- Netherlands

- /

- Capital Markets

- /

- ENXTAM:CVC

High Insider Ownership Fuels Growth Stocks In December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, global markets are navigating a mixed landscape with U.S. consumer confidence dipping and major indices experiencing moderate gains amid fluctuations in economic indicators. Despite these challenges, large-cap growth stocks have shown resilience, particularly in the technology sector, which has been a driving force behind recent market rallies. In this environment, companies with high insider ownership can be particularly appealing to investors seeking stability and potential growth. High insider ownership often signals confidence from those closest to the company’s operations and can align management's interests with those of shareholders, making such companies attractive options for consideration in uncertain times.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Propel Holdings (TSX:PRL) | 23.9% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

Underneath we present a selection of stocks filtered out by our screen.

CVC Capital Partners (ENXTAM:CVC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CVC Capital Partners plc is a private equity and venture capital firm that focuses on middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales, and spinouts with a market cap of €22.37 billion.

Operations: CVC Capital Partners plc generates revenue through its specialization in middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity investments, mature investments, recapitalizations, strip sales, and spinouts.

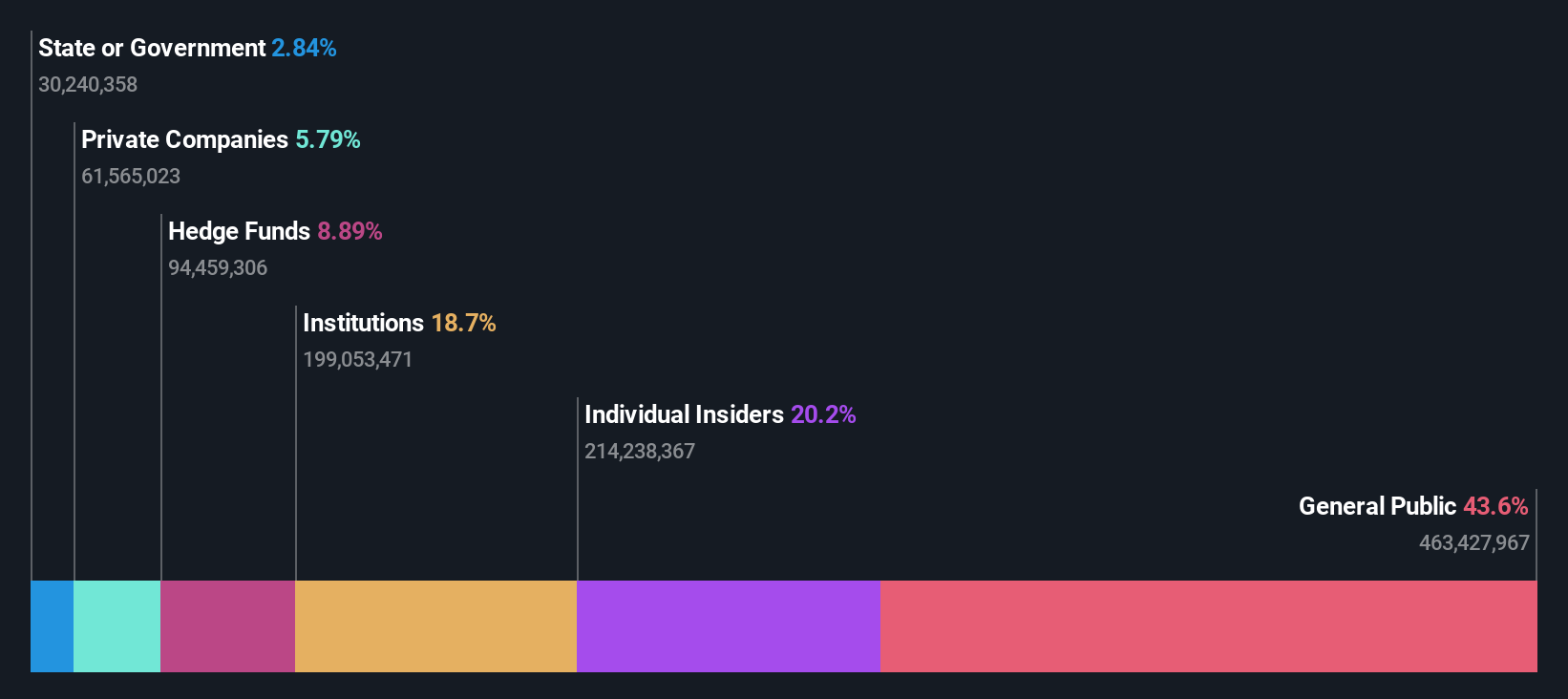

Insider Ownership: 20.2%

Revenue Growth Forecast: 14.4% p.a.

CVC Capital Partners is trading at 24.1% below its estimated fair value, with earnings expected to grow significantly over the next three years, outpacing both market and revenue growth. Despite high debt levels, CVC's return on equity is forecasted to be very high in three years. Recent M&A activities include potential stakes in Telecom Italia and a sale of its stake in HealthCare Global Enterprises, reflecting strategic repositioning amidst strong financial performance.

- Click here to discover the nuances of CVC Capital Partners with our detailed analytical future growth report.

- Our valuation report here indicates CVC Capital Partners may be overvalued.

Changsha Jingjia Microelectronics (SZSE:300474)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Changsha Jingjia Microelectronics Co., Ltd. operates in the semiconductor industry, focusing on the design and development of electronic components, with a market cap of CN¥53.15 billion.

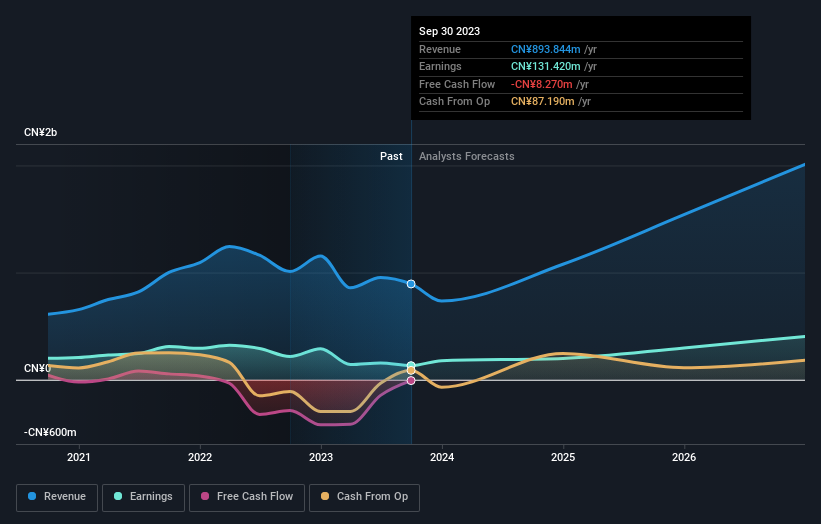

Operations: The company's revenue from the Computer, Communications and Other Electronic Equipment Manufacturing segment is CN¥893.84 million.

Insider Ownership: 34%

Revenue Growth Forecast: 29.0% p.a.

Changsha Jingjia Microelectronics shows potential with forecasted earnings growth of 33.01% annually, surpassing the Chinese market average. Despite recent revenue decline to CNY 441.06 million, net income improved to CNY 23.87 million, indicating better profitability management. However, high share price volatility and past shareholder dilution present risks. Recent private placements raised significant capital, suggesting strategic expansion plans but insider ownership details remain limited over the past three months.

- Take a closer look at Changsha Jingjia Microelectronics' potential here in our earnings growth report.

- According our valuation report, there's an indication that Changsha Jingjia Microelectronics' share price might be on the expensive side.

CD Projekt (WSE:CDR)

Simply Wall St Growth Rating: ★★★★★★

Overview: CD Projekt S.A., along with its subsidiaries, focuses on developing, publishing, and digitally distributing video games for PCs and consoles in Poland, with a market cap of PLN19.04 billion.

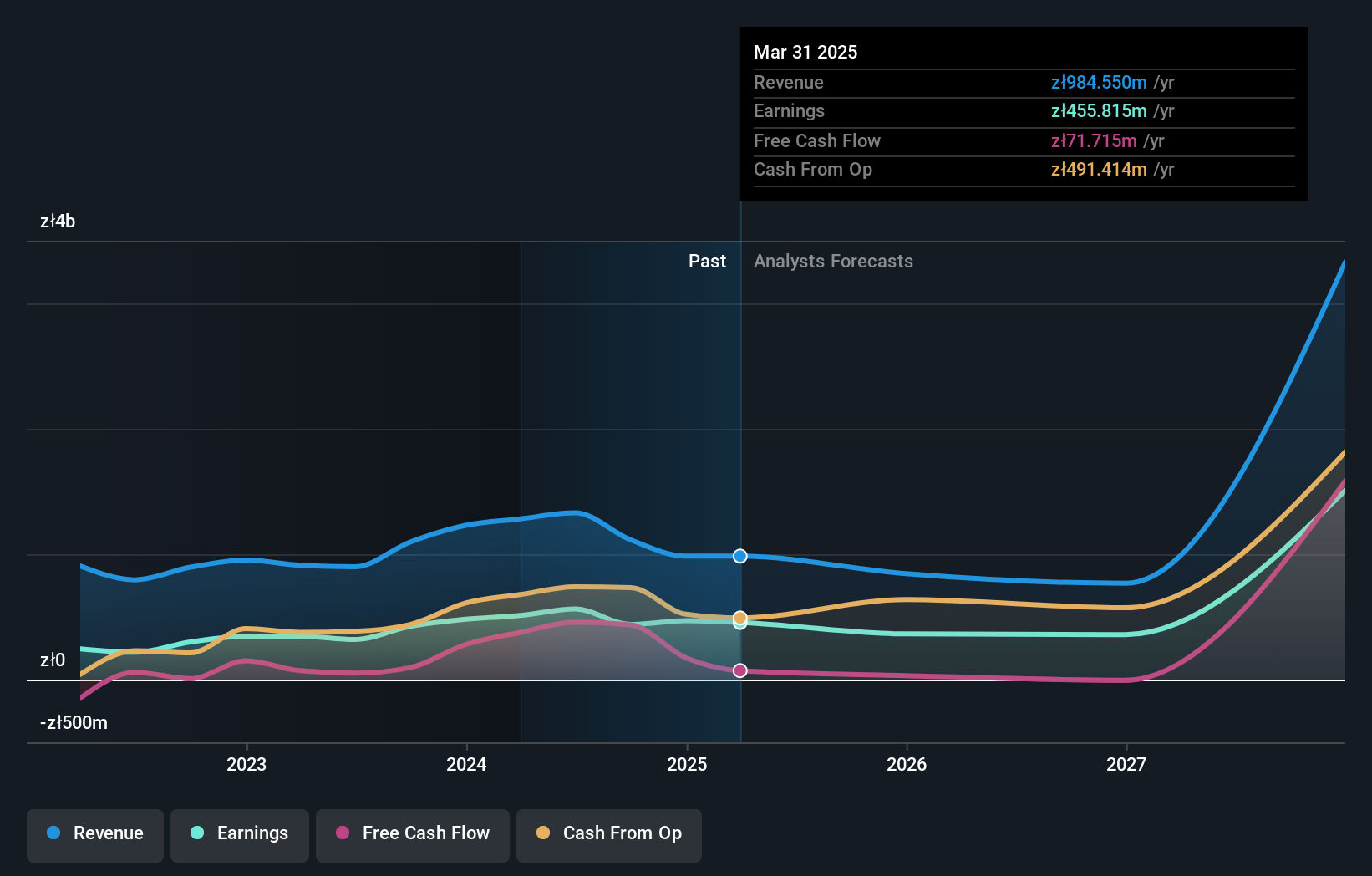

Operations: The company's revenue segments include GOG.Com, generating PLN203.76 million, and CD PROJEKT RED, contributing PLN937.83 million.

Insider Ownership: 29.7%

Revenue Growth Forecast: 24.9% p.a.

CD Projekt's earnings are forecast to grow 27% annually, outpacing the Polish market. Revenue is similarly expected to rise at 24.9% per year, despite recent declines with Q3 revenue at PLN 227.56 million compared to PLN 442.68 million a year ago. The company's Return on Equity is projected to be high in three years (34.6%). Recent events include an Extraordinary General Meeting addressing board appointments and governance matters, reflecting active insider involvement without significant recent insider trading activity reported.

- Dive into the specifics of CD Projekt here with our thorough growth forecast report.

- The valuation report we've compiled suggests that CD Projekt's current price could be inflated.

Summing It All Up

- Click this link to deep-dive into the 1507 companies within our Fast Growing Companies With High Insider Ownership screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:CVC

CVC Capital Partners

A private equity and venture capital firm specializing in middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature, recapitalizations, strip sales, and spinouts.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives