- Poland

- /

- Telecom Services and Carriers

- /

- WSE:YRL

Is Now The Time To Put Unima 2000 Systemy Teleinformatyczne (WSE:U2K) On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like Unima 2000 Systemy Teleinformatyczne (WSE:U2K), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Unima 2000 Systemy Teleinformatyczne

How Fast Is Unima 2000 Systemy Teleinformatyczne Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Unima 2000 Systemy Teleinformatyczne has grown EPS by 4.8% per year. While that sort of growth rate isn't amazing, it does show the business is growing.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While Unima 2000 Systemy Teleinformatyczne may have maintained EBIT margins over the last year, revenue has fallen. And that does make me a little more cautious of the stock.

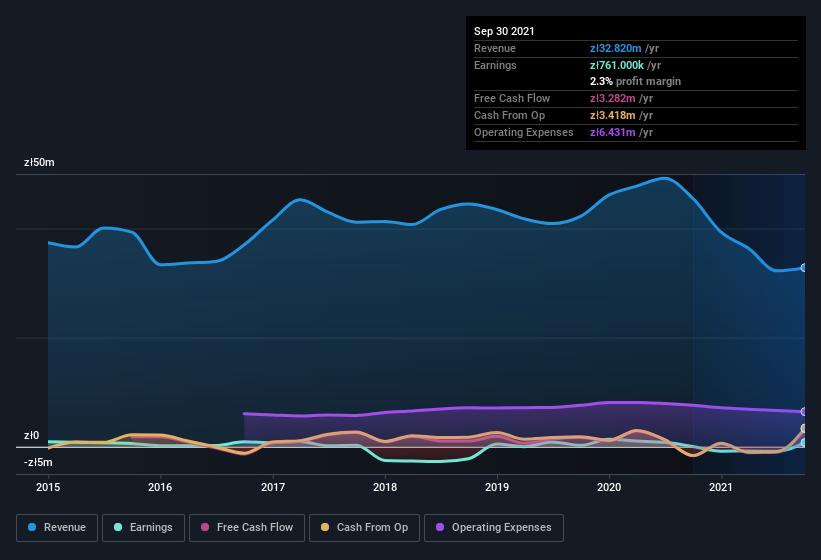

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Unima 2000 Systemy Teleinformatyczne isn't a huge company, given its market capitalization of zł10m. That makes it extra important to check on its balance sheet strength.

Are Unima 2000 Systemy Teleinformatyczne Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So we're pleased to report that Unima 2000 Systemy Teleinformatyczne insiders own a meaningful share of the business. In fact, they own 64% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Of course, Unima 2000 Systemy Teleinformatyczne is a very small company, with a market cap of only zł10m. So despite a large proportional holding, insiders only have zł6.5m worth of stock. That might not be a huge sum but it should be enough to keep insiders motivated!

Should You Add Unima 2000 Systemy Teleinformatyczne To Your Watchlist?

One positive for Unima 2000 Systemy Teleinformatyczne is that it is growing EPS. That's nice to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. We should say that we've discovered 2 warning signs for Unima 2000 Systemy Teleinformatyczne (1 is a bit unpleasant!) that you should be aware of before investing here.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:YRL

yarrl

Operates in the information technology (IT) and telecommunications industries in Poland.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026