As European markets navigate a complex landscape of mixed monetary policy decisions and economic indicators, the pan-European STOXX Europe 600 Index recently ended the week slightly lower, reflecting investor caution. In this environment, identifying promising small-cap stocks requires a keen eye for companies with strong fundamentals and growth potential that can thrive despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Moury Construct | 1.73% | 11.11% | 23.28% | ★★★★★☆ |

| Dekpol | 64.28% | 10.52% | 14.34% | ★★★★★☆ |

| Sparta | NA | -9.54% | -15.40% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

We'll examine a selection from our screener results.

BioGaia (OM:BIOG B)

Simply Wall St Value Rating: ★★★★★★

Overview: BioGaia AB (publ) is a healthcare company that develops, manufactures, markets, and sells probiotic products for gut, oral, and immune health across Europe, the Middle East, Africa, the United States, Asia-Pacific, Australia, and New Zealand with a market cap of approximately SEK11.07 billion.

Operations: BioGaia generates revenue primarily from its Pediatrics segment, contributing SEK 1.08 billion, and the Adult Health segment, which adds SEK 352.62 million. The company's financial performance is significantly driven by these segments without any mention of "Other" or unallocated revenues.

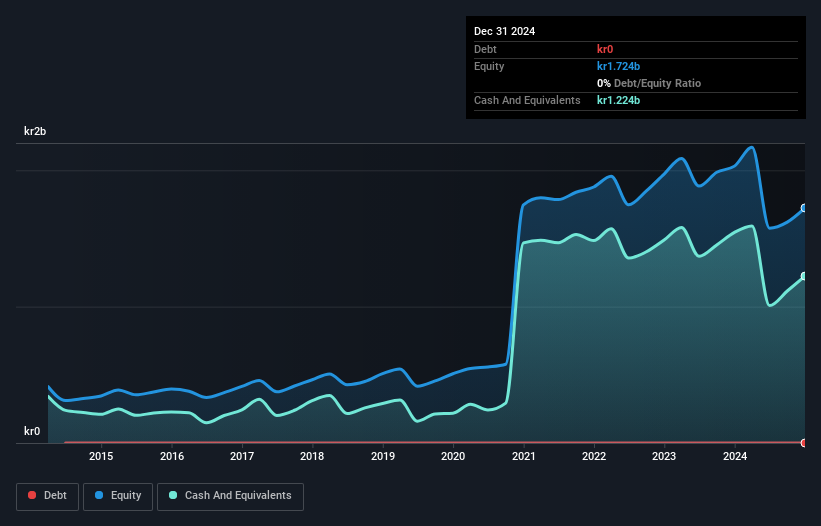

BioGaia, a healthcare firm known for its probiotic products, is navigating a complex landscape with strategic expansions and product innovations. The company recently announced the establishment of its own distribution in Germany and Austria under the BiGaia brand, aiming to tap into the EUR 242 million German probiotic market. Despite facing challenges like a 28.6% earnings drop over the past year and reduced net profit margins from 29.3% to 19.9%, BioGaia remains debt-free with high-quality earnings and positive free cash flow of SEK 365 million as of September 2024. With projected annual earnings growth of over 21%, BioGaia is poised for future expansion in new health segments like skin microbiome through its subsidiary BioGaia New Sciences, led by industry veteran Maik Lepatey.

Comp (WSE:CMP)

Simply Wall St Value Rating: ★★★★★★

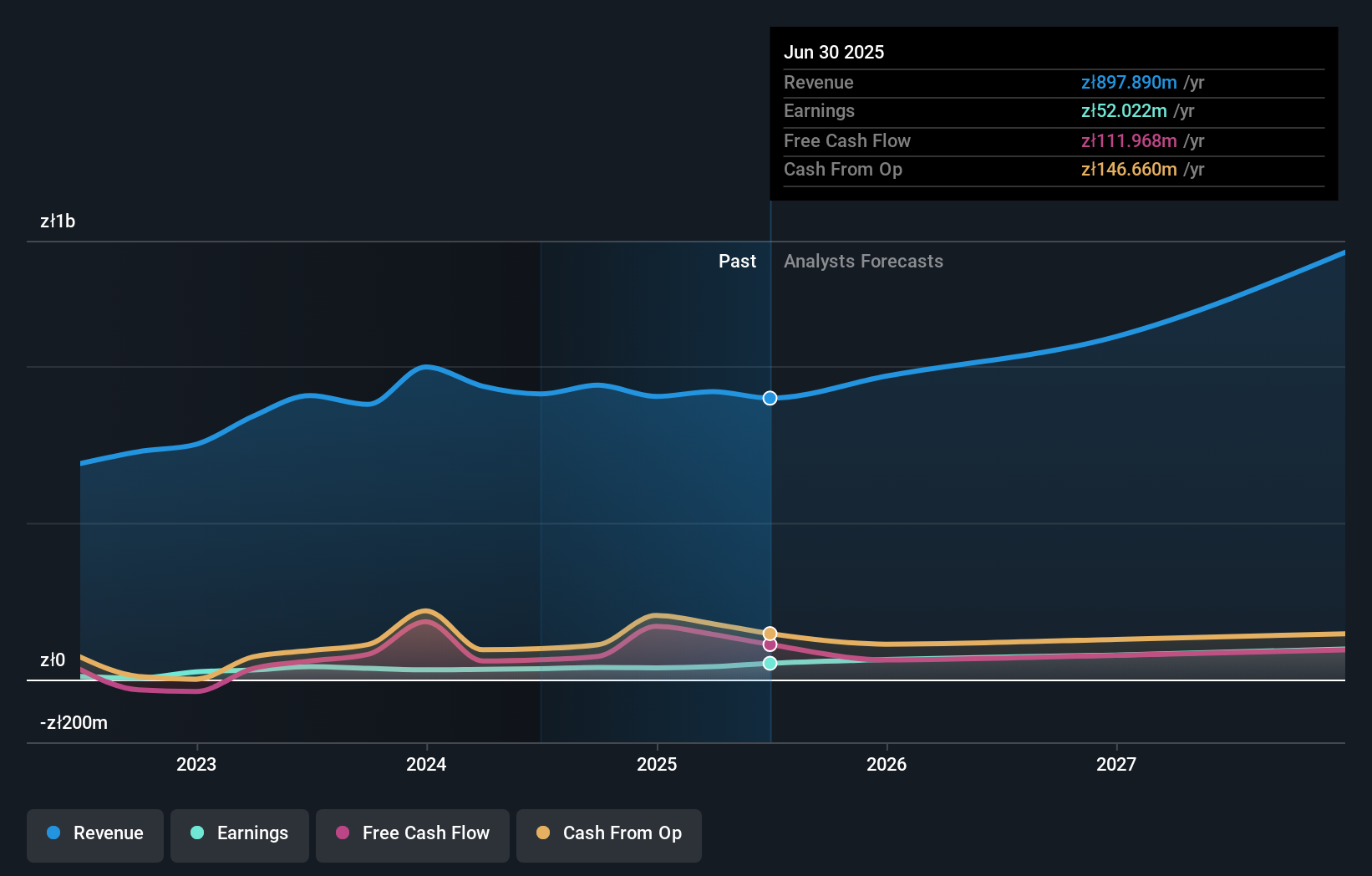

Overview: Comp S.A. is a technology firm offering IT and network security services and solutions in Poland, with a market capitalization of PLN1.23 billion.

Operations: Comp S.A. generates revenue primarily from its IT and Retail segments, with the IT segment contributing PLN 537.36 million and the Retail segment adding PLN 361.36 million.

CMP, a promising player in the IT sector, has shown impressive financial health with its debt to equity ratio dropping from 45.6% to 23.7% over five years and a satisfactory net debt to equity ratio of 18.1%. Its EBIT covers interest payments 8.1 times, indicating robust earnings capacity. The company reported significant earnings growth of 49.3% last year, outpacing the industry average considerably and trading slightly below fair value estimates by 2.1%. Recently added to the S&P Global BMI Index, CMP's net income for H1 rose to PLN35.6 million from PLN21.26 million the previous year, reflecting strong performance momentum despite revenue fluctuations.

- Dive into the specifics of Comp here with our thorough health report.

Examine Comp's past performance report to understand how it has performed in the past.

Uzin Utz (XTRA:UZU)

Simply Wall St Value Rating: ★★★★★★

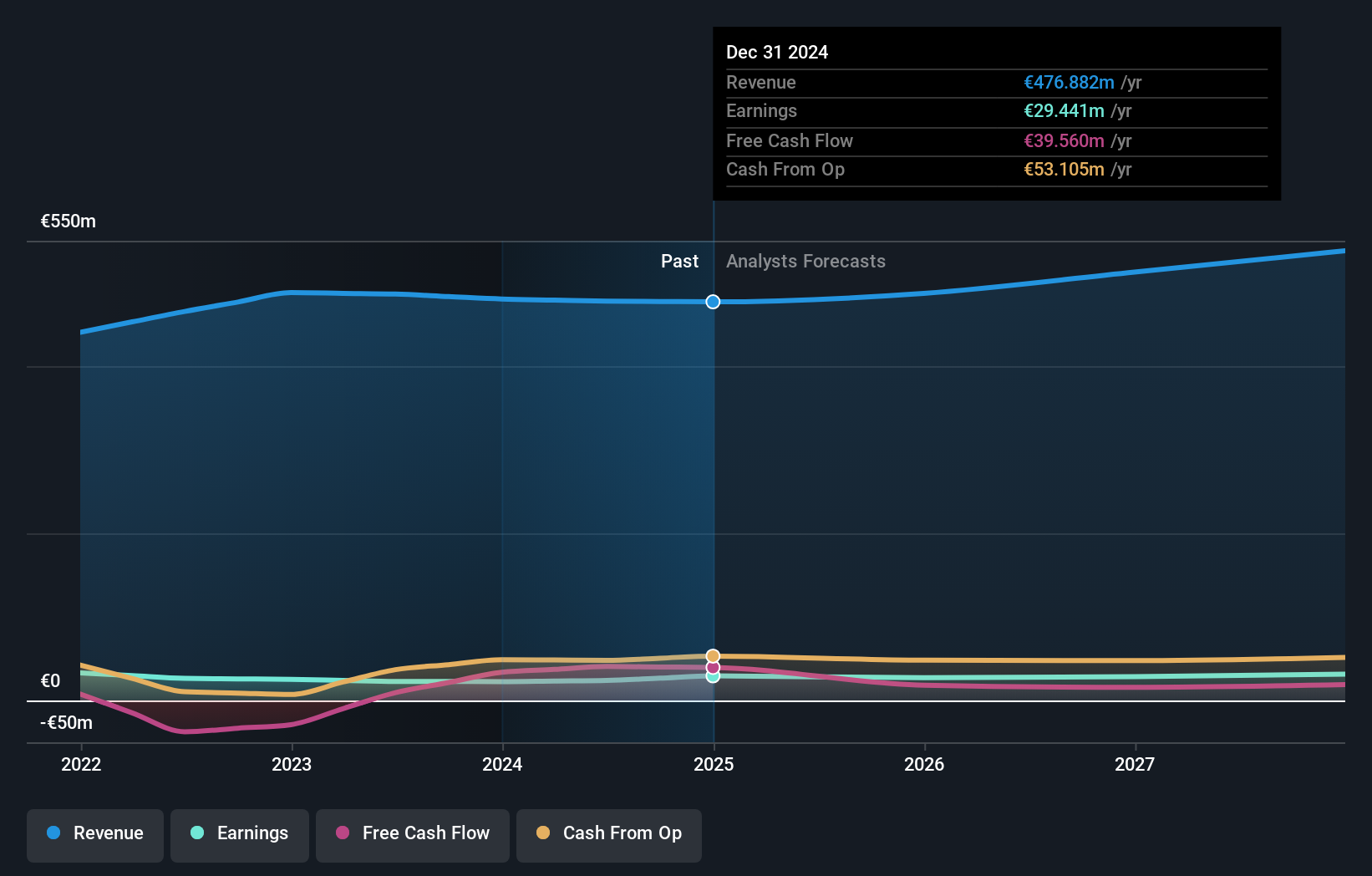

Overview: Uzin Utz SE is a company that specializes in the development, manufacturing, and sale of construction chemical system products across Germany, the United States, Netherlands, and other international markets, with a market capitalization of approximately €383.37 million.

Operations: Uzin Utz SE's primary revenue streams include Germany - Laying Systems (€213.88 million) and Western Europe (€77.63 million), contributing significantly to its financial performance. The company also generates notable income from the USA - Laying Systems (€73.12 million) and Netherlands - Laying Systems (€88.65 million).

Uzin Utz, a notable player in the European market, demonstrates robust financial health with a debt to equity ratio decreasing from 49.5% to 26.4% over five years. The company enjoys high-quality earnings and has shown impressive growth, with earnings surging by 29.5% last year—outpacing the broader Chemicals industry at just 3.7%. Its price-to-earnings ratio of 12.4x is attractively lower than the German market average of 18.4x, suggesting good relative value for investors seeking opportunities in this sector. Recent half-year results reveal sales of €251.75 million and net income rising to €13.95 million from €12.38 million previously, highlighting its steady performance trajectory.

- Click here and access our complete health analysis report to understand the dynamics of Uzin Utz.

Review our historical performance report to gain insights into Uzin Utz's's past performance.

Summing It All Up

- Delve into our full catalog of 331 European Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioGaia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIOG B

BioGaia

A healthcare company, develops, manufactures, markets and sells probiotic products for gut, oral, and immune health in Europe, the Middle East, Africa, the United States, the Asia-Pacific, Australia, and New Zealand.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives