- Poland

- /

- Healthcare Services

- /

- WSE:MSM

Optimistic Investors Push Massmedica S.A. (WSE:MSM) Shares Up 41% But Growth Is Lacking

The Massmedica S.A. (WSE:MSM) share price has done very well over the last month, posting an excellent gain of 41%. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

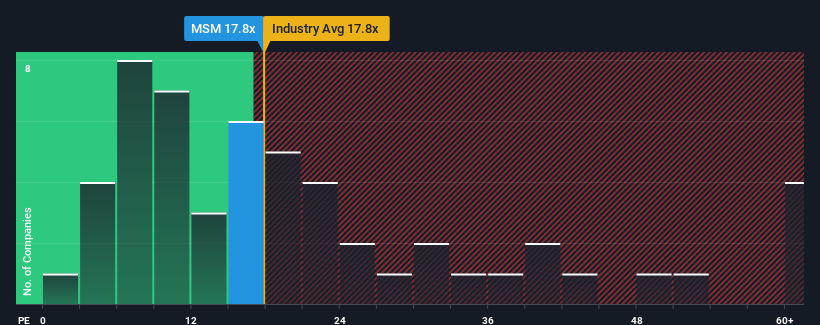

Following the firm bounce in price, Massmedica's price-to-earnings (or "P/E") ratio of 17.8x might make it look like a sell right now compared to the market in Poland, where around half of the companies have P/E ratios below 12x and even P/E's below 7x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Massmedica has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Massmedica

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Massmedica's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 24%. Still, incredibly EPS has fallen 15% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 10% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's alarming that Massmedica's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Massmedica shares have received a push in the right direction, but its P/E is elevated too. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Massmedica revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You should always think about risks. Case in point, we've spotted 3 warning signs for Massmedica you should be aware of.

If these risks are making you reconsider your opinion on Massmedica, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Massmedica, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:MSM

Massmedica

Engages in the distribution of implants and other medical materials used in the treatment of musculoskeletal system diseases and regenerative medicines in Poland.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives