- Poland

- /

- Entertainment

- /

- WSE:TEN

Analysts Are Betting On Ten Square Games S.A. (WSE:TEN) With A Big Upgrade This Week

Celebrations may be in order for Ten Square Games S.A. (WSE:TEN) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The revenue forecast for this year has experienced a facelift, with analysts now much more optimistic on its sales pipeline.

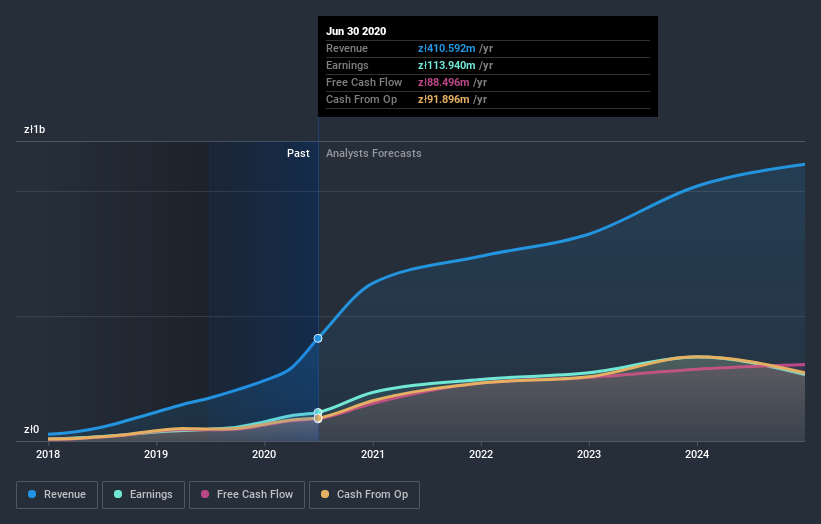

Following the upgrade, the latest consensus from Ten Square Games' seven analysts is for revenues of zł631m in 2020, which would reflect a substantial 54% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to jump 61% to zł25.27. Before this latest update, the analysts had been forecasting revenues of zł545m and earnings per share (EPS) of zł24.45 in 2020. The forecasts seem more optimistic now, with a decent improvement in revenue and a small increase to earnings per share estimates.

See our latest analysis for Ten Square Games

It will come as no surprise to learn that the analysts have increased their price target for Ten Square Games 10% to zł644 on the back of these upgrades. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on Ten Square Games, with the most bullish analyst valuing it at zł774 and the most bearish at zł505 per share. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Ten Square Games' past performance and to peers in the same industry. It's pretty clear that there is an expectation that Ten Square Games' revenue growth will slow down substantially, with revenues next year expected to grow 54%, compared to a historical growth rate of 138% over the past year. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 4.4% next year. So it's pretty clear that, while Ten Square Games' revenue growth is expected to slow, it's still expected to grow faster than the industry itself.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. There was also a nice increase in the price target, with analysts apparently feeling that the intrinsic value of the business is improving. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Ten Square Games.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have estimates - from multiple Ten Square Games analysts - going out to 2024, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you decide to trade Ten Square Games, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Ten Square Games might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About WSE:TEN

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)