- Switzerland

- /

- Medical Equipment

- /

- SWX:CLTN

Proeduca Altus And 2 Other Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

In recent weeks, the European market has faced a challenging environment, with the pan-European STOXX Europe 600 Index declining amid concerns over U.S. trade tariffs and monetary policy uncertainties. Despite these headwinds, opportunities still exist for investors willing to explore lesser-known stocks that can enhance their portfolios by offering unique growth potential in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nederman Holding | 69.60% | 11.43% | 16.35% | ★★★★★★ |

| FRoSTA | 6.15% | 4.62% | 14.67% | ★★★★★★ |

| Linc | NA | 19.35% | 23.17% | ★★★★★★ |

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| OHB | 57.88% | 1.74% | 24.66% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Proeduca Altus (BME:PRO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Proeduca Altus, S.A. is a company that specializes in providing online education services and has a market capitalization of approximately €1.39 billion.

Operations: Proeduca Altus generates revenue primarily through the provision of services, amounting to €344.09 million, alongside a minor contribution from sales at €0.03 million.

Proeduca Altus, a notable player in the education sector, has demonstrated robust financial health with a 20.8% earnings growth over the past year, outpacing the Consumer Services industry average of 12.5%. The company's debt to equity ratio improved from 0.2 to 0.1 over five years, reflecting prudent financial management. Recent developments include Portobello Capital and Sofina acquiring over 30% of Proeduca's shares at a valuation of €1.4 billion, aiming for delisting from BME Growth. Despite these changes, founder Miguel Arrufat retains majority control with a 51% stake in the company’s operations.

- Click here and access our complete health analysis report to understand the dynamics of Proeduca Altus.

Explore historical data to track Proeduca Altus' performance over time in our Past section.

COLTENE Holding (SWX:CLTN)

Simply Wall St Value Rating: ★★★★★★

Overview: COLTENE Holding AG specializes in the development, manufacturing, and sale of dental disposables, tools, and equipment across various global regions with a market cap of CHF365.69 million.

Operations: With a revenue of CHF250.20 million, COLTENE Holding AG generates income from the sale of dental disposables, tools, and equipment. The company operates across multiple regions including Europe, the Middle East, Africa, North America, Latin America, and Asia/Oceania.

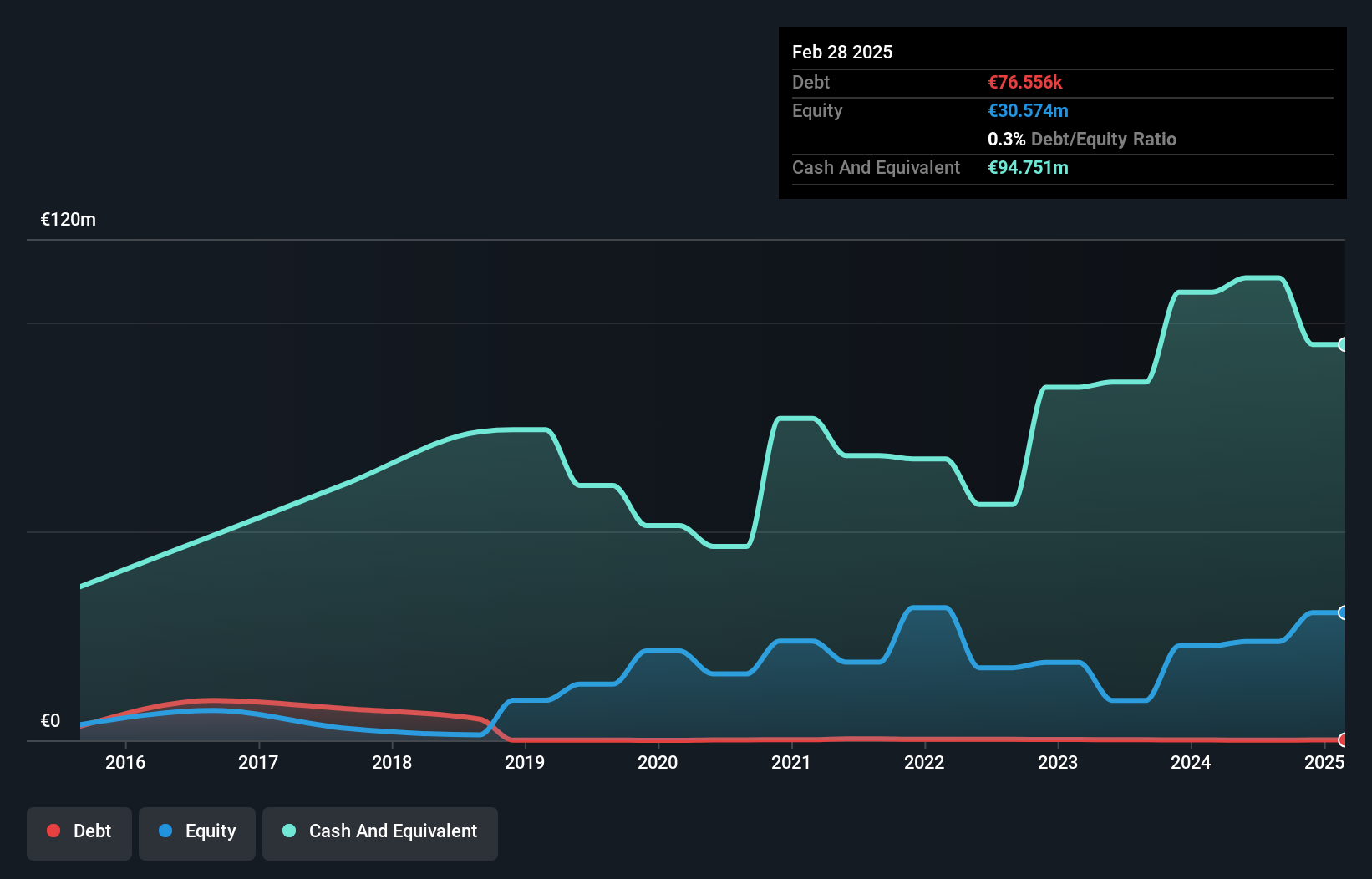

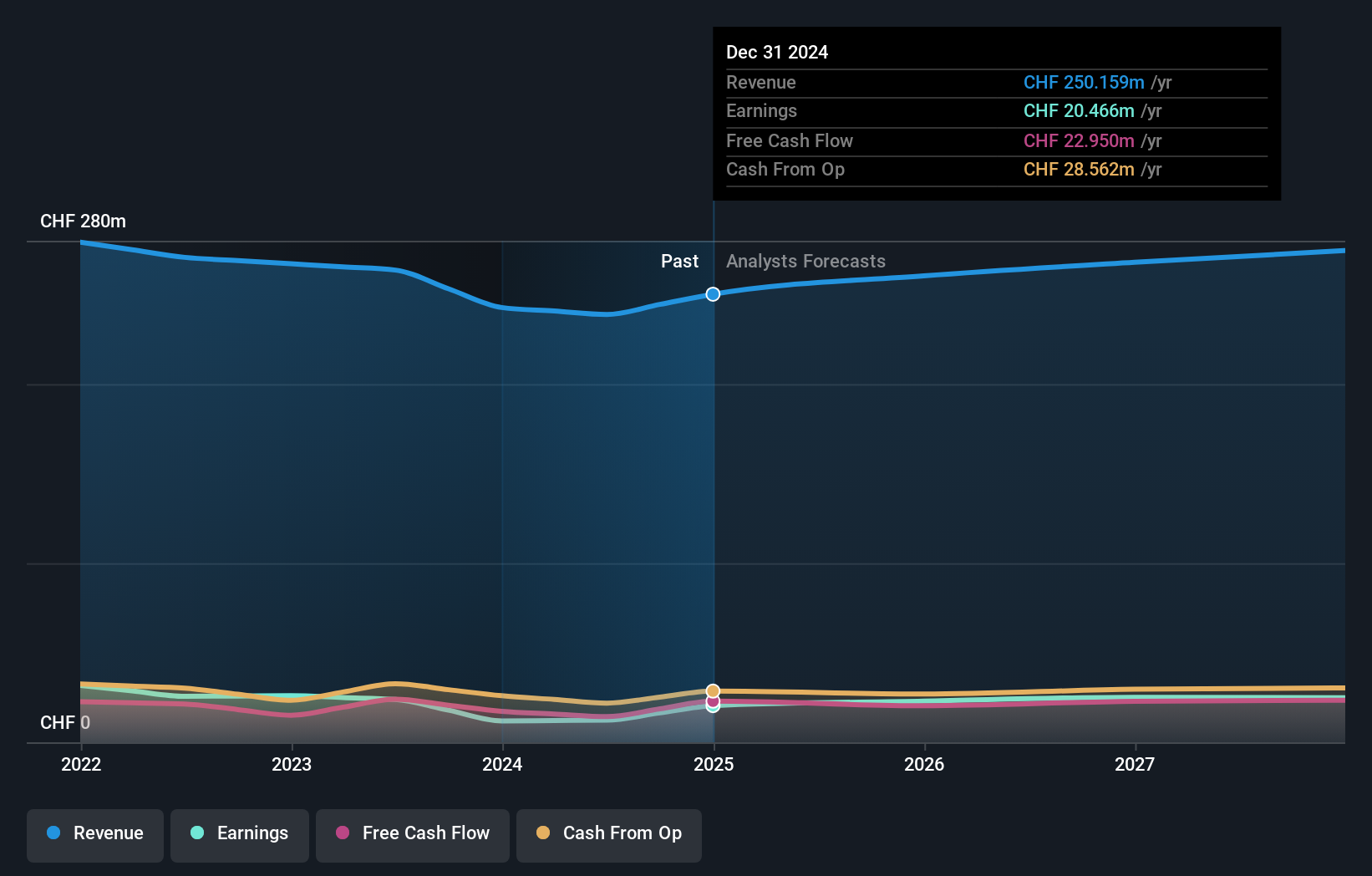

This Swiss company, COLTENE Holding, is making waves in the medical equipment industry with its impressive earnings growth of 71.6% over the past year, outpacing the industry's 4.5%. Trading at a value 35.3% below its estimated fair value suggests potential upside for investors. The firm's debt to equity ratio has improved significantly from 64.9% to 36.8% over five years, reflecting better financial health and stability. With net income climbing to CHF 20.5 million from CHF 11.9 million last year and interest payments well covered by EBIT at a robust 67 times coverage, COLTENE appears financially sound with promising prospects ahead.

- Unlock comprehensive insights into our analysis of COLTENE Holding stock in this health report.

Assess COLTENE Holding's past performance with our detailed historical performance reports.

Vercom (WSE:VRC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Vercom S.A. develops cloud communications platforms and has a market cap of PLN2.60 billion.

Operations: Revenue is primarily driven by cloud communication services. The company has experienced fluctuations in its net profit margin, which indicates variability in profitability over time.

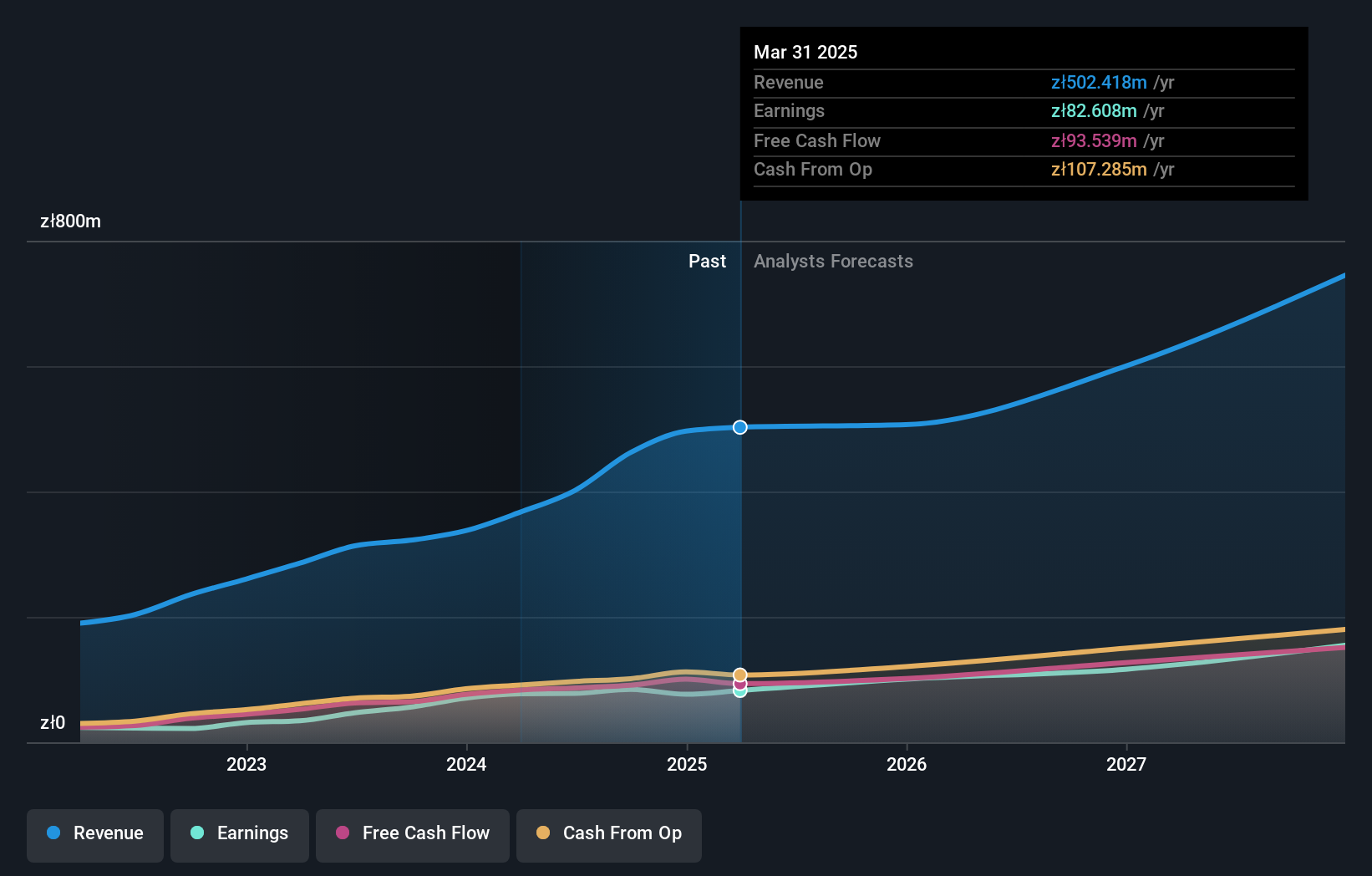

Vercom, a nimble player in the software sector, is catching attention with its robust financial health. The company reported net income of PLN 76.58 million for the year ending December 2024, up from PLN 70.4 million previously, alongside sales climbing to PLN 496.23 million from PLN 337.38 million. Its earnings growth of 8.8% outpaced the software industry average of 8.3%, showcasing strong performance relative to peers. Vercom's interest payments are comfortably covered by EBIT at a ratio of 20.7 times, indicating solid financial management and positioning it well for future expansion with forecasted earnings growth at over 21% annually.

- Take a closer look at Vercom's potential here in our health report.

Evaluate Vercom's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 356 European Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade COLTENE Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CLTN

COLTENE Holding

Develops, manufactures, and sells disposables, tools, and equipment for dentists and dental laboratories in Europe, the Middle East, Africa, North America, Latin America, and Asia/Oceania.

Flawless balance sheet, undervalued and pays a dividend.