- Poland

- /

- Telecom Services and Carriers

- /

- WSE:CPS

Here's Why Cyfrowy Polsat (WSE:CPS) Is Weighed Down By Its Debt Load

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Cyfrowy Polsat S.A. (WSE:CPS) makes use of debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Cyfrowy Polsat

How Much Debt Does Cyfrowy Polsat Carry?

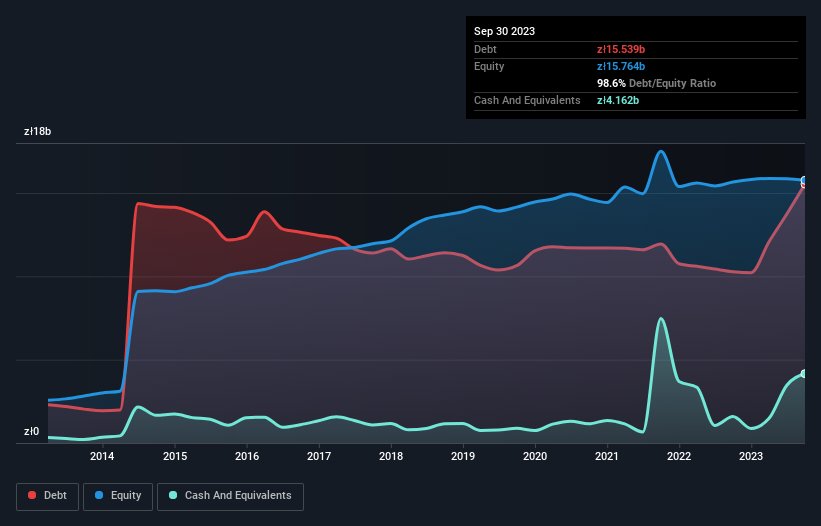

You can click the graphic below for the historical numbers, but it shows that as of September 2023 Cyfrowy Polsat had zł15.5b of debt, an increase on zł10.3b, over one year. However, because it has a cash reserve of zł4.16b, its net debt is less, at about zł11.4b.

How Healthy Is Cyfrowy Polsat's Balance Sheet?

According to the last reported balance sheet, Cyfrowy Polsat had liabilities of zł6.76b due within 12 months, and liabilities of zł14.3b due beyond 12 months. On the other hand, it had cash of zł4.16b and zł3.40b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by zł13.5b.

This deficit casts a shadow over the zł6.53b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Cyfrowy Polsat would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Cyfrowy Polsat shareholders face the double whammy of a high net debt to EBITDA ratio (5.2), and fairly weak interest coverage, since EBIT is just 1.3 times the interest expense. The debt burden here is substantial. Even worse, Cyfrowy Polsat saw its EBIT tank 21% over the last 12 months. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Cyfrowy Polsat's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Looking at the most recent three years, Cyfrowy Polsat recorded free cash flow of 38% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

To be frank both Cyfrowy Polsat's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least its conversion of EBIT to free cash flow is not so bad. After considering the datapoints discussed, we think Cyfrowy Polsat has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Cyfrowy Polsat (of which 1 can't be ignored!) you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:CPS

Cyfrowy Polsat

Provides digital satellite platform and terrestrial television (TV), and telecommunication services primarily in Poland.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success