As European markets navigate the complexities of global growth concerns and currency fluctuations, the pan-European STOXX Europe 600 Index recently ended slightly lower, reflecting mixed performances across major stock indexes. In this environment, dividend stocks can offer a potential buffer against market volatility by providing consistent income streams, making them an attractive consideration for investors seeking stability amidst economic uncertainties.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.29% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.89% | ★★★★★☆ |

| Swiss Re (SWX:SREN) | 4.12% | ★★★★★☆ |

| Rubis (ENXTPA:RUI) | 7.14% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.59% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.96% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.24% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.66% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.62% | ★★★★★☆ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.72% | ★★★★★☆ |

Click here to see the full list of 220 stocks from our Top European Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Valmet Oyj (HLSE:VALMT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Valmet Oyj is a company that develops and supplies process technologies, automation, and services for the pulp, paper, and energy industries across various global regions, with a market cap of €5.67 billion.

Operations: Valmet Oyj generates its revenue from three main segments: Services (€1.91 billion), Automation (€1.49 billion), and Process Technologies (€1.85 billion).

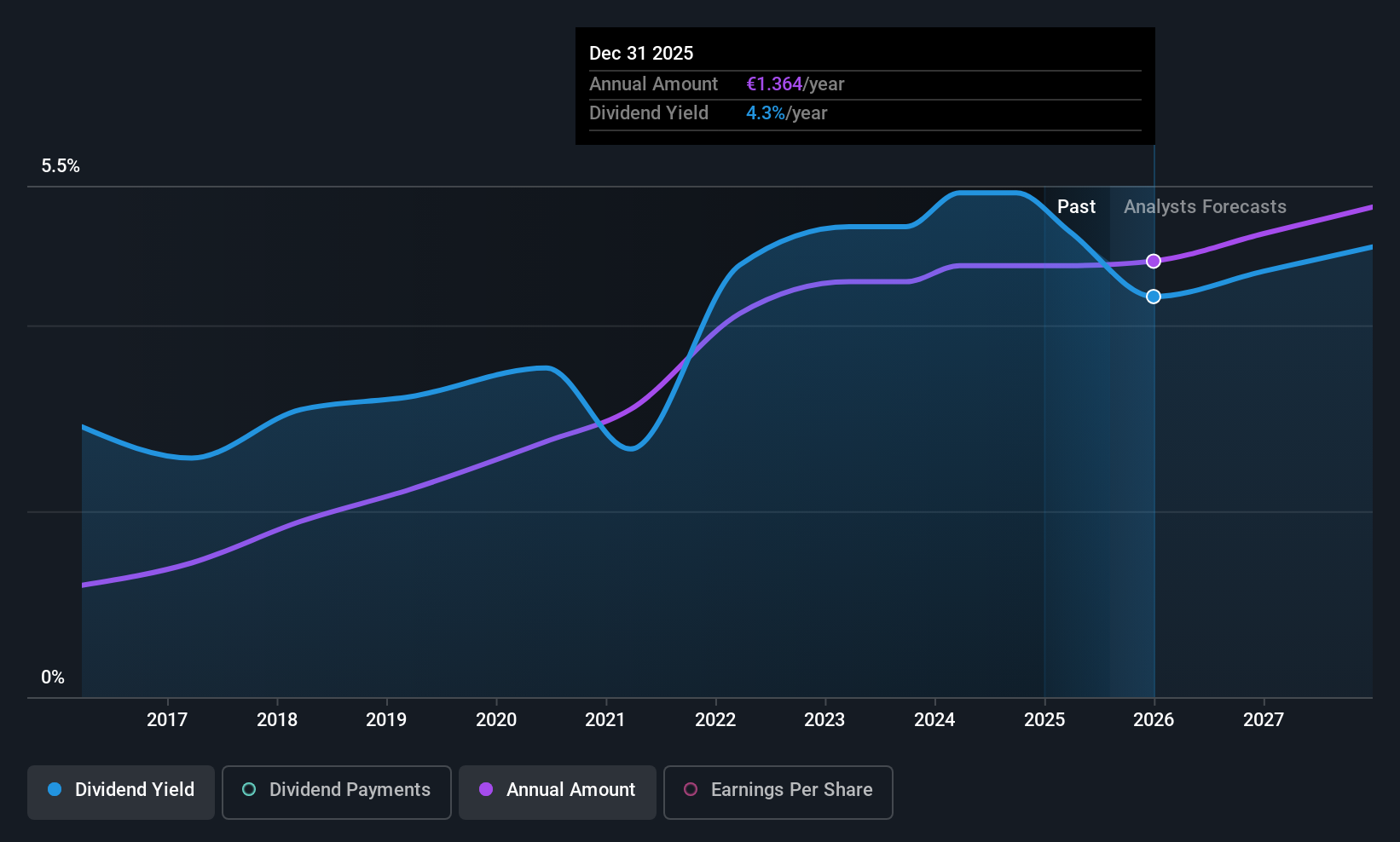

Dividend Yield: 4.4%

Valmet Oyj has a history of stable and growing dividend payments over the past decade, though its current dividend yield of 4.39% is below the top tier in Finland. The company's high payout ratio of 97.5% indicates dividends are not well covered by earnings, but a reasonable cash payout ratio of 52% suggests coverage by cash flows is adequate. Recent orders in Asia and South America could support future revenue growth, potentially impacting dividend sustainability positively.

- Click to explore a detailed breakdown of our findings in Valmet Oyj's dividend report.

- The analysis detailed in our Valmet Oyj valuation report hints at an deflated share price compared to its estimated value.

Powszechny Zaklad Ubezpieczen (WSE:PZU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Powszechny Zaklad Ubezpieczen SA offers life and non-life insurance products and services across Poland, the Baltic States, and Ukraine, with a market cap of PLN53.38 billion.

Operations: Powszechny Zaklad Ubezpieczen SA's revenue segments include Mass Insurance (PLN16.13 billion), Banking Activities (PLN42.39 billion), Group and Individually Continued Insurance (PLN11.91 billion), Corporate Insurance (PLN5.45 billion), Baltic Countries operations (PLN3.50 billion), Investments (PLN844 million), Pensions (PLN373 million), Ukraine operations (PLN281 million), and Life Investment Insurance (PLN109 million).

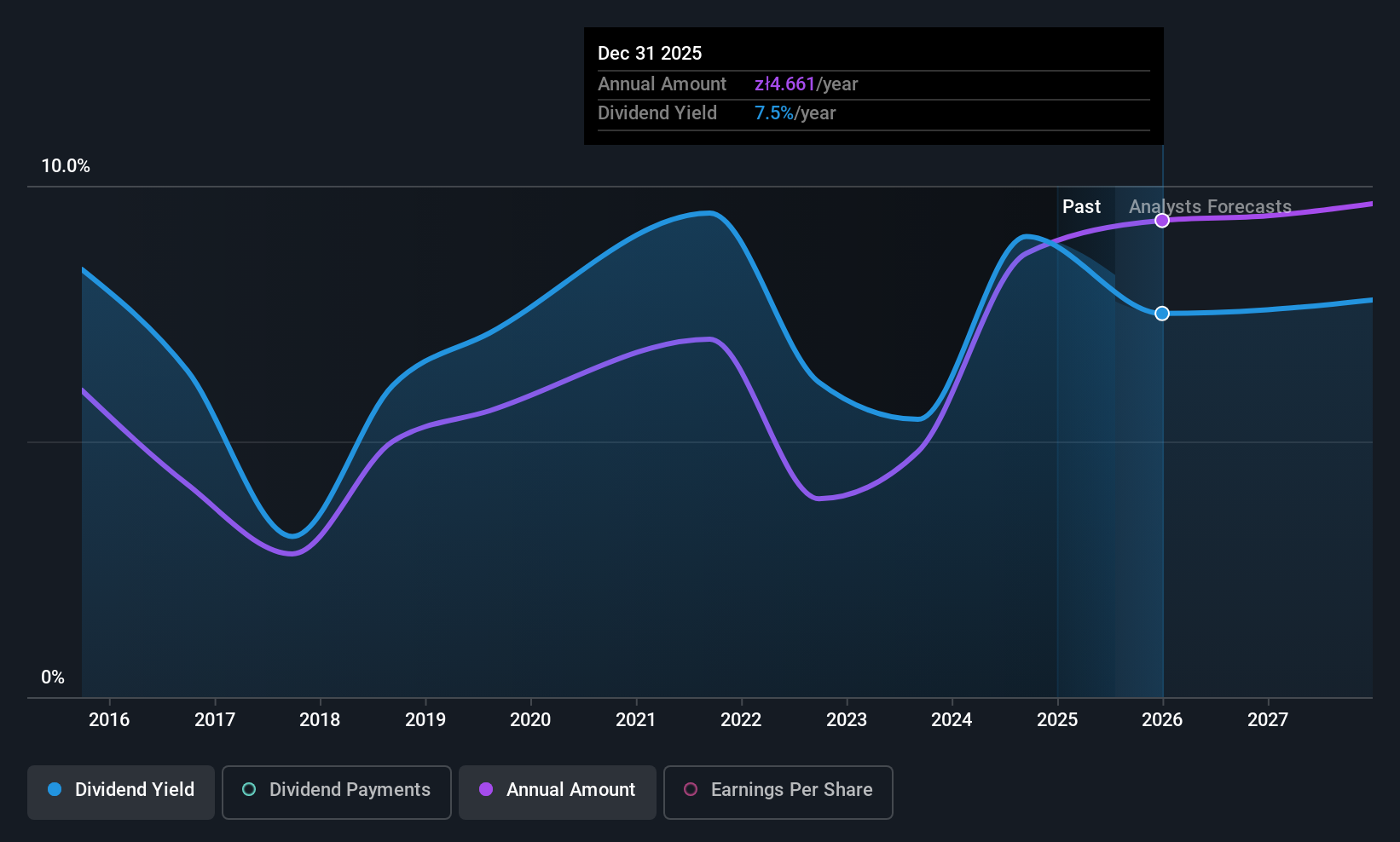

Dividend Yield: 7.2%

Powszechny Zaklad Ubezpieczen (PZU) offers a dividend yield of 7.23%, slightly below the top tier in Poland. Its dividends are well-covered by both earnings and cash flows, with payout ratios of 63% and 14.6%, respectively, suggesting sustainability despite an unstable track record over the past decade. Recent financial results show strong earnings growth, with net income for Q2 2025 at PLN 1.47 billion, up from PLN 1.19 billion the previous year, supporting potential future dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of Powszechny Zaklad Ubezpieczen.

- Upon reviewing our latest valuation report, Powszechny Zaklad Ubezpieczen's share price might be too pessimistic.

Santander Bank Polska (WSE:SPL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Santander Bank Polska S.A. offers a range of banking products and services to individuals, SMEs, corporate clients, and public sector institutions, with a market cap of PLN51.87 billion.

Operations: Santander Bank Polska S.A.'s revenue is primarily derived from Retail Banking (PLN10.10 billion), Business and Corporate Banking (PLN2.95 billion), and Corporate & Investment Banking (PLN1.49 billion).

