If EPS Growth Is Important To You, Orzel Spolka Akcyjna (WSE:ORL) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Orzel Spolka Akcyjna (WSE:ORL). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Orzel Spolka Akcyjna

How Fast Is Orzel Spolka Akcyjna Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. We can see that in the last three years Orzel Spolka Akcyjna grew its EPS by 12% per year. That growth rate is fairly good, assuming the company can keep it up.

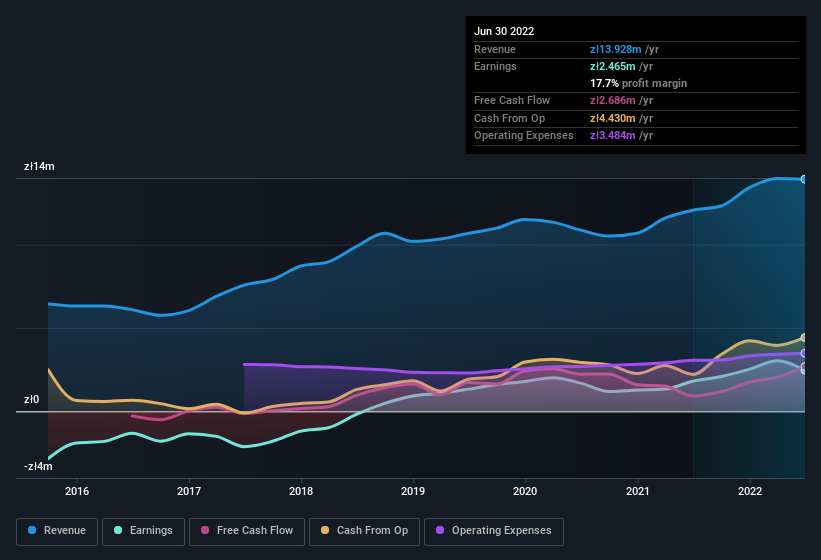

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Orzel Spolka Akcyjna shareholders is that EBIT margins have grown from 18% to 25% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Orzel Spolka Akcyjna is no giant, with a market capitalisation of zł22m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Orzel Spolka Akcyjna Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So those who are interested in Orzel Spolka Akcyjna will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Actually, with 46% of the company to their names, insiders are profoundly invested in the business. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. Valued at only zł22m Orzel Spolka Akcyjna is really small for a listed company. That means insiders only have zł10m worth of shares, despite the large proportional holding. That might not be a huge sum but it should be enough to keep insiders motivated!

Does Orzel Spolka Akcyjna Deserve A Spot On Your Watchlist?

As previously touched on, Orzel Spolka Akcyjna is a growing business, which is encouraging. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. These two factors are a huge highlight for the company which should be a strong contender your watchlists. We don't want to rain on the parade too much, but we did also find 3 warning signs for Orzel Spolka Akcyjna (2 can't be ignored!) that you need to be mindful of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:ORL

Orzel Spolka Akcyjna

Engages in the production of rubber granules that results from the recycling process of used tires.

Moderate risk with imperfect balance sheet.

Market Insights

Community Narratives