- Poland

- /

- Healthcare Services

- /

- WSE:MSM

There's Reason For Concern Over Massmedica S.A.'s (WSE:MSM) Massive 44% Price Jump

The Massmedica S.A. (WSE:MSM) share price has done very well over the last month, posting an excellent gain of 44%. Looking further back, the 22% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

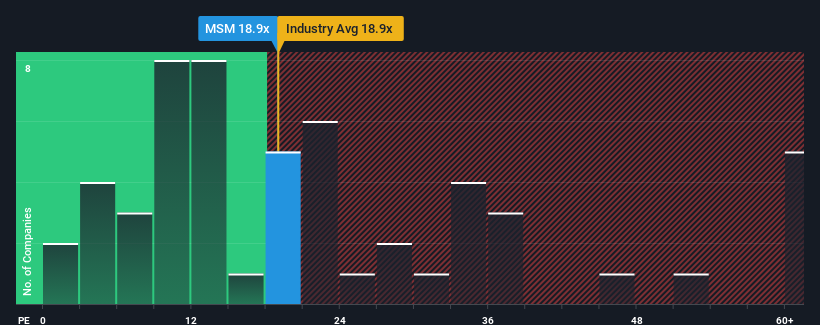

Since its price has surged higher, Massmedica may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 18.9x, since almost half of all companies in Poland have P/E ratios under 12x and even P/E's lower than 7x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, Massmedica has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Massmedica

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Massmedica's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 95%. Still, incredibly EPS has fallen 11% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 16% shows it's an unpleasant look.

In light of this, it's alarming that Massmedica's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Massmedica's P/E is flying high just like its stock has during the last month. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Massmedica currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Massmedica you should know about.

If you're unsure about the strength of Massmedica's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:MSM

Massmedica

Engages in the distribution of implants and other medical materials used in the treatment of musculoskeletal system diseases and regenerative medicines in Poland.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives