Amid a backdrop of mixed performances across major European stock indexes, with Germany's DAX and Italy's FTSE MIB making gains while France's CAC 40 and the UK's FTSE 100 experienced slight declines, investors are navigating a landscape shaped by trade tensions and monetary policy shifts. In this context, identifying promising investment opportunities can be challenging yet rewarding. Penny stocks—typically smaller or newer companies—remain relevant as they offer potential growth at lower price points. When backed by strong financials, these stocks can provide an intriguing opportunity for investors seeking to uncover hidden value in the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.31 | SEK2.21B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK3.39 | SEK306.93M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.68 | SEK275.94M | ✅ 3 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.48 | SEK211.72M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.66 | PLN124.05M | ✅ 4 ⚠️ 2 View Analysis > |

| AMSC (OB:AMSC) | NOK1.454 | NOK104.49M | ✅ 2 ⚠️ 5 View Analysis > |

| Cellularline (BIT:CELL) | €2.64 | €55.68M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €1.00 | €33.49M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.65 | €17.39M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.275 | €314.1M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 440 stocks from our European Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Ebusco Holding (ENXTAM:EBUS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ebusco Holding N.V., with a market cap of €5.58 million, is involved in the development, manufacture, and distribution of zero-emission buses and charging systems through its subsidiaries.

Operations: Ebusco Holding N.V. has not reported any specific revenue segments, focusing instead on the development, manufacture, and distribution of zero-emission buses and charging systems.

Market Cap: €5.58M

Ebusco Holding N.V., with a market cap of €5.58 million, focuses on zero-emission buses and charging systems but remains pre-revenue, indicating limited financial traction. The company has been removed from the Netherlands ASCX AMS Small Cap Index, reflecting challenges in maintaining its market position. Despite reducing its debt to equity ratio significantly over five years to 29.7%, Ebusco's unprofitability persists with losses increasing annually by 74.5%. Short-term assets (€200.4M) comfortably cover both short- and long-term liabilities, yet the lack of experienced management and high share price volatility pose additional risks for investors considering penny stocks in Europe.

- Click here to discover the nuances of Ebusco Holding with our detailed analytical financial health report.

- Examine Ebusco Holding's past performance report to understand how it has performed in prior years.

Scout Gaming Group (OM:SCOUT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Scout Gaming Group AB (publ) operates as a B2B provider of daily fantasy, sportsbook, fantasy betting, and other sports betting products mainly in Sweden, Norway, Ukraine, and Malta with a market cap of SEK52.25 million.

Operations: Scout Gaming Group AB (publ) has not reported any specific revenue segments.

Market Cap: SEK52.25M

Scout Gaming Group AB, with a market cap of SEK52.25 million, operates without debt and has no long-term liabilities, providing a stable financial foundation despite being unprofitable. The company reported revenue growth to SEK12.44 million in Q1 2025 from SEK7.99 million the previous year, though it remains pre-revenue by broader standards due to its limited financial traction. While the management team is experienced and losses have been reduced over five years at 18.4% annually, high share price volatility and negative return on equity highlight potential risks for investors evaluating penny stocks in Europe.

- Click here and access our complete financial health analysis report to understand the dynamics of Scout Gaming Group.

- Gain insights into Scout Gaming Group's historical outcomes by reviewing our past performance report.

Lukardi (WSE:LUK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lukardi S.A. offers a range of professional IT services in Poland and has a market capitalization of PLN33.05 million.

Operations: The company's revenue is derived entirely from its Computer Services segment, amounting to PLN35.28 million.

Market Cap: PLN33.05M

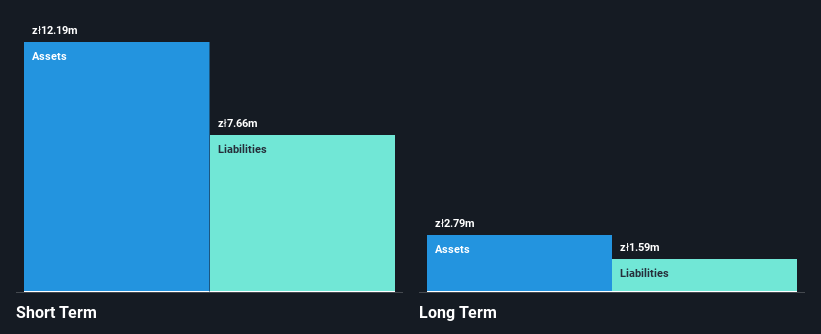

Lukardi S.A., with a market cap of PLN33.05 million, operates in the IT sector and reported a full-year revenue of PLN35.28 million for 2024, down from PLN43.07 million the previous year, while reducing its net loss to PLN0.14 million from PLN0.46 million. Despite being unprofitable, Lukardi shows financial resilience with short-term assets exceeding both short- and long-term liabilities and maintaining a satisfactory net debt to equity ratio of 25.9%. The company’s cash runway extends beyond three years even as free cash flow shrinks annually by 10.2%, offering some stability amidst high share price volatility.

- Unlock comprehensive insights into our analysis of Lukardi stock in this financial health report.

- Assess Lukardi's previous results with our detailed historical performance reports.

Summing It All Up

- Get an in-depth perspective on all 440 European Penny Stocks by using our screener here.

- Ready For A Different Approach? This technology could replace computers: discover the 22 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:LUK

Flawless balance sheet and fair value.

Market Insights

Community Narratives