- Turkey

- /

- Healthcare Services

- /

- IBSE:MPARK

3 Leading Insider Owned Growth Stocks With Up To 39% Earnings Expansion

Reviewed by Simply Wall St

As global markets navigate a period of mixed economic signals, including a dip in U.S. consumer confidence and fluctuating indices, investors are keenly observing the performance of growth stocks. In this environment, companies with high insider ownership can be particularly appealing, as they often reflect management's confidence in the business's potential for expansion and resilience amidst market uncertainties.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

MLP Saglik Hizmetleri (IBSE:MPARK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MLP Saglik Hizmetleri A.S. operates healthcare services in Turkey, Azerbaijan, and Hungary with a market cap of TRY68.67 billion.

Operations: The company generates revenue of TRY28.14 billion from its Healthcare Facilities & Services segment across Turkey, Azerbaijan, and Hungary.

Insider Ownership: 16.3%

Earnings Growth Forecast: 28.0% p.a.

MLP Saglik Hizmetleri demonstrates strong growth potential with a forecasted revenue increase of 34.4% annually, surpassing the TR market's 25.1%. Its price-to-earnings ratio of 12.2x suggests it is undervalued compared to the market average of 16.4x. Recent earnings reports show significant improvements, with third-quarter sales reaching TRY 9,782.37 million and net income at TRY 2,090.78 million, indicating robust financial performance despite slower earnings growth than the broader market expectations.

- Click here to discover the nuances of MLP Saglik Hizmetleri with our detailed analytical future growth report.

- Our valuation report here indicates MLP Saglik Hizmetleri may be overvalued.

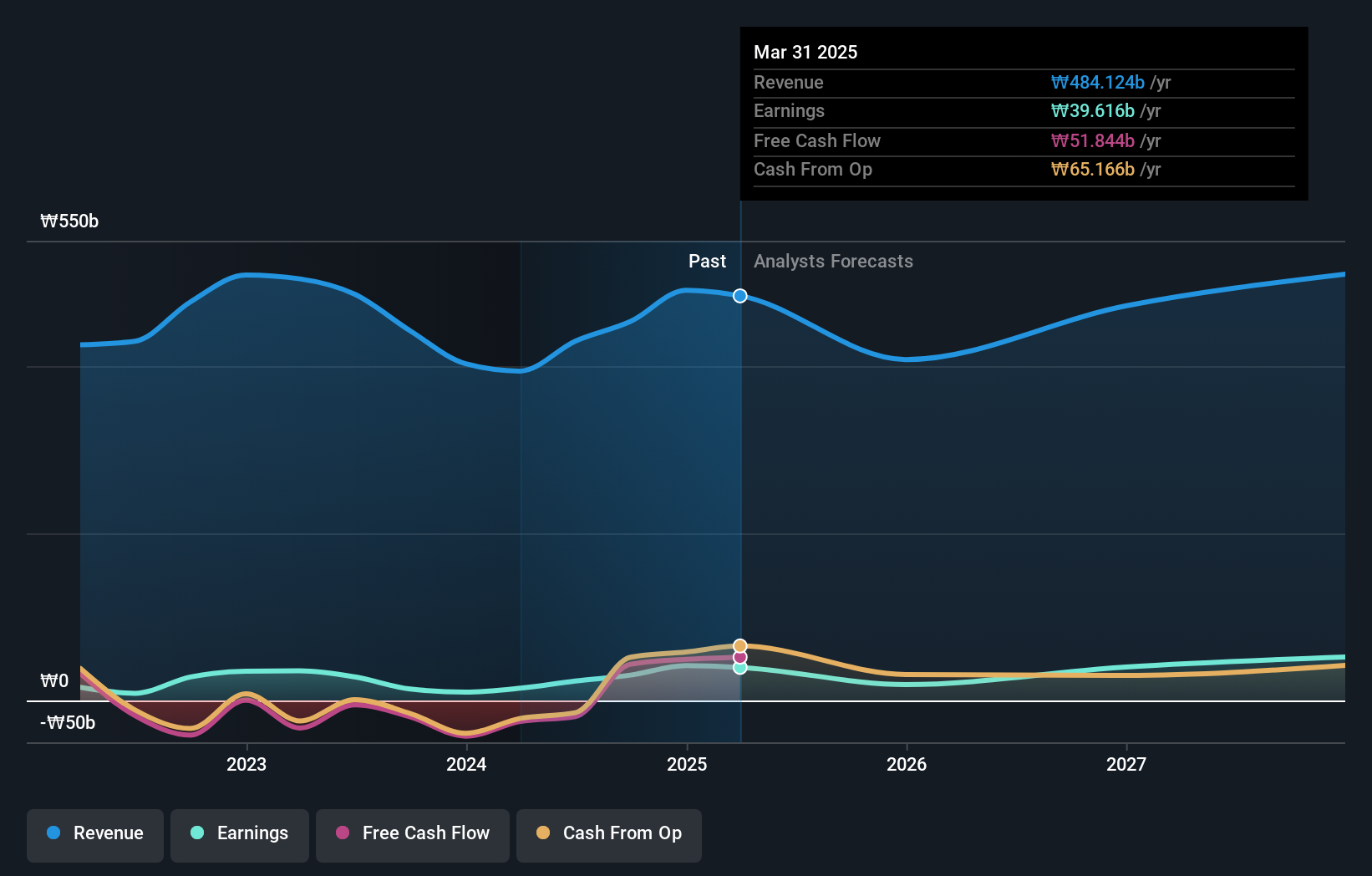

ZeusLtd (KOSDAQ:A079370)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zeus Co., Ltd. offers semiconductor, robot, and display total solutions both in South Korea and internationally, with a market cap of ₩394.91 billion.

Operations: The company's revenue is primarily derived from its Equipment Division, generating ₩477.92 billion, and Valve segment, contributing ₩23.54 billion.

Insider Ownership: 33.8%

Earnings Growth Forecast: 39.4% p.a.

ZeusLtd showcases strong growth potential, with earnings forecasted to grow 39.4% annually, outpacing the KR market's 28.8%. Recent financial results highlight impressive performance, with third-quarter sales increasing to KRW 125 billion and net income rising significantly. The company trades at a good value relative to peers and is priced below its estimated fair value by 33.6%. Despite no substantial insider trading activity recently, insider ownership remains high, supporting confidence in future prospects.

- Delve into the full analysis future growth report here for a deeper understanding of ZeusLtd.

- Our expertly prepared valuation report ZeusLtd implies its share price may be lower than expected.

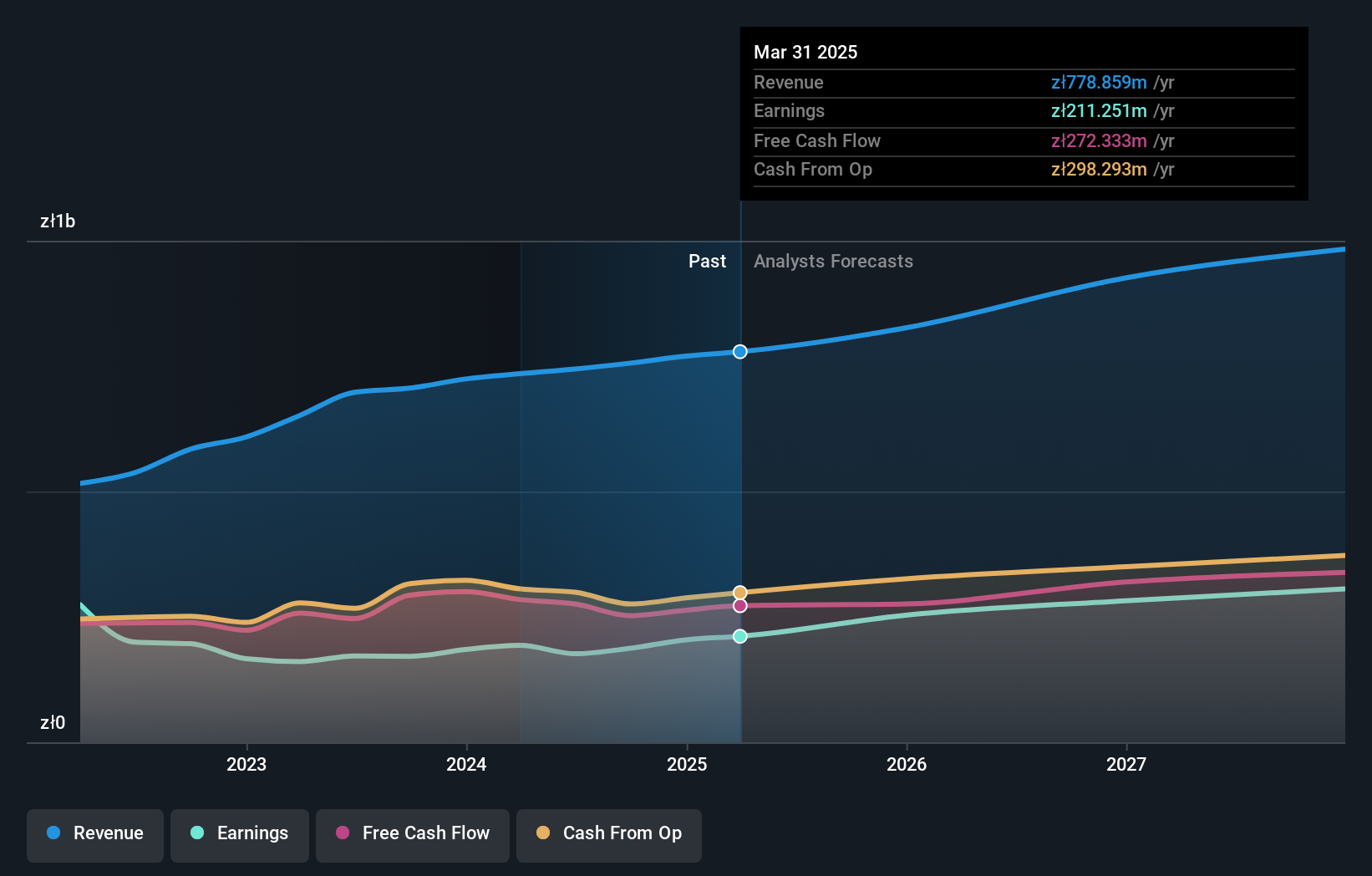

Grupa Pracuj (WSE:GPP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Grupa Pracuj S.A. operates in the digital recruitment market across Poland, Ukraine, and Germany with a market capitalization of PLN4.04 billion.

Operations: The company generates revenue from its Staffing & Outsourcing Services segment, amounting to PLN756.07 million.

Insider Ownership: 11.7%

Earnings Growth Forecast: 20.2% p.a.

Grupa Pracuj demonstrates promising growth prospects, with earnings projected to rise 20.2% annually, surpassing the Polish market's 15.3%. Recent results show a sales increase to PLN 192.95 million and net income of PLN 60.59 million for Q3, indicating solid performance. The company trades at a significant discount to its estimated fair value and boasts a very high forecasted return on equity of 47%, though it lacks recent insider trading activity data.

- Click to explore a detailed breakdown of our findings in Grupa Pracuj's earnings growth report.

- According our valuation report, there's an indication that Grupa Pracuj's share price might be on the expensive side.

Where To Now?

- Explore the 1497 names from our Fast Growing Companies With High Insider Ownership screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:MPARK

MLP Saglik Hizmetleri

Provides healthcare service in Turkey, Azerbaijan, and Hungary.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.