Software Mansion S.A. (WSE:SWM) Pays A zł2.00 Dividend In Just Three Days

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Software Mansion S.A. (WSE:SWM) is about to go ex-dividend in just 3 days. Typically, the ex-dividend date is two business days before the record date, which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is important as the process of settlement involves at least two full business days. So if you miss that date, you would not show up on the company's books on the record date. This means that investors who purchase Software Mansion's shares on or after the 28th of August will not receive the dividend, which will be paid on the 30th of September.

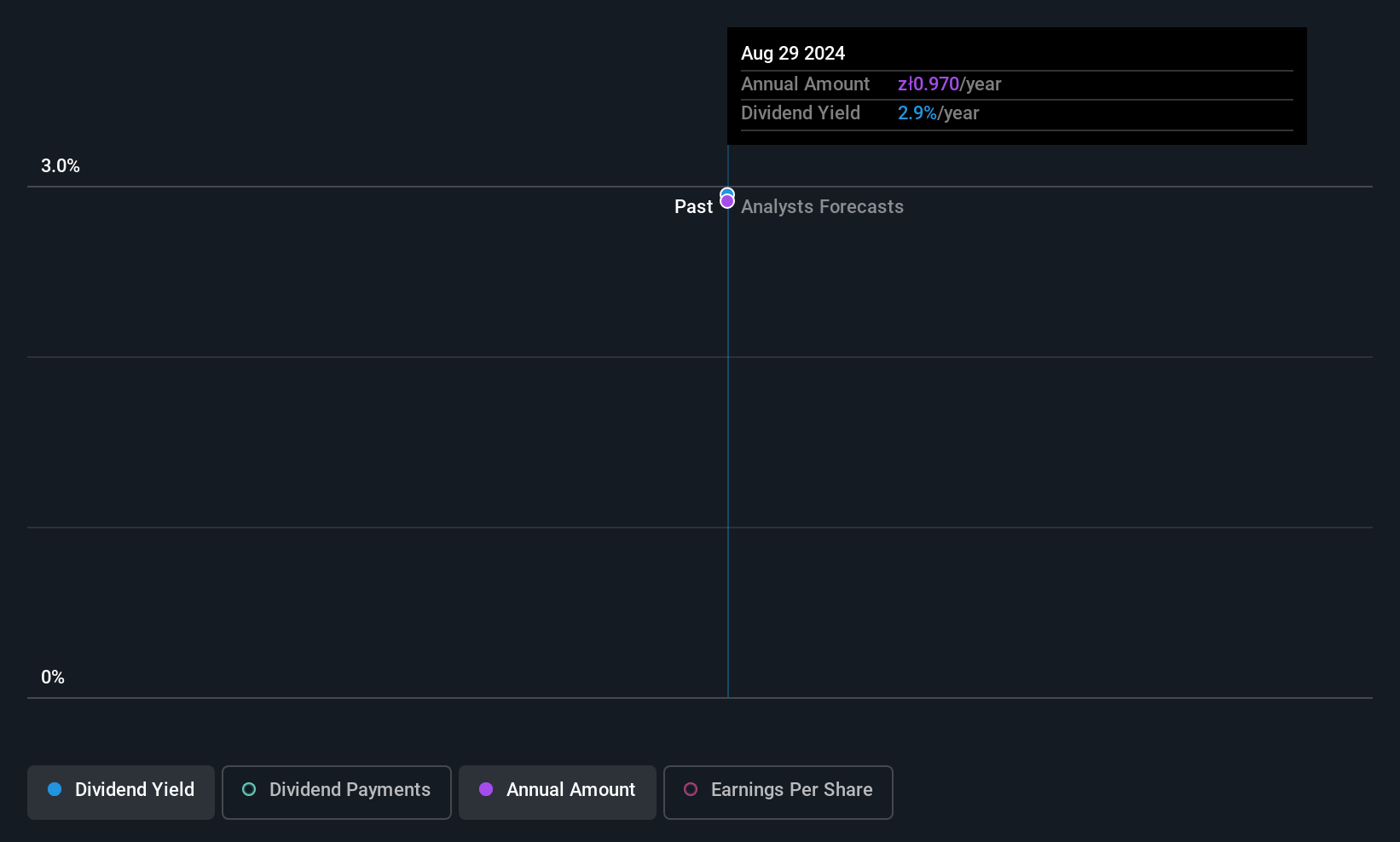

The company's next dividend payment will be zł2.00 per share, and in the last 12 months, the company paid a total of zł2.00 per share. Calculating the last year's worth of payments shows that Software Mansion has a trailing yield of 4.0% on the current share price of zł50.00. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether Software Mansion can afford its dividend, and if the dividend could grow.

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. It paid out 89% of its earnings as dividends last year, which is not unreasonable, but limits reinvestment in the business and leaves the dividend vulnerable to a business downturn. It could become a concern if earnings started to decline. A useful secondary check can be to evaluate whether Software Mansion generated enough free cash flow to afford its dividend. Fortunately, it paid out only 38% of its free cash flow in the past year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Check out our latest analysis for Software Mansion

Click here to see how much of its profit Software Mansion paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. From this perspective it's somewhat discouraging that earnings per share are down 4.6% but we'd note that investment in future growth can cause a similar impact.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the last two years, Software Mansion has lifted its dividend by approximately 44% a year on average. The only way to pay higher dividends when earnings are shrinking is either to pay out a larger percentage of profits, spend cash from the balance sheet, or borrow the money. Software Mansion is already paying out a high percentage of its income, so without earnings growth, we're doubtful of whether this dividend will grow much in the future.

Final Takeaway

Is Software Mansion an attractive dividend stock, or better left on the shelf? The payout ratios are within a reasonable range, implying the dividend may be sustainable. Declining earnings are a serious concern, however, and could pose a threat to the dividend in future. Overall, it's not a bad combination, but we feel that there are likely more attractive dividend prospects out there.

Want to learn more about Software Mansion? Here's a visualisation of its historical rate of revenue and earnings growth.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:SWM

Software Mansion

Engages in creating development tools and open-source software in Poland and internationally.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)