- Turkey

- /

- Hospitality

- /

- IBSE:KSTUR

Undiscovered Gems on None Exchange for November 2024

Reviewed by Simply Wall St

In a week marked by intense economic data releases and earnings reports, global markets saw mixed performances with small-cap stocks holding up better than their large-cap counterparts. The S&P MidCap 400 Index hit record highs before retreating, reflecting the broader market's cautious sentiment amid ongoing macroeconomic uncertainties and labor market fluctuations. In such an environment, identifying potential "undiscovered gems" requires a focus on companies that exhibit resilience and adaptability to shifting economic conditions. These qualities can be crucial for navigating the complexities of today's financial landscape while uncovering promising investment opportunities in lesser-known stocks.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Infinity Capital Investments | 0.61% | 8.72% | 14.99% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 72.83% | 12.17% | 19.18% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Kustur Kusadasi Turizm Endüstrisi (IBSE:KSTUR)

Simply Wall St Value Rating: ★★★★★★

Overview: Kustur Kusadasi Turizm Endüstrisi A.S. operates holiday clubs in Turkey and has a market cap of TRY12.96 billion.

Operations: Kustur Kusadasi Turizm Endüstrisi generates revenue primarily from its Casinos & Resorts segment, amounting to TRY262.96 million. The company has a market cap of TRY12.96 billion.

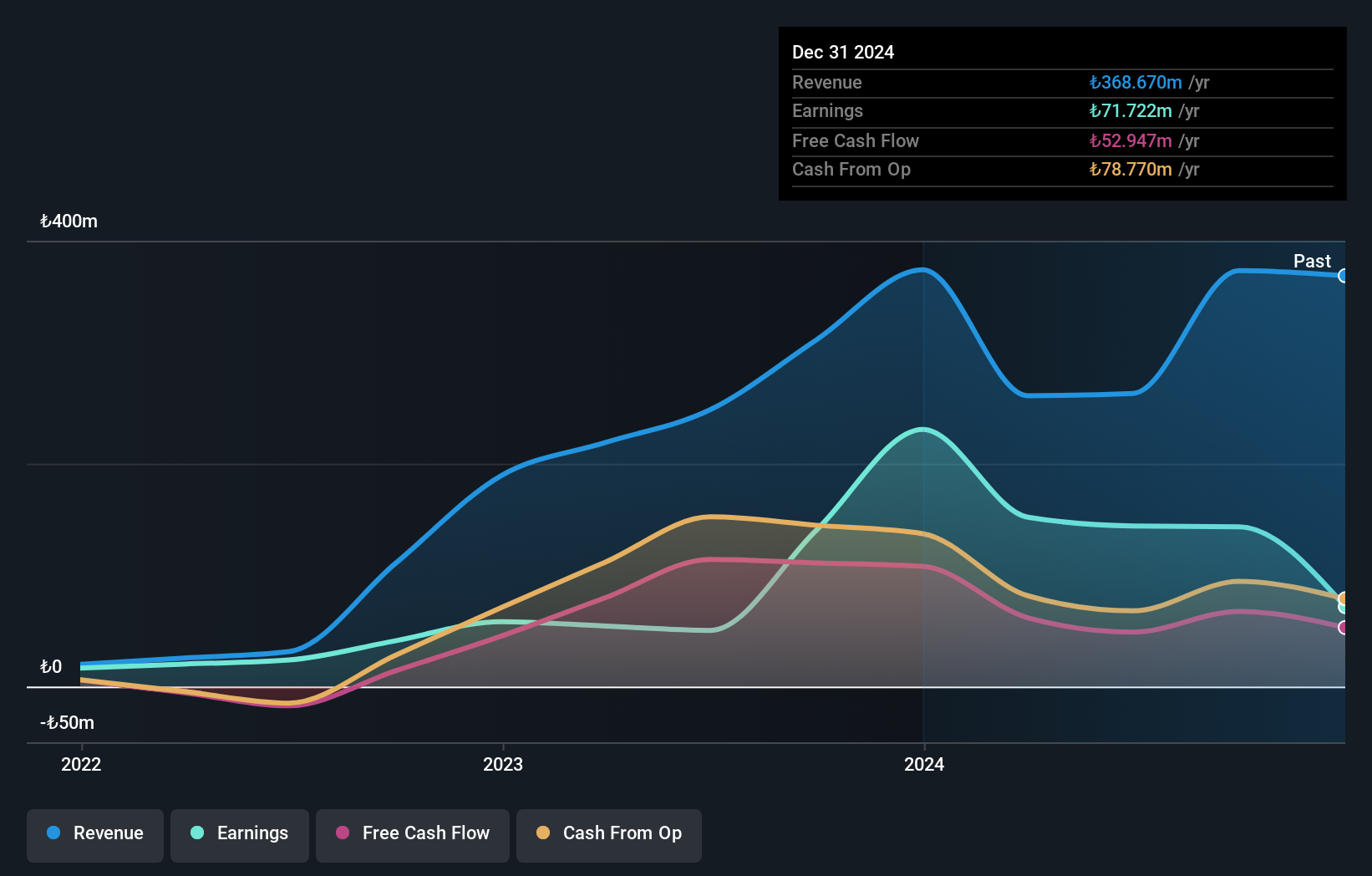

Kustur Kusadasi Turizm Endüstrisi, a nimble player in the hospitality sector, has shown impressive earnings growth of 186.1% over the past year, outpacing its industry peers. Despite this robust performance, the company reported a net loss of TRY 16.28 million for the first half of 2024 compared to TRY 0.62 million last year, with basic loss per share rising to TRY 3.8 from TRY 0.1. Notably debt-free for five years and recently added to the S&P Global BMI Index, KSTUR's high level of non-cash earnings suggests potential resilience amid share price volatility.

Zhejiang grandwall electric science&technologyltd (SHSE:603897)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zhejiang Grandwall Electric Science & Technology Co., Ltd. and its subsidiaries focus on the research, development, production, and sale of electromagnetic wire products both in China and internationally, with a market cap of CN¥4.63 billion.

Operations: Zhejiang Grandwall generates revenue primarily from the sale of electromagnetic wire products. The company's financial performance is reflected in its market capitalization of CN¥4.63 billion.

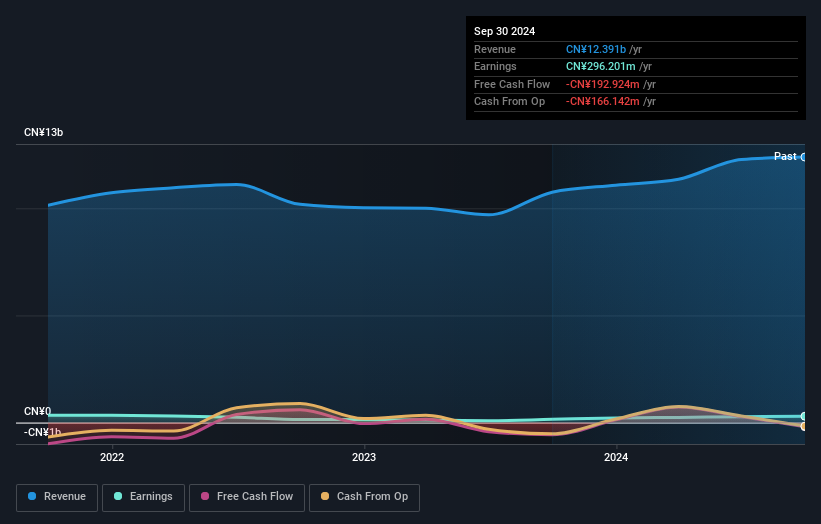

Zhejiang Grandwall Electric, a relatively small player in the electrical industry, is making waves with its impressive earnings growth of 96.8% over the past year, significantly outpacing the industry's 0.3%. For the nine months ending September 2024, sales reached CNY 9.51 billion compared to CNY 8.20 billion a year earlier, while net income climbed to CNY 188.87 million from CNY 109.18 million previously. Despite trading at approximately 16.6% below estimated fair value and having more cash than total debt, its debt-to-equity ratio has increased from 28% to 40% over five years—an aspect worth monitoring closely for potential investors.

- Navigate through the intricacies of Zhejiang grandwall electric science&technologyltd with our comprehensive health report here.

Learn about Zhejiang grandwall electric science&technologyltd's historical performance.

Auto Partner (WSE:APR)

Simply Wall St Value Rating: ★★★★★★

Overview: Auto Partner SA is a company that specializes in selling spare parts for cars, light commercial vehicles, and motorcycles both in Poland and internationally, with a market capitalization of PLN2.97 billion.

Operations: Auto Partner generates revenue primarily through the sale of spare parts and accessories for motor vehicles, amounting to PLN3.94 billion.

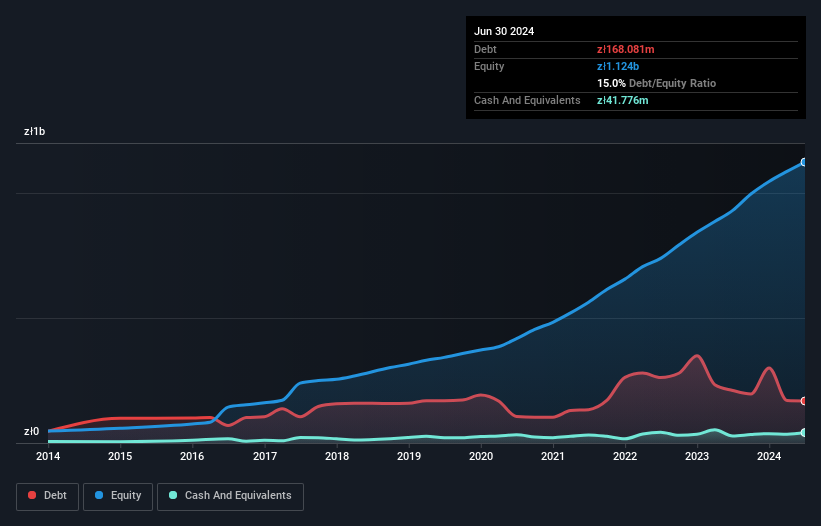

Auto Partner has been making strides with a notable reduction in its debt to equity ratio from 49.3% to 15% over the last five years, indicating improved financial health. The company's earnings growth of 0.9% outpaces the Specialty Retail industry, which saw a -9.6% change, suggesting resilience amidst broader challenges. Despite a dip in net income for Q2 2024 to PLN 56.93 million from PLN 64.15 million last year, sales increased significantly to PLN 1,062 million from PLN 938 million previously. Trading at favorable valuations compared to peers and boasting high-quality earnings further underscores its potential as an investment opportunity.

- Delve into the full analysis health report here for a deeper understanding of Auto Partner.

Evaluate Auto Partner's historical performance by accessing our past performance report.

Make It Happen

- Discover the full array of 4735 Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kustur Kusadasi Turizm Endüstrisi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:KSTUR

Flawless balance sheet with solid track record.