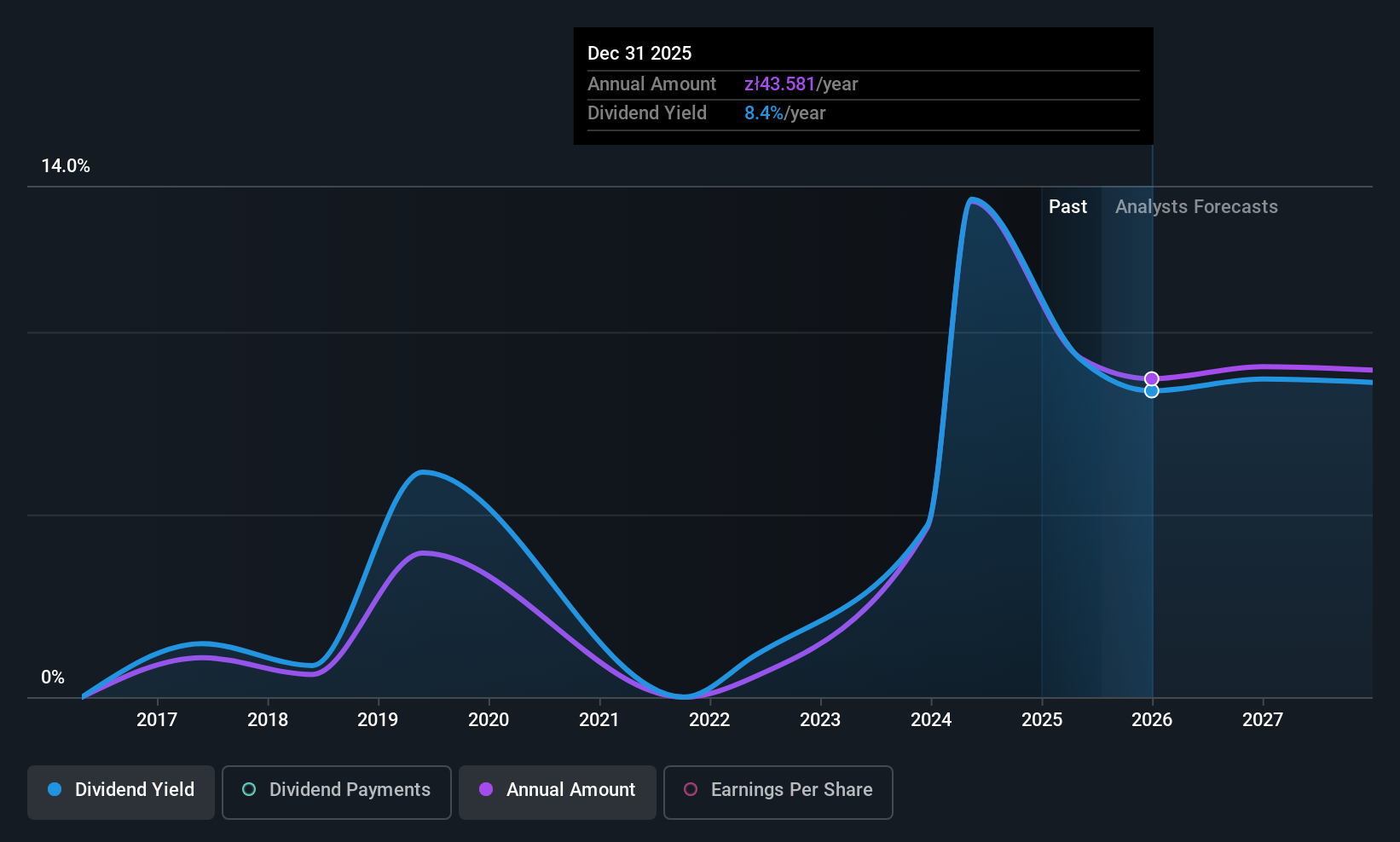

Dividend Yield: 9.1%

Santander Bank Polska offers a high dividend yield of 9.14%, ranking in the top 25% of Polish dividend payers. Despite this, its dividend history is marked by volatility and unreliability over the past decade. Recent earnings growth is strong, with Q2 2025 net income rising to PLN 1.02 billion from PLN 794.9 million a year ago, supporting current payout coverage at an 81% ratio and forecasted sustainability at 74.2%. However, concerns include high bad loans (4.1%) and low allowances (71%).

- Navigate through the intricacies of Santander Bank Polska with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Santander Bank Polska shares in the market.

Taking Advantage

- Investigate our full lineup of 220 Top European Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:VALMT

Valmet Oyj

Develops and supplies process technologies, automation, and services for the pulp, paper, and energy industries in North America, South America, China, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives