We Think Enter Air Sp. z o.o (WSE:ENT) Is Taking Some Risk With Its Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Enter Air Sp. z o.o. (WSE:ENT) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Enter Air Sp. z o.o

What Is Enter Air Sp. z o.o's Debt?

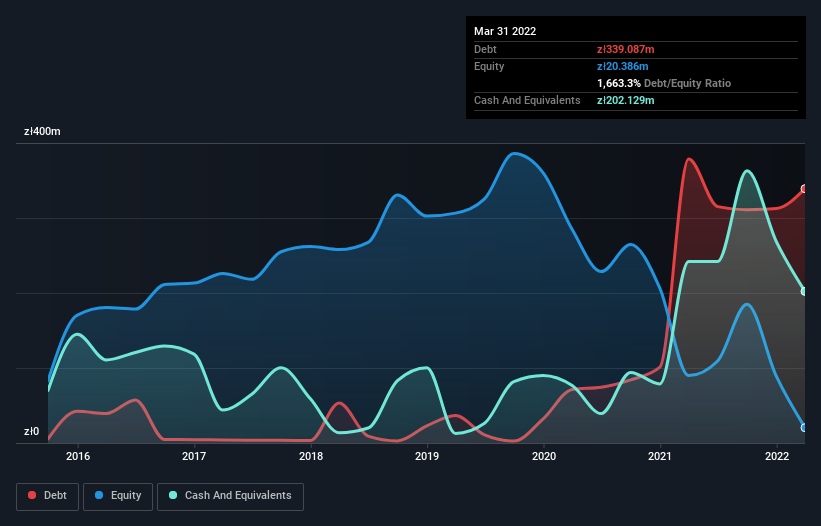

As you can see below, Enter Air Sp. z o.o had zł339.1m of debt at March 2022, down from zł378.7m a year prior. However, it does have zł202.1m in cash offsetting this, leading to net debt of about zł137.0m.

How Strong Is Enter Air Sp. z o.o's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Enter Air Sp. z o.o had liabilities of zł558.2m due within 12 months and liabilities of zł1.22b due beyond that. On the other hand, it had cash of zł202.1m and zł98.4m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by zł1.48b.

This deficit casts a shadow over the zł401.8m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Enter Air Sp. z o.o would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Given net debt is only 0.48 times EBITDA, it is initially surprising to see that Enter Air Sp. z o.o's EBIT has low interest coverage of 1.2 times. So while we're not necessarily alarmed we think that its debt is far from trivial. Notably, Enter Air Sp. z o.o made a loss at the EBIT level, last year, but improved that to positive EBIT of zł58m in the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Enter Air Sp. z o.o will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Over the last year, Enter Air Sp. z o.o actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

On the face of it, Enter Air Sp. z o.o's interest cover left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Enter Air Sp. z o.o stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Enter Air Sp. z o.o has 3 warning signs (and 2 which are potentially serious) we think you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Enter Air might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:ENT

Good value average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)