As the European markets face pressures from concerns over artificial intelligence stock valuations, major indices like the STOXX Europe 600 and Germany's DAX have recently seen declines. In this environment, investors may find opportunities in value stocks that are trading at estimated discounts, offering potential resilience amidst market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| YIT Oyj (HLSE:YIT) | €3.048 | €5.98 | 49% |

| Vinext (BIT:VNXT) | €3.38 | €6.57 | 48.6% |

| Truecaller (OM:TRUE B) | SEK25.44 | SEK50.66 | 49.8% |

| STEICO (XTRA:ST5) | €20.40 | €39.84 | 48.8% |

| Roche Bobois (ENXTPA:RBO) | €35.20 | €69.45 | 49.3% |

| Micro Systemation (OM:MSAB B) | SEK63.40 | SEK126.60 | 49.9% |

| eDreams ODIGEO (BME:EDR) | €7.26 | €14.34 | 49.4% |

| Doxee (BIT:DOX) | €3.75 | €7.43 | 49.5% |

| Demant (CPSE:DEMANT) | DKK227.80 | DKK447.90 | 49.1% |

| Atea (OB:ATEA) | NOK150.60 | NOK300.13 | 49.8% |

We'll examine a selection from our screener results.

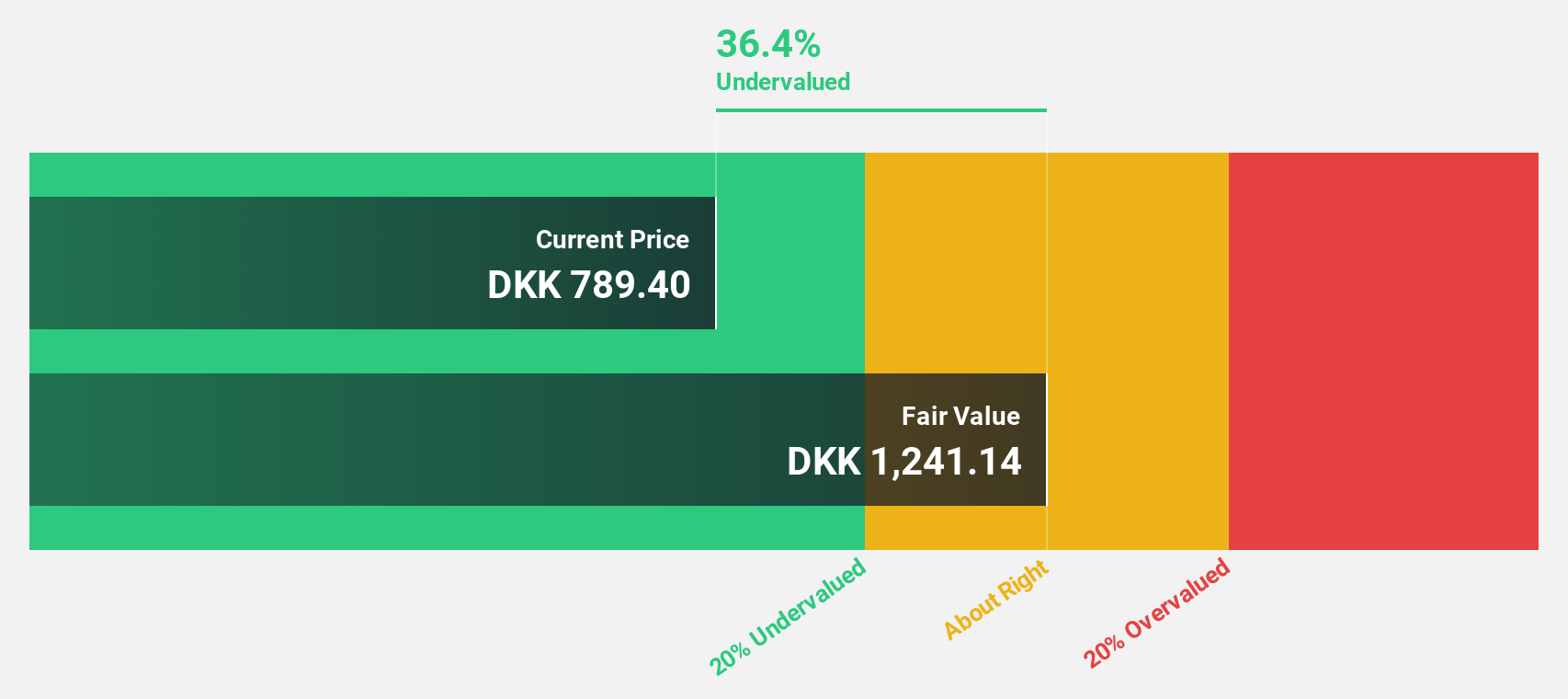

Pandora (CPSE:PNDORA)

Overview: Pandora A/S designs, manufactures, and markets jewelry products with a market cap of DKK60.29 billion.

Operations: The company's revenue is derived from two main segments: Core, contributing DKK24.19 billion, and Fuel with More, adding DKK8.48 billion.

Estimated Discount To Fair Value: 36%

Pandora is trading at DKK 800, significantly below its estimated fair value of DKK 1,249.07, suggesting it may be undervalued based on cash flows. Despite a high debt level and an unstable dividend track record, Pandora's earnings are forecast to grow faster than the Danish market at 5.1% annually. The company's recent quarterly sales increase to DKK 6.27 billion highlights ongoing revenue growth amid strategic transitions in leadership and brand positioning efforts under the Phoenix strategy.

- Our growth report here indicates Pandora may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Pandora.

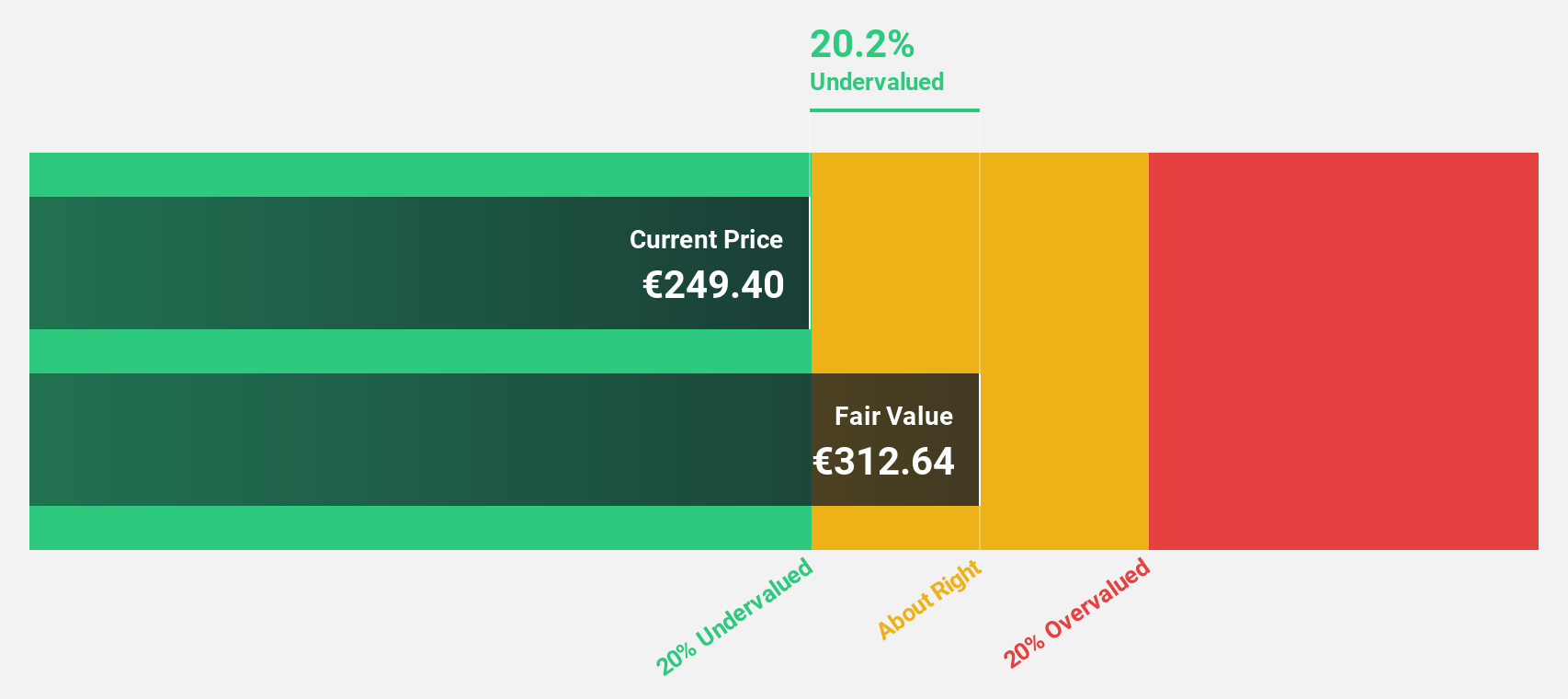

Thales (ENXTPA:HO)

Overview: Thales S.A. operates globally, offering solutions in defence and security, aerospace and space, as well as digital identity and security markets, with a market cap of €49.49 billion.

Operations: The company's revenue is primarily derived from its Defence segment at €11.96 billion, followed by Aerospace at €5.81 billion, and Cyber & Digital at €4.08 billion.

Estimated Discount To Fair Value: 36%

Thales is trading at €241, well below its estimated fair value of €376.71, highlighting potential undervaluation based on cash flows. Its earnings are forecast to grow 16.87% annually, outpacing the French market's growth rate. Recent strategic moves include a Memorandum of Understanding with Airbus and Leonardo to enhance Europe's space capabilities, which could drive future synergies and revenue expansion. However, slower-than-ideal revenue growth remains a consideration for investors assessing long-term prospects.

- Upon reviewing our latest growth report, Thales' projected financial performance appears quite optimistic.

- Get an in-depth perspective on Thales' balance sheet by reading our health report here.

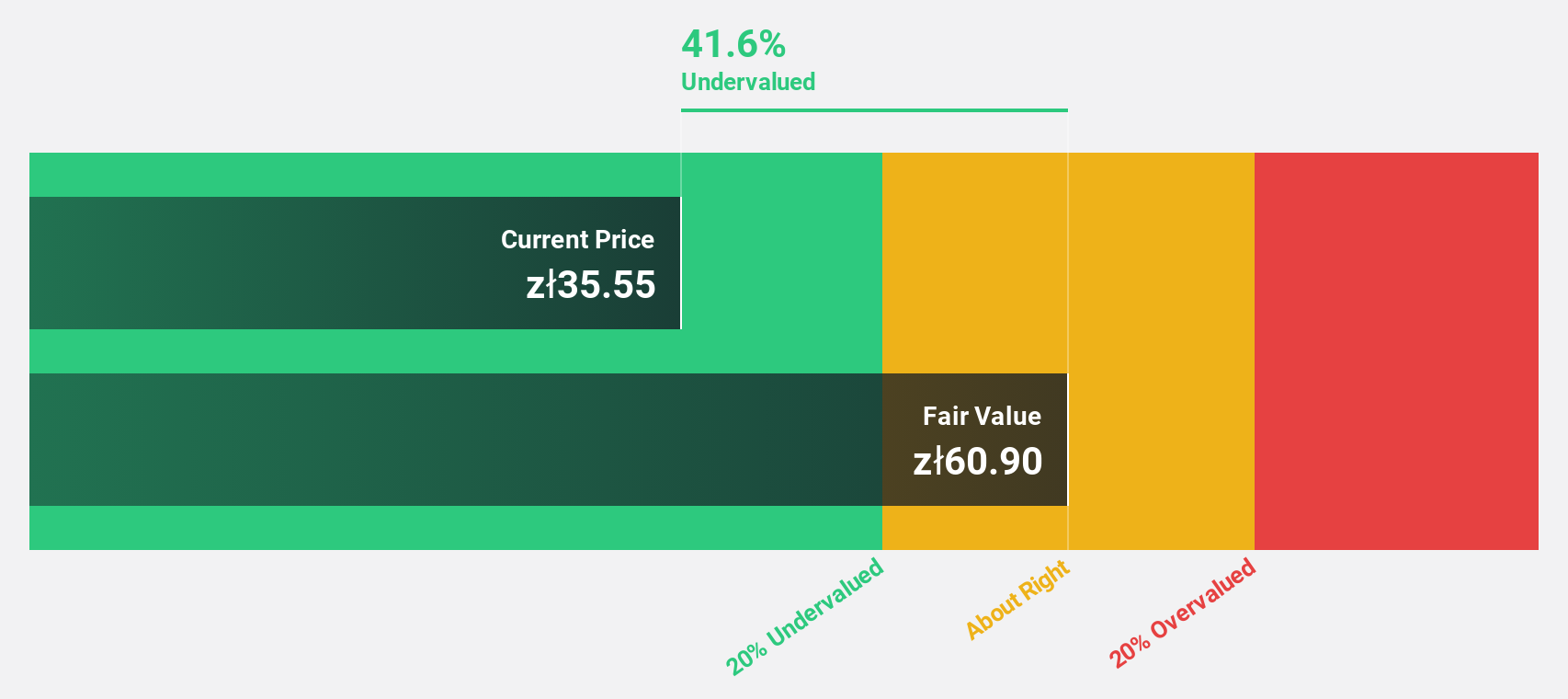

Allegro.eu (WSE:ALE)

Overview: Allegro.eu S.A. operates a commerce platform serving consumers in Poland, the Czech Republic, and internationally, with a market cap of PLN35.42 billion.

Operations: The company's revenue segments include Allegro at PLN9.76 billion and Ceneo at PLN357.29 million.

Estimated Discount To Fair Value: 46%

Allegro.eu is trading at PLN34.8, significantly below its estimated fair value of PLN64.39, indicating potential undervaluation based on cash flows. Its earnings are projected to grow 21.6% annually, surpassing the Polish market's growth rate of 15.8%. Recent earnings reports show improved financial performance with revenue and net income increases year-over-year, reinforcing its strong growth trajectory despite revenue growing slower than 20% per year.

- Our earnings growth report unveils the potential for significant increases in Allegro.eu's future results.

- Click to explore a detailed breakdown of our findings in Allegro.eu's balance sheet health report.

Key Takeaways

- Navigate through the entire inventory of 195 Undervalued European Stocks Based On Cash Flows here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:PNDORA

Pandora

Engages in the designing, manufacturing, and marketing of jewelry products.

Undervalued with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives