- Sweden

- /

- Communications

- /

- OM:KEBNI B

European Penny Stocks To Watch In August 2025

Reviewed by Simply Wall St

The European market has shown resilience, with the pan-European STOXX Europe 600 Index rising by 2.11% on the back of strong corporate earnings and optimism surrounding geopolitical tensions. As investors navigate these conditions, penny stocks—often representing smaller or less-established companies—remain an intriguing area for potential growth. Despite being a somewhat outdated term, penny stocks can still offer valuable opportunities when backed by solid financials and promising business models.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.05 | €22.87M | ✅ 2 ⚠️ 5 View Analysis > |

| Maps (BIT:MAPS) | €3.34 | €44.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €299.94M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €3.12 | €65.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.90 | €18.32M | ✅ 2 ⚠️ 3 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK3.255 | SEK3.12B | ✅ 4 ⚠️ 1 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.60 | €406.57M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.09 | €288.55M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.934 | €31.5M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 336 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

KebNi (OM:KEBNI B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: KebNi AB (publ) is a company that develops, produces, and sells products for stabilization, navigation, and satellite communication globally with a market cap of SEK608.74 million.

Operations: The company does not report specific revenue segments.

Market Cap: SEK608.74M

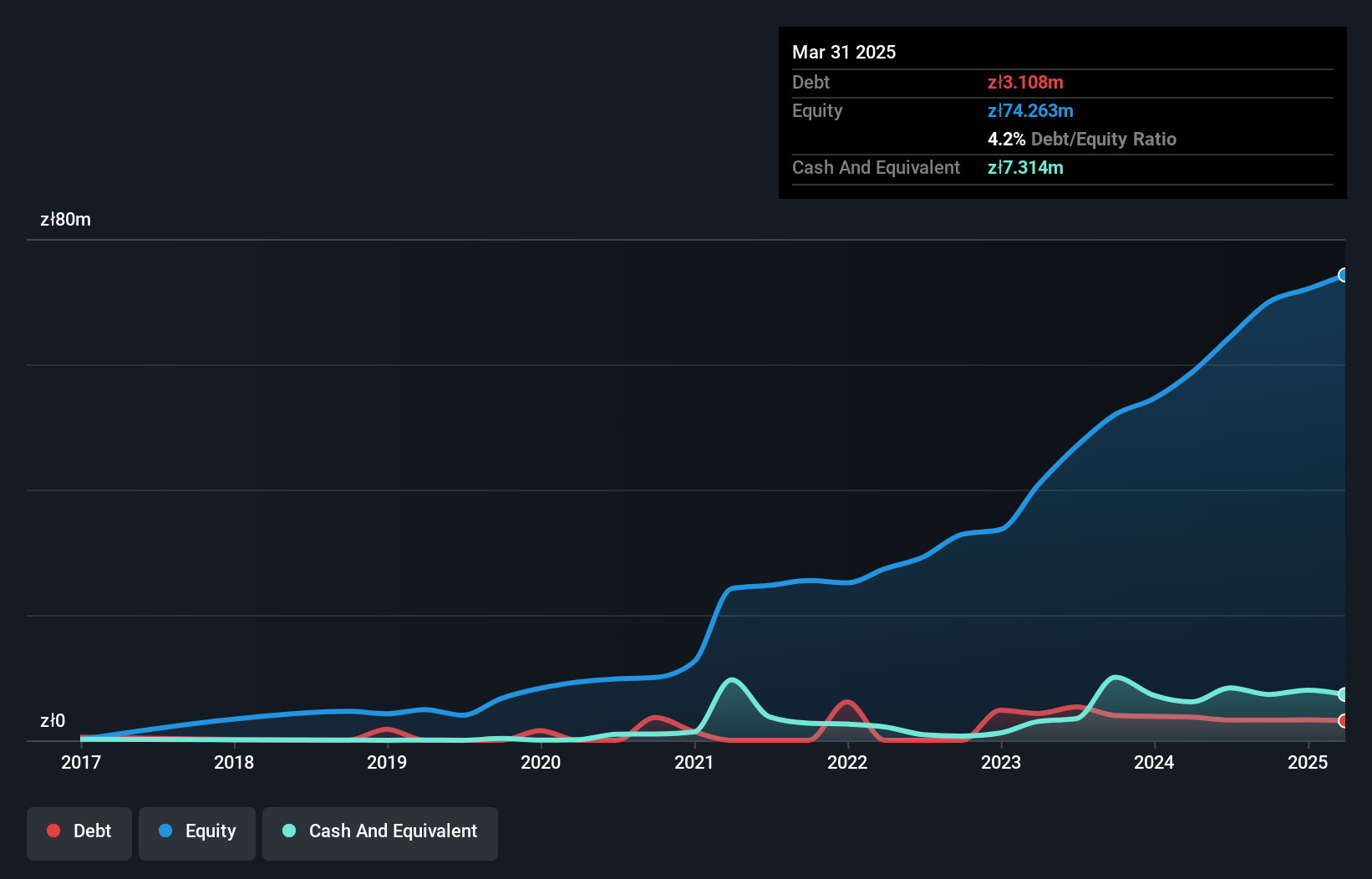

KebNi AB has demonstrated financial resilience with a market cap of SEK608.74 million, showing steady revenue growth in recent quarters. The company reported second-quarter sales of SEK36.12 million, an increase from the previous year, and achieved profitability with a net income of SEK2.39 million for the quarter. KebNi's strategic collaborations, such as with KAIST on drone technology and securing orders from the European Space Agency for satellite communication equipment, highlight its expanding footprint in high-tech markets. Despite having no debt and covering liabilities comfortably with assets, its Return on Equity remains low at 2.3%.

- Click to explore a detailed breakdown of our findings in KebNi's financial health report.

- Gain insights into KebNi's future direction by reviewing our growth report.

4MASS Spólka Akcyjna (WSE:4MS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 4Mass Spólka Akcyjna is involved in the manufacture and distribution of make-up products, with a market capitalization of PLN115.73 million.

Operations: The company generates revenue of PLN116.10 million from its production and distribution of cosmetic products.

Market Cap: PLN115.73M

4MASS Spólka Akcyjna, with a market cap of PLN115.73 million, reported first-quarter revenue of PLN27.87 million and a net income decline to PLN2.3 million from the previous year. Its Price-To-Earnings ratio is favorable compared to the Polish market, suggesting potential value for investors. The company's debt is well covered by operating cash flow and it maintains more cash than total debt, indicating strong financial health. Although its earnings growth was negative last year, 4MASS has shown profitability over five years with high-quality earnings and an impressive Return on Equity of 21%. However, recent profit margins have decreased from the previous year.

- Unlock comprehensive insights into our analysis of 4MASS Spólka Akcyjna stock in this financial health report.

- Assess 4MASS Spólka Akcyjna's previous results with our detailed historical performance reports.

11880 Solutions (XTRA:TGT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: 11880 Solutions AG, with a market cap of €18.62 million, provides telephone directory assistance services to both private and business customers in Germany through its subsidiaries.

Operations: The company's revenue is derived from two main segments: Digital, which generates €44.09 million, and Directory Assistance, contributing €10.95 million.

Market Cap: €18.62M

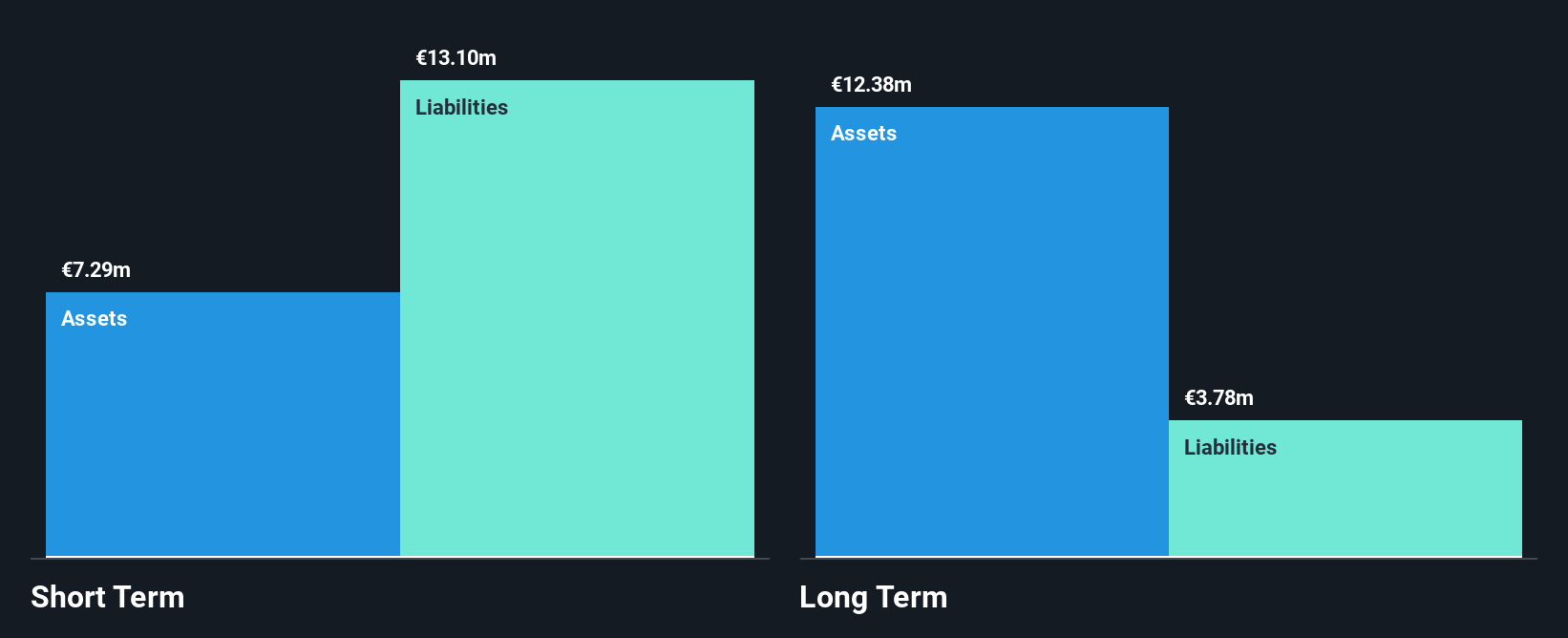

11880 Solutions AG, with a market cap of €18.62 million, is navigating challenges typical of penny stocks, including volatility and financial instability. The company's revenue from its Digital and Directory Assistance segments amounted to €27.22 million for the first half of 2025 but reported a net loss of €1.11 million, an increase from the previous year. Despite having satisfactory debt levels with a net debt to equity ratio of 37.1%, it remains unprofitable with negative return on equity at -6.77%. However, it has over three years' cash runway due to positive free cash flow growth.

- Get an in-depth perspective on 11880 Solutions' performance by reading our balance sheet health report here.

- Gain insights into 11880 Solutions' past trends and performance with our report on the company's historical track record.

Summing It All Up

- Click here to access our complete index of 336 European Penny Stocks.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KebNi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:KEBNI B

KebNi

Develops, produces, and sells products and applications for stabilization, navigation, and satcom worldwide.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives