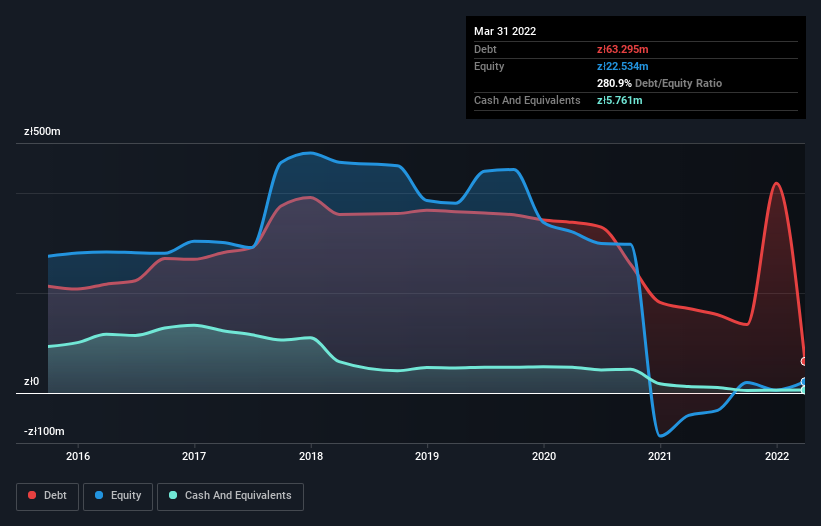

The image below, which you can click on for greater detail, shows that OT Logistics had debt of zł63.3m at the end of March 2022, a reduction from zł168.9m over a year. However, it also had zł5.76m in cash, and so its net debt is zł57.5m.

A Look At OT Logistics' Liabilities

We can see from the most recent balance sheet that OT Logistics had liabilities of zł193.6m falling due within a year, and liabilities of zł415.9m due beyond that. On the other hand, it had cash of zł5.76m and zł96.4m worth of receivables due within a year. So its liabilities total zł507.3m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the zł151.3m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, OT Logistics would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

OT Logistics has a low net debt to EBITDA ratio of only 0.35. And its EBIT covers its interest expense a whopping 1k times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Even more impressive was the fact that OT Logistics grew its EBIT by 139,890% over twelve months. That boost will make it even easier to pay down debt going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But it is OT Logistics's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Looking at the most recent two years, OT Logistics recorded free cash flow of 35% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

We feel some trepidation about OT Logistics's difficulty level of total liabilities, but we've got positives to focus on, too. To wit both its interest cover and EBIT growth rate were encouraging signs. We think that OT Logistics's debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example - OT Logistics has 3 warning signs we think you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:OTS

OT Logistics

Provides port services in Poland and Central and Eastern Europe.

Mediocre balance sheet second-rate dividend payer.

Market Insights

Community Narratives