- Switzerland

- /

- Capital Markets

- /

- SWX:EFGN

Three High-Quality Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets experience mixed signals with U.S. consumer confidence dipping and stock indexes showing moderate gains, investors are navigating a complex landscape marked by fluctuating economic indicators and geopolitical tensions. In such an environment, focusing on high-quality dividend stocks can provide a measure of stability and income, as these stocks often represent companies with strong fundamentals and resilient business models capable of weathering market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.27% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.81% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1949 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Eni (BIT:ENI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eni S.p.A. is a global integrated energy company with a market capitalization of €40.67 billion.

Operations: Eni S.p.A.'s revenue segments include Exploration & Production (€23.93 billion), Global Gas & LNG Portfolio (€15.71 billion), and Corporate and Other Activities (€2.07 billion).

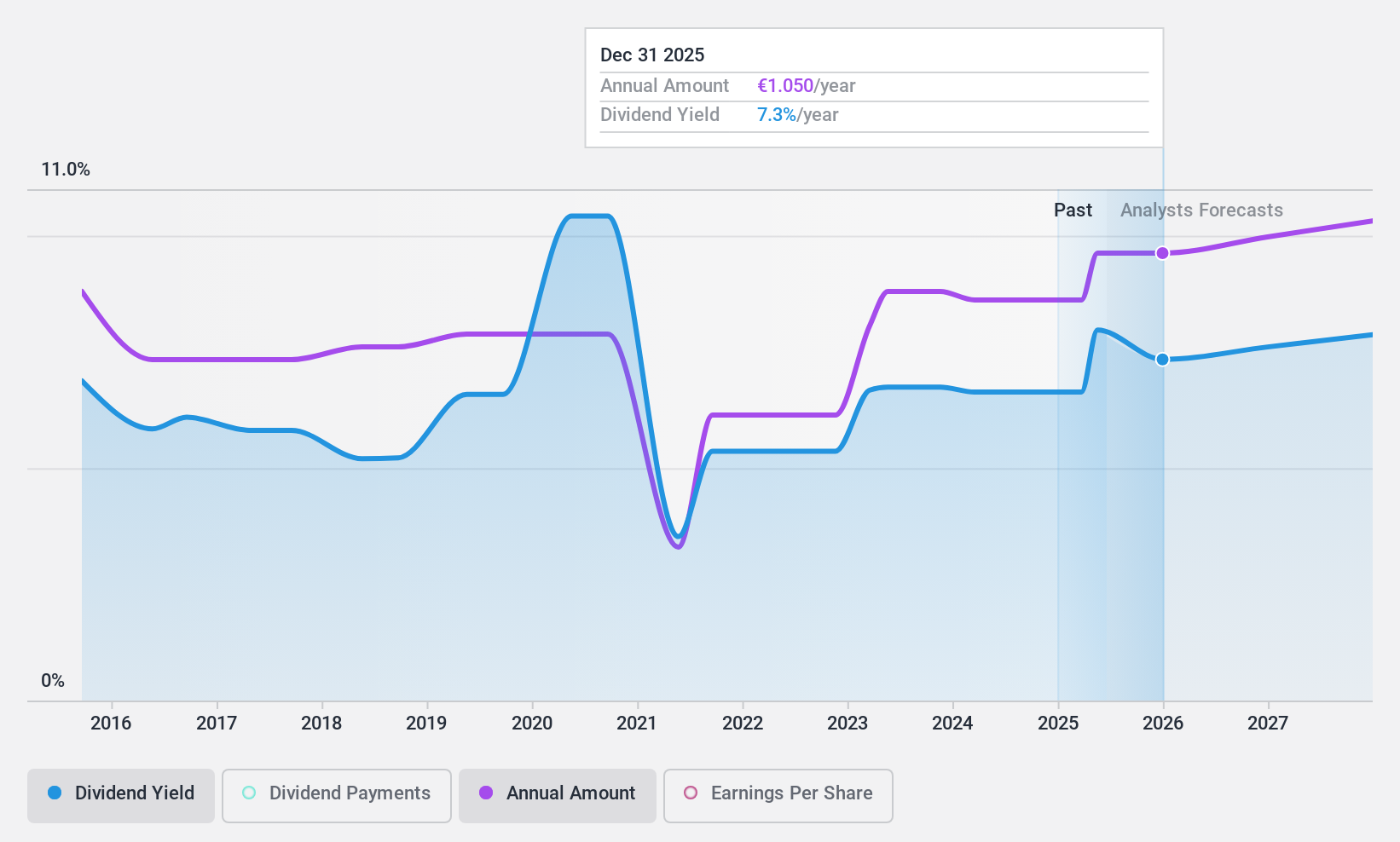

Dividend Yield: 7.2%

Eni's dividend yield of 7.18% ranks among the top 25% in the Italian market, indicating an attractive payout for income-focused investors. Despite this, Eni's dividends have been volatile over the past decade and have decreased during this period. The company's dividends are well-covered by earnings with a payout ratio of 29.9%, and cash flows also support these payments with a cash payout ratio of 58.5%. Recent earnings showed declines, impacting overall profitability and net income margins compared to last year.

- Unlock comprehensive insights into our analysis of Eni stock in this dividend report.

- Upon reviewing our latest valuation report, Eni's share price might be too pessimistic.

EFG International (SWX:EFGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EFG International AG, with a market cap of CHF3.96 billion, operates through its subsidiaries to offer private banking, wealth management, and asset management services.

Operations: EFG International AG generates revenue from several segments, including the Americas (CHF128.80 million), Asia Pacific (CHF176.70 million), United Kingdom (CHF193.30 million), Switzerland & Italy (CHF449.70 million), Global Markets & Treasury (CHF55.30 million), Investment and Wealth Solutions (CHF122.90 million), and Continental Europe & Middle East (CHF257.30 million).

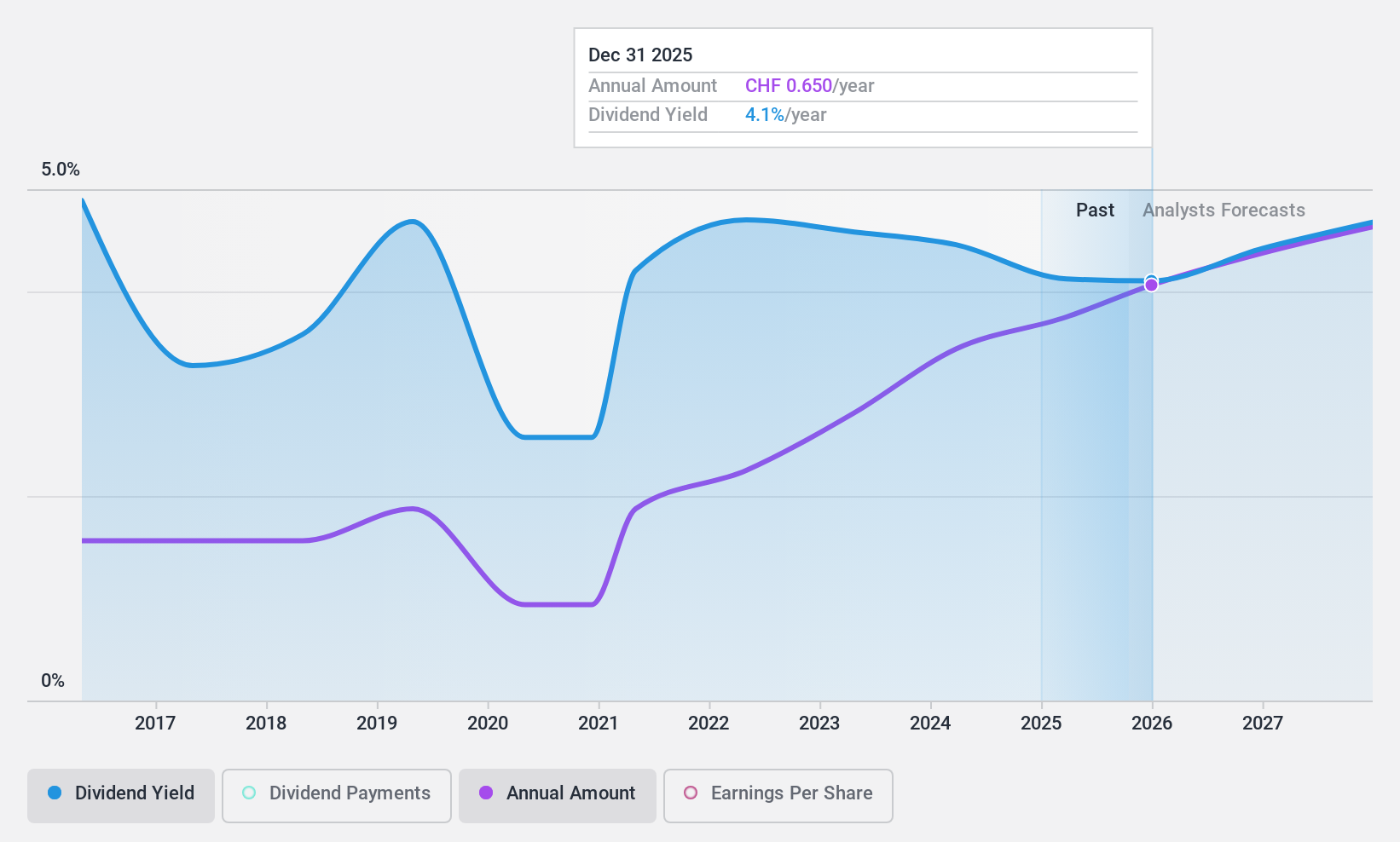

Dividend Yield: 4.2%

EFG International's dividend yield of 4.18% falls short of the top 25% in the Swiss market, and its dividends have experienced volatility with significant annual drops over the past decade. Despite this instability, current and forecasted payout ratios (55.2% and 62.4%, respectively) suggest dividends are covered by earnings. The company's recent earnings growth of 31% is notable, although a high level of bad loans (2.4%) could pose risks to financial stability amid acquisition plans.

- Click here to discover the nuances of EFG International with our detailed analytical dividend report.

- The analysis detailed in our EFG International valuation report hints at an inflated share price compared to its estimated value.

Ambra (WSE:AMB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ambra S.A. and its subsidiaries manufacture, import, and distribute grape wines across Poland, the Czech Republic, Slovakia, and Romania with a market cap of PLN535.64 million.

Operations: Ambra S.A.'s revenue segments include Basic Activity in Poland generating PLN675.85 million, Romania contributing PLN176.66 million, and the Czech Republic and Slovakia adding PLN88.79 million.

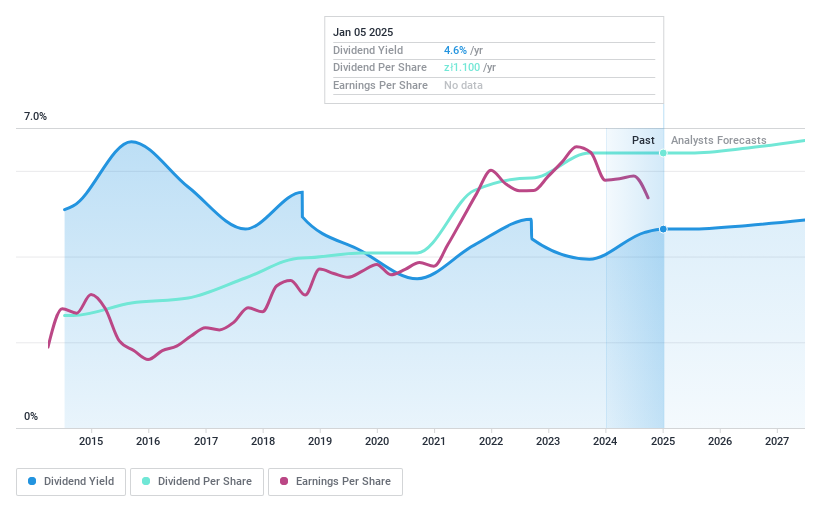

Dividend Yield: 5%

Ambra's dividend yield of 4.98% is modest compared to Poland's top payers, yet it offers stability with consistent growth over the past decade. The company's dividends are securely covered by earnings and cash flows, with payout ratios of 55.1% and 44.3%, respectively. Despite recent declines in quarterly net income from PLN 9.76 million to PLN 4.99 million, Ambra trades at a significant discount to its estimated fair value, enhancing its appeal for dividend investors seeking reliability amidst market fluctuations.

- Take a closer look at Ambra's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Ambra is priced lower than what may be justified by its financials.

Next Steps

- Take a closer look at our Top Dividend Stocks list of 1949 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EFG International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:EFGN

EFG International

Provides private banking, wealth management, and asset management services.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives