As global markets navigate a mixed economic landscape, with U.S. consumer confidence dipping and major indices experiencing both gains and losses, investors are increasingly looking for stability amidst uncertainty. In such an environment, dividend stocks can offer a reliable income stream and potential resilience against market volatility, making them an attractive consideration for those seeking to balance growth with income.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.28% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.59% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.35% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.81% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.17% | ★★★★★★ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

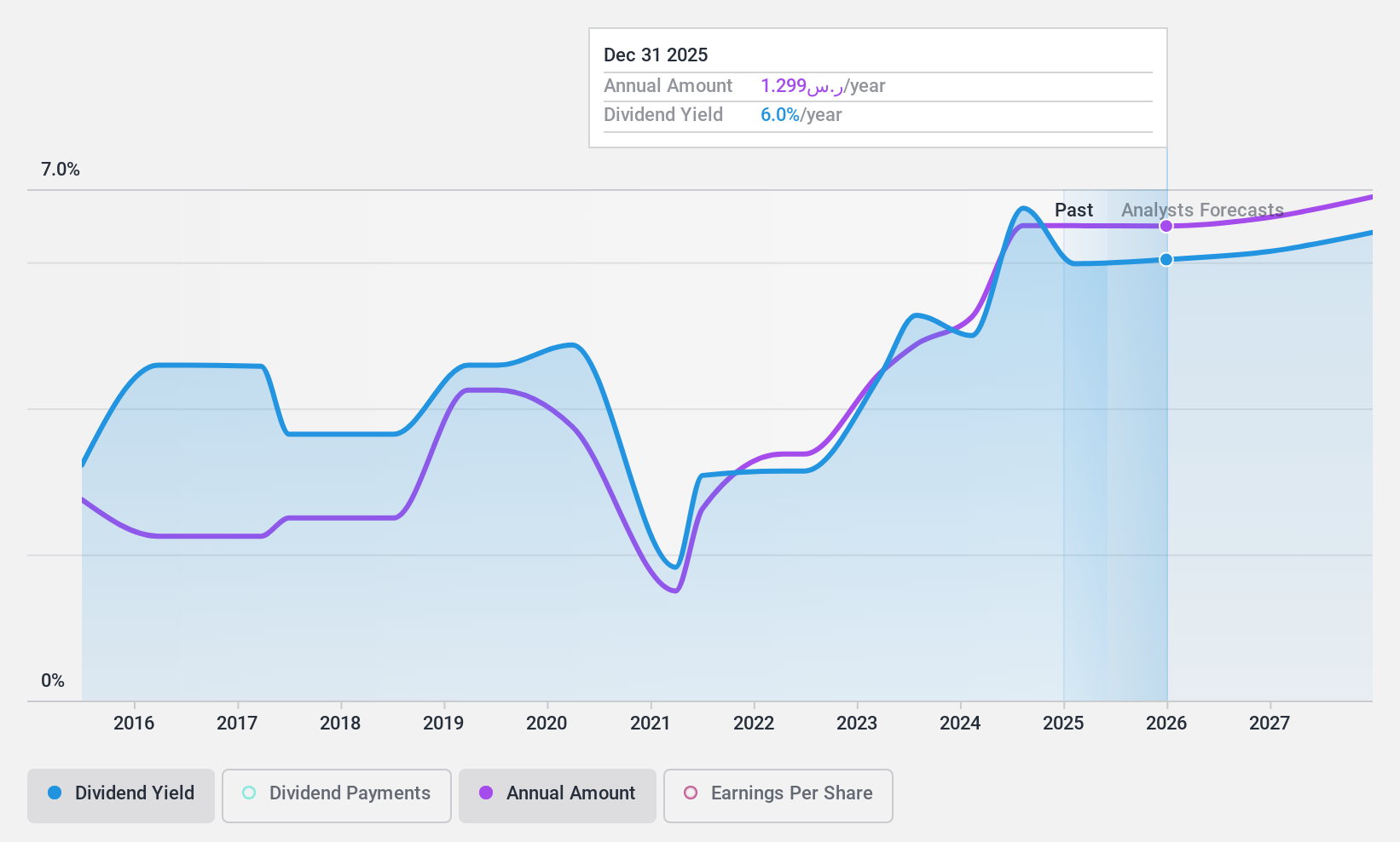

Arab National Bank (SASE:1080)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Arab National Bank operates in the Kingdom of Saudi Arabia and the United Kingdom, offering a range of banking products and services, with a market cap of SAR41.28 billion.

Operations: Arab National Bank's revenue is primarily derived from its Corporate Banking segment at SAR6.56 billion, followed by Retail Banking at SAR2.15 billion, and Investment and Brokerage Services at SAR499.79 million.

Dividend Yield: 6.3%

Arab National Bank's recent earnings report shows a solid increase in net income, with SAR 1.24 billion for Q3 2024, up from SAR 1.08 billion last year, supporting its dividend capability. The bank trades at a favorable P/E ratio of 8.9x compared to the SA market average of 23.1x, offering good relative value. Despite past volatility in dividends, current payments are covered by earnings with a payout ratio of approximately 50%, and future coverage is forecasted to remain stable at around 52%.

- Navigate through the intricacies of Arab National Bank with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Arab National Bank's share price might be too pessimistic.

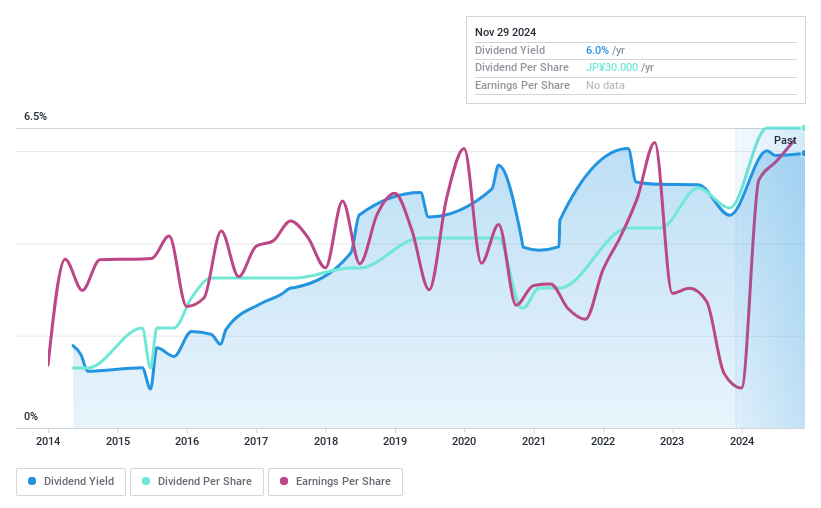

MIRARTH HOLDINGSInc (TSE:8897)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MIRARTH HOLDINGS, Inc. operates in the real estate sector in Japan and has a market capitalization of ¥69.58 billion.

Operations: MIRARTH HOLDINGS, Inc. generates revenue from its Real Estate Business at ¥189.09 billion, Energy Business at ¥13.73 million, and Asset Management Business at ¥1.05 million.

Dividend Yield: 5.8%

MIRARTH HOLDINGS Inc. offers a dividend yield of 5.85%, placing it in the top 25% of dividend payers in Japan, although its dividend history is marked by volatility and unreliability over the past decade. Recent increases, such as the JPY 7.00 per share for Q2 2024, highlight potential growth. Dividends are well covered by earnings and cash flows with payout ratios of 29% and 20.6%, respectively, despite a high debt level and past shareholder dilution concerns.

- Unlock comprehensive insights into our analysis of MIRARTH HOLDINGSInc stock in this dividend report.

- Our comprehensive valuation report raises the possibility that MIRARTH HOLDINGSInc is priced lower than what may be justified by its financials.

