- Japan

- /

- Trade Distributors

- /

- TSE:8058

Top Dividend Stocks For December 2024

Reviewed by Simply Wall St

As global markets continue to climb, with major indices like the Dow Jones Industrial Average and S&P 500 reaching record highs, investors are navigating a landscape influenced by geopolitical developments and domestic policy shifts. Amidst this backdrop, dividend stocks remain a compelling option for those seeking stable returns, offering potential resilience against market volatility while providing regular income streams.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.18% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.20% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.33% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.85% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.34% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.91% | ★★★★★★ |

Click here to see the full list of 1946 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Starzen (TSE:8043)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Starzen Company Limited processes, manufactures, and sells meat and meat products in Japan with a market cap of ¥55.95 billion.

Operations: Starzen Company Limited generates revenue through its operations in the processing, manufacturing, and sale of meat and meat products within Japan.

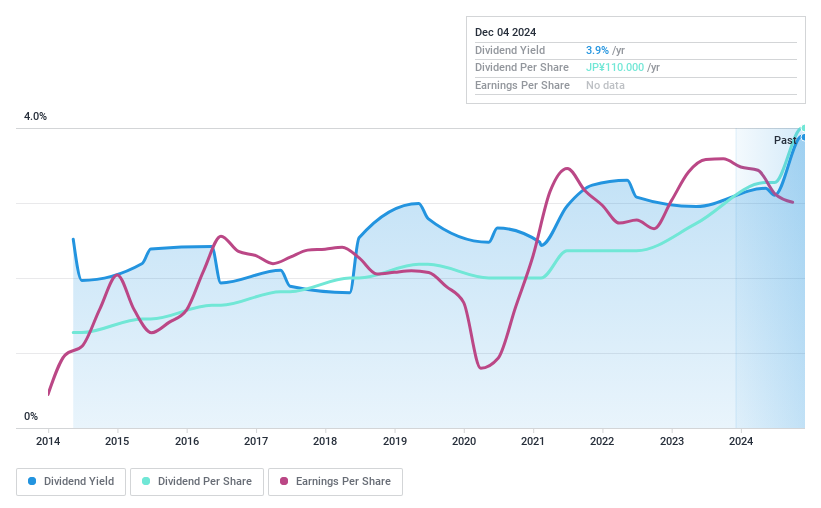

Dividend Yield: 3.8%

Starzen has announced an increase in its year-end dividend to ¥110 per share, up from a previous forecast of ¥90. The company aims for a 3.0% dividend on equity (DOE) as part of its new policy to provide stable returns amidst significant investments planned over the next three years. Although dividends are not covered by free cash flow, they are well-covered by earnings with a low payout ratio of 23.6%.

- Unlock comprehensive insights into our analysis of Starzen stock in this dividend report.

- Our valuation report here indicates Starzen may be overvalued.

Mitsubishi (TSE:8058)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsubishi Corporation operates globally across sectors such as natural gas, industrial materials, chemicals, mineral resources, automotive and mobility, food and consumer industry, power solutions, and urban development with a market cap of approximately ¥10.45 trillion.

Operations: Mitsubishi Corporation's revenue segments include Food Industry (¥2.36 billion), Power Solution (¥1.38 billion), Mineral Resources (¥3.27 billion), Materials Solution (¥2.39 billion), Smart-Life Creation (¥3.53 billion), and Environmental Energy (¥1.14 billion).

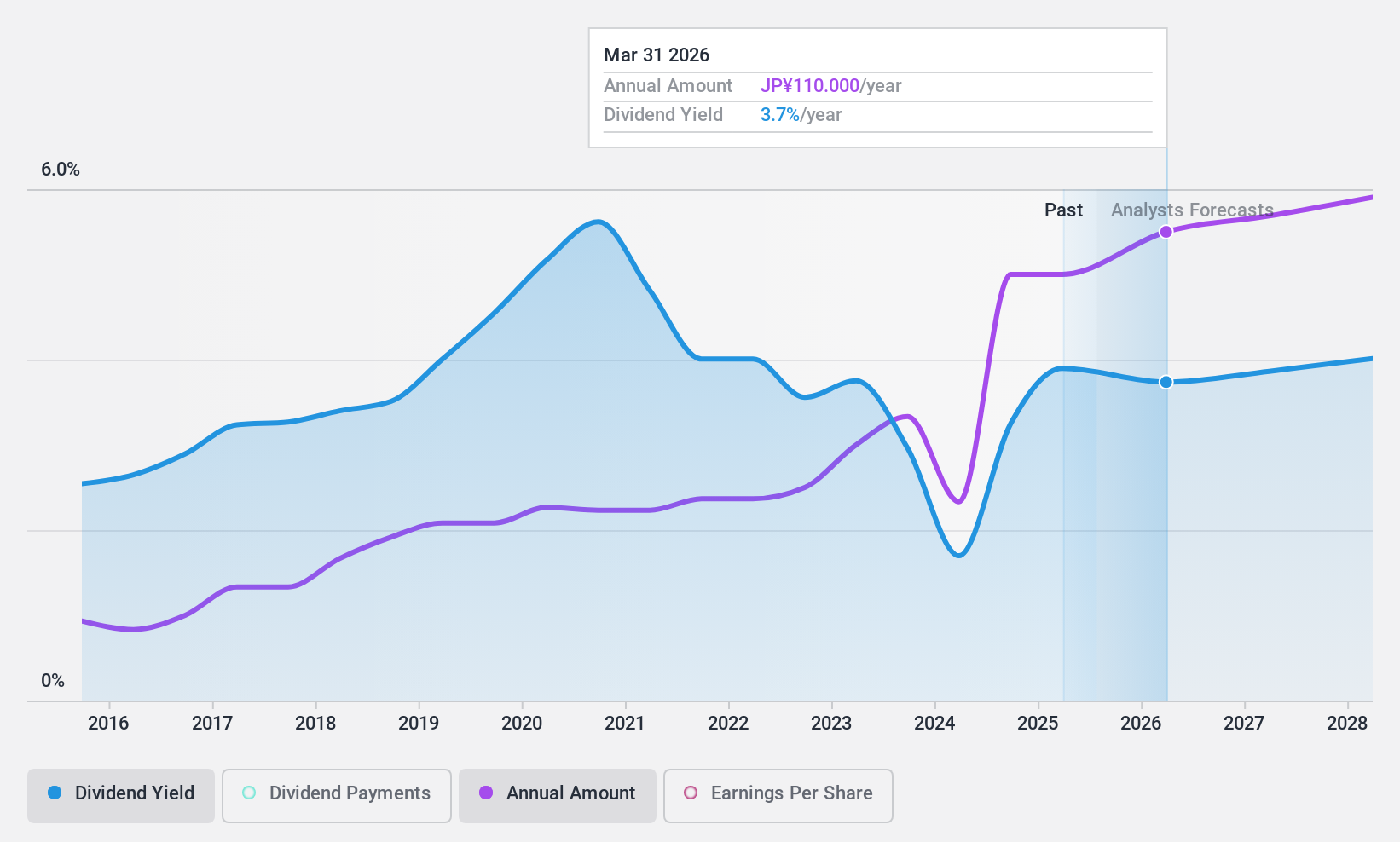

Dividend Yield: 3.8%

Mitsubishi's dividend payments have been volatile over the past decade, though they are well-covered by earnings and cash flows with payout ratios of 31.2% and 36.1%, respectively. Despite a forecasted decline in earnings, the company trades at a good value relative to peers and is below fair value estimates. Recent strategic partnerships, like the investment in AC Ventures Holding Corp., may offer growth opportunities that could stabilize future dividends amidst current volatility concerns.

- Delve into the full analysis dividend report here for a deeper understanding of Mitsubishi.

- The valuation report we've compiled suggests that Mitsubishi's current price could be quite moderate.

Kino Polska TV Spolka Akcyjna (WSE:KPL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kino Polska TV Spolka Akcyjna is a media company that operates in Poland and internationally, with a market cap of PLN412.29 million.

Operations: Kino Polska TV Spolka Akcyjna generates revenue from various segments, including Zoom TV (PLN31.65 million), Freeze TV (PLN56.52 million), Kino Polska Channels (PLN35.35 million), Sale of License Rights (PLN17.51 million), Production of TV Channels (PLN7.61 million), and Filmbox Movie Channels and Thematic Channels (PLN158.00 million).

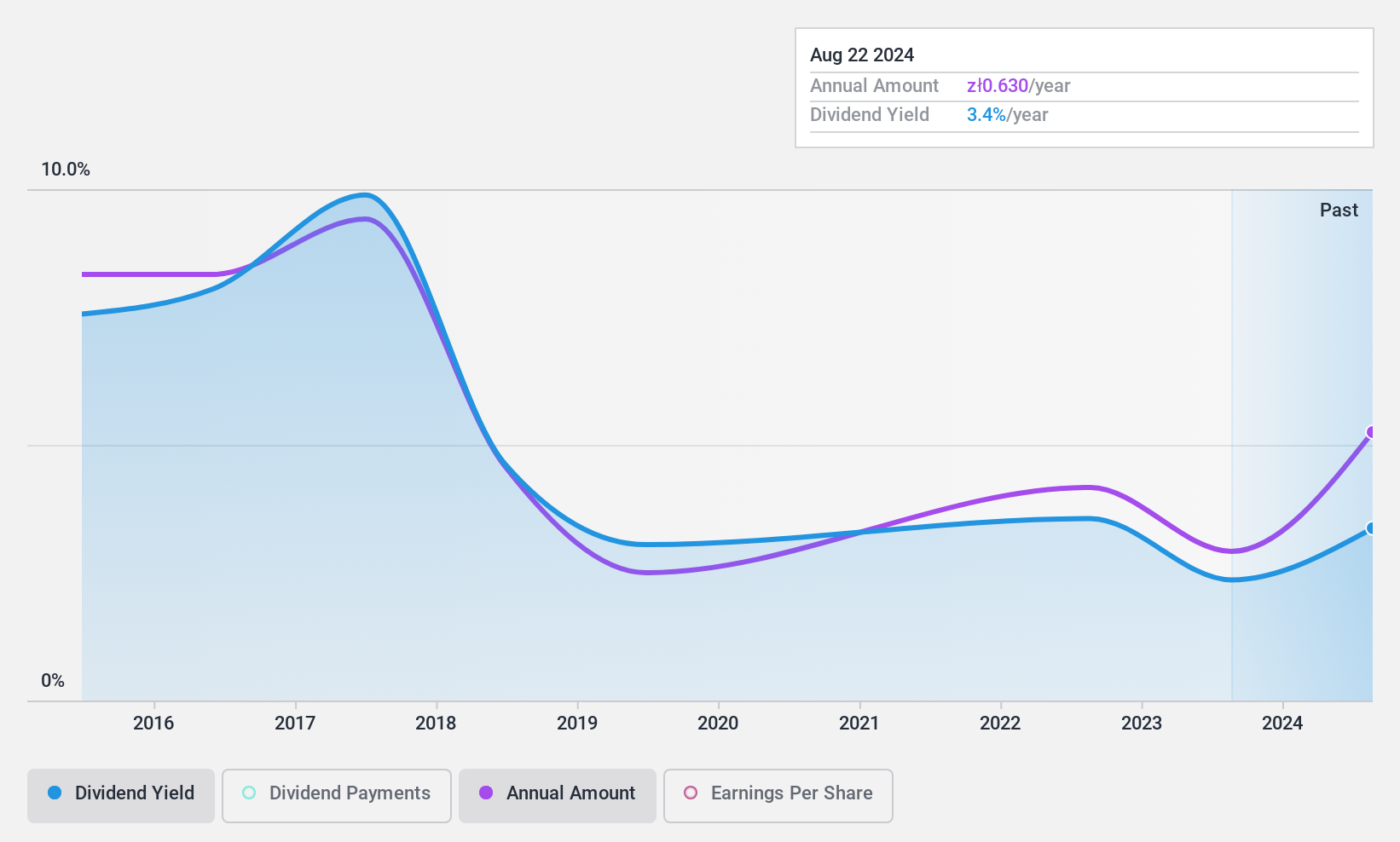

Dividend Yield: 3%

Kino Polska TV Spolka Akcyjna's dividend payments are well-covered by earnings and cash flows, with low payout ratios of 17.6% and 18.2%, respectively, indicating sustainability despite a volatile track record over the past decade. The company's recent earnings report shows significant growth, with net income rising to PLN 15.32 million in Q3 2024 from PLN 8.73 million a year ago, suggesting potential for future dividend stability if this trend continues.

- Click here and access our complete dividend analysis report to understand the dynamics of Kino Polska TV Spolka Akcyjna.

- Insights from our recent valuation report point to the potential undervaluation of Kino Polska TV Spolka Akcyjna shares in the market.

Key Takeaways

- Reveal the 1946 hidden gems among our Top Dividend Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Mitsubishi, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8058

Mitsubishi

Engages in the natural gas, industrial materials and infrastructure, chemicals, mineral resources, automotive and mobility, food and consumer industry, power solution, and urban development businesses worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives