Here's What Eurotel's (WSE:ETL) Strong Returns On Capital Mean

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Ergo, when we looked at the ROCE trends at Eurotel (WSE:ETL), we liked what we saw.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Eurotel is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.23 = zł24m ÷ (zł182m - zł78m) (Based on the trailing twelve months to September 2021).

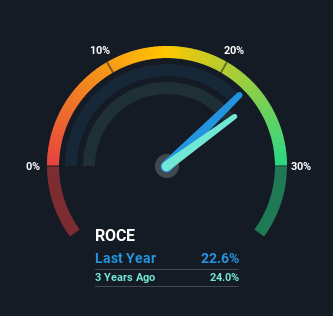

So, Eurotel has an ROCE of 23%. That's a fantastic return and not only that, it outpaces the average of 15% earned by companies in a similar industry.

Check out our latest analysis for Eurotel

Historical performance is a great place to start when researching a stock so above you can see the gauge for Eurotel's ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Eurotel, check out these free graphs here.

What The Trend Of ROCE Can Tell Us

It's hard not to be impressed by Eurotel's returns on capital. Over the past five years, ROCE has remained relatively flat at around 23% and the business has deployed 121% more capital into its operations. Returns like this are the envy of most businesses and given it has repeatedly reinvested at these rates, that's even better. If Eurotel can keep this up, we'd be very optimistic about its future.

On a separate but related note, it's important to know that Eurotel has a current liabilities to total assets ratio of 43%, which we'd consider pretty high. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

The Bottom Line On Eurotel's ROCE

In summary, we're delighted to see that Eurotel has been compounding returns by reinvesting at consistently high rates of return, as these are common traits of a multi-bagger. And the stock has done incredibly well with a 170% return over the last five years, so long term investors are no doubt ecstatic with that result. So while investors seem to be recognizing these promising trends, we still believe the stock deserves further research.

On a final note, we've found 2 warning signs for Eurotel that we think you should be aware of.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

Valuation is complex, but we're here to simplify it.

Discover if Eurotel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:ETL

Eurotel

Operates a chain of retail stores of telecommunications operators and various electronics manufacturers in Poland.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026