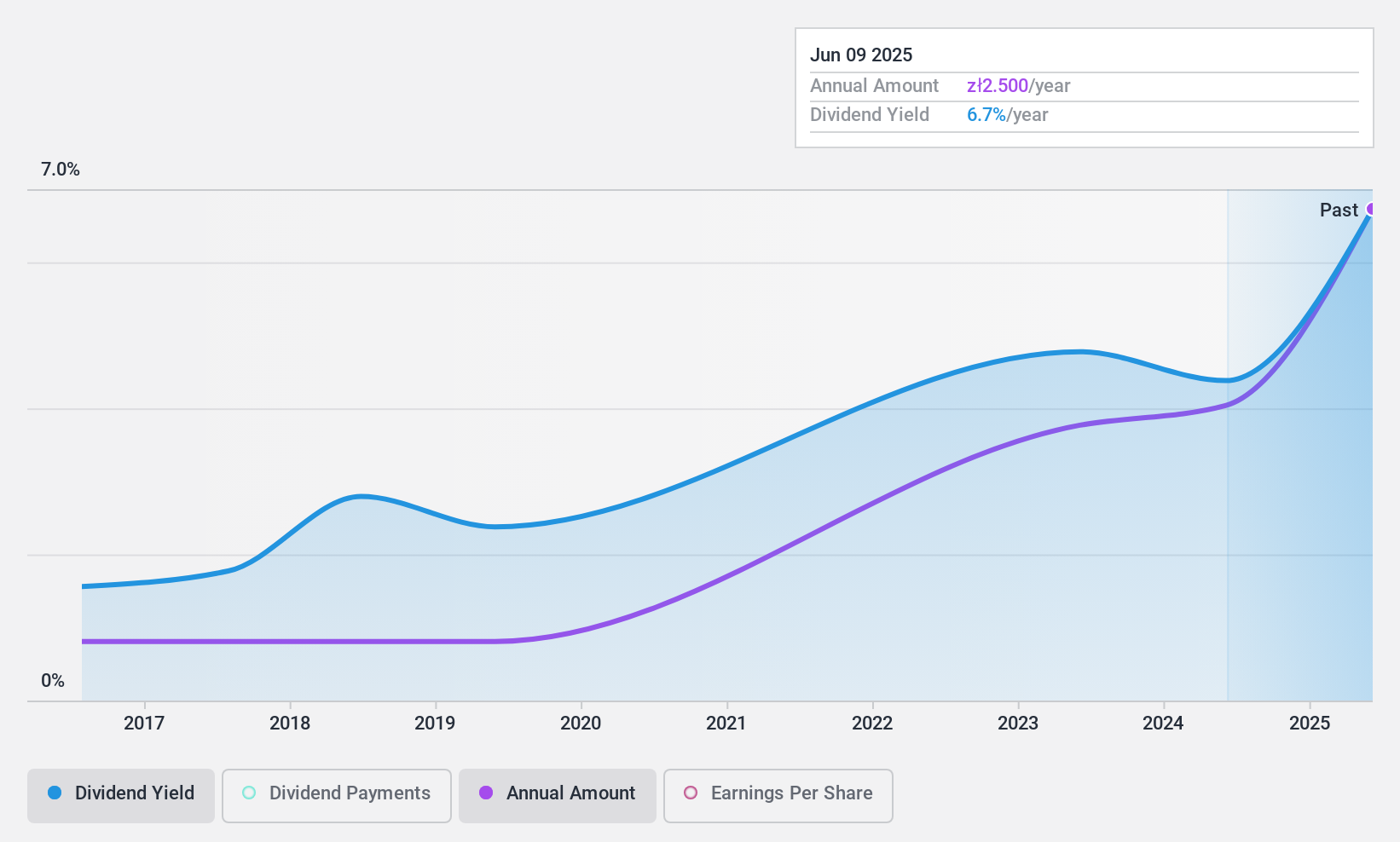

Selena FM (WSE:SEL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Selena FM S.A. operates through its subsidiaries to produce, distribute, and sell construction chemicals, building materials for doors and windows, and general building accessories to both professional and individual users, with a market cap of PLN627.54 million.

Operations: Selena FM S.A.'s revenue is primarily derived from its Parent Company at PLN898.66 million, Production in Poland at PLN687.26 million, Eastern Europe and Asia at PLN489.75 million, Western Europe at PLN458.90 million, Distribution in Poland at PLN327.80 million, and America contributing PLN107.88 million.

Dividend Yield: 5.2%

Selena FM's dividend payments are covered by earnings and cash flows, with payout ratios of 59.7% and 72.2%, respectively, although the dividends have been volatile over the past decade. The dividend yield of 5.17% is below top-tier levels in Poland. Recent earnings showed a decline in third-quarter net income to PLN 24.93 million from PLN 54.89 million last year, though nine-month earnings increased slightly to PLN 69.11 million from PLN 61.72 million previously.

- Delve into the full analysis dividend report here for a deeper understanding of Selena FM.

- In light of our recent valuation report, it seems possible that Selena FM is trading beyond its estimated value.

Next Steps

- Gain an insight into the universe of 1938 Top Dividend Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:SEL

Selena FM

Through its subsidiaries, produces, distributes, and sells construction chemicals, building materials for doors and windows, and general building accessories to professional and individual users.

Flawless balance sheet average dividend payer.