The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Airway Medix S.A. (WSE:AWM) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Airway Medix

How Much Debt Does Airway Medix Carry?

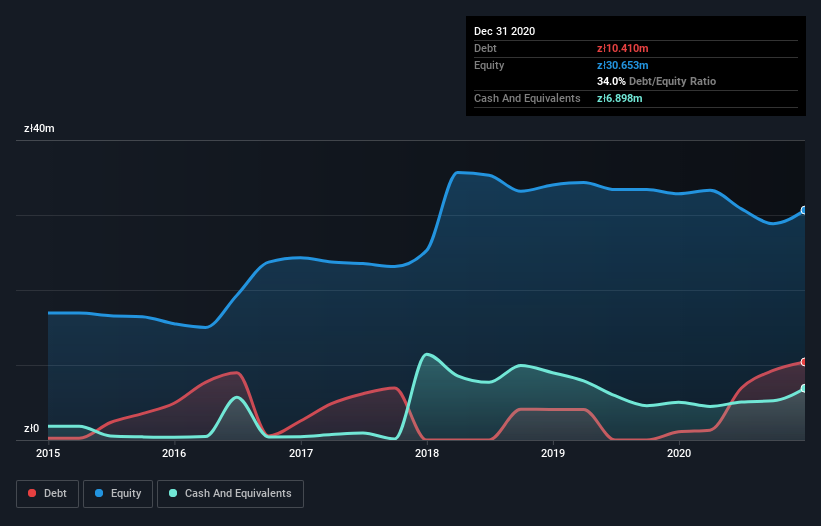

As you can see below, at the end of December 2020, Airway Medix had zł10.4m of debt, up from zł1.09m a year ago. Click the image for more detail. However, because it has a cash reserve of zł6.90m, its net debt is less, at about zł3.51m.

How Healthy Is Airway Medix's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Airway Medix had liabilities of zł13.0m due within 12 months and liabilities of zł7.87m due beyond that. Offsetting these obligations, it had cash of zł6.90m as well as receivables valued at zł15.3m due within 12 months. So it can boast zł1.39m more liquid assets than total liabilities.

Having regard to Airway Medix's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the zł99.8m company is struggling for cash, we still think it's worth monitoring its balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. But it is Airway Medix's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Given its lack of meaningful operating revenue, Airway Medix shareholders no doubt hope it can fund itself until it can sell some of its new medical technology.

Caveat Emptor

While Airway Medix's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. To be specific the EBIT loss came in at zł2.2m. Looking on the brighter side, the business has adequate liquid assets, which give it time to grow and develop before its debt becomes a near-term issue. Still, we'd be more encouraged to study the business in depth if it already had some free cash flow. So it seems too risky for our taste. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 4 warning signs for Airway Medix you should be aware of, and 3 of them are concerning.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Airway Medix, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:AWM

Airway Medix

Engages in the research, development, and commercialization of medical devices for the mechanically ventilated patients in the intensive care units and for the patients in life-threatening conditions in the anaesthesiology departments.

Good value with slight risk.

Market Insights

Community Narratives