- France

- /

- Gas Utilities

- /

- ENXTPA:RUI

Rubis And 2 More Reliable Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate the complexities of new policy directions and economic indicators, investors are seeking stability amidst fluctuating indices and sector-specific volatility. In this environment, dividend stocks can offer a reliable income stream, appealing to those looking for consistent returns even as broader market conditions shift. A good dividend stock typically combines a strong track record of payouts with the potential for steady growth, making it an attractive option for enhancing portfolio resilience in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.78% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.20% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.37% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.58% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.88% | ★★★★★★ |

Click here to see the full list of 1950 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

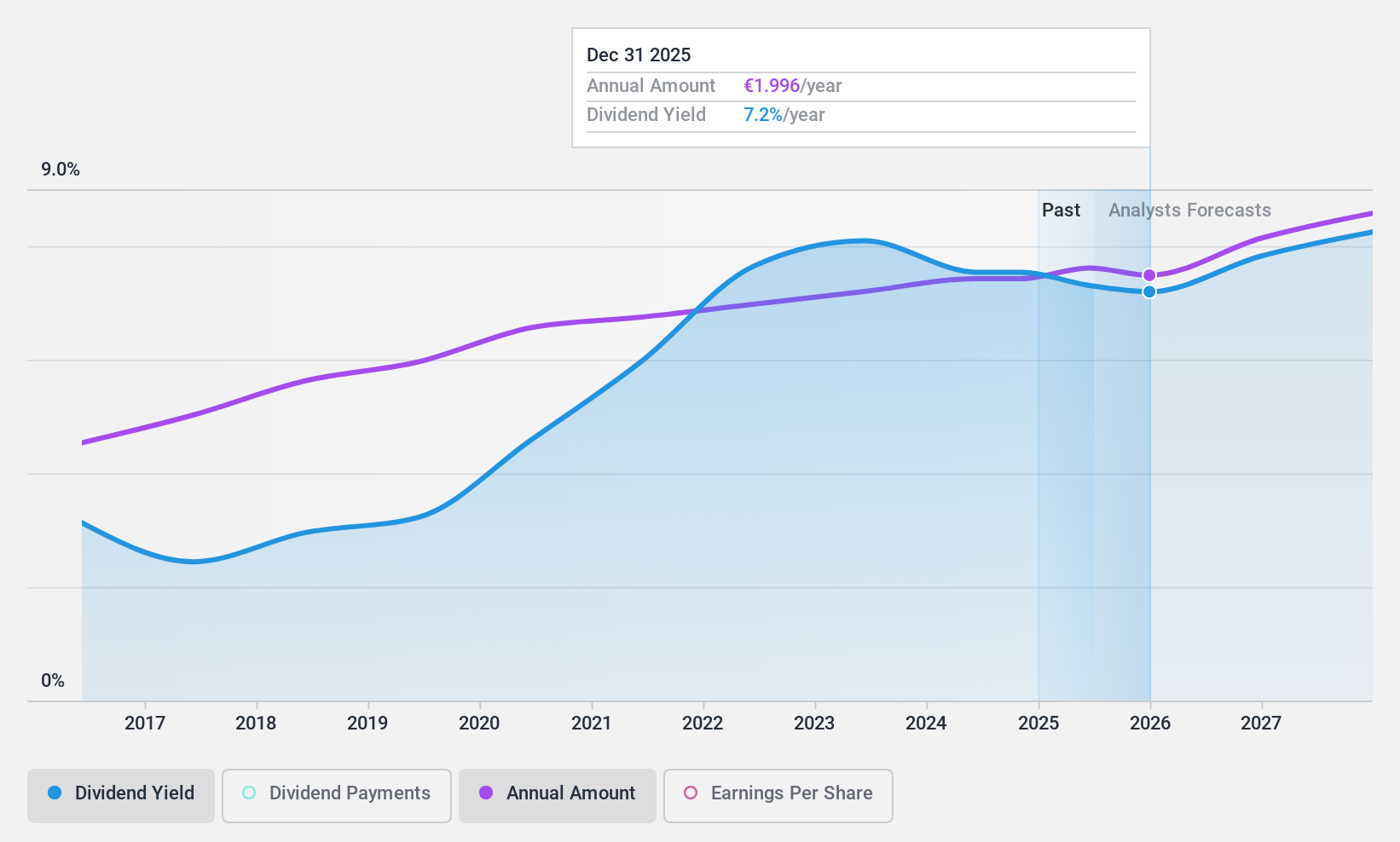

Rubis (ENXTPA:RUI)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Rubis operates bulk liquid storage facilities for commercial and industrial customers across Europe, Africa, and the Caribbean, with a market cap of €2.36 billion.

Operations: Rubis generates its revenue primarily from Energy Distribution (€6.60 billion) and Renewable Electricity Production (€48.02 million).

Dividend Yield: 8.6%

Rubis offers an attractive dividend yield of 8.56%, ranking in the top 25% of French dividend payers, supported by a sustainable payout ratio of 65.4%. Despite stable dividends over the past decade, recent earnings guidance suggests potential challenges with net income projected between €340-375 million for 2024, influenced by a capital gain from asset disposal. The company is actively seeking acquisitions to bolster its market presence in Africa and the Caribbean.

- Click here and access our complete dividend analysis report to understand the dynamics of Rubis.

- Our expertly prepared valuation report Rubis implies its share price may be lower than expected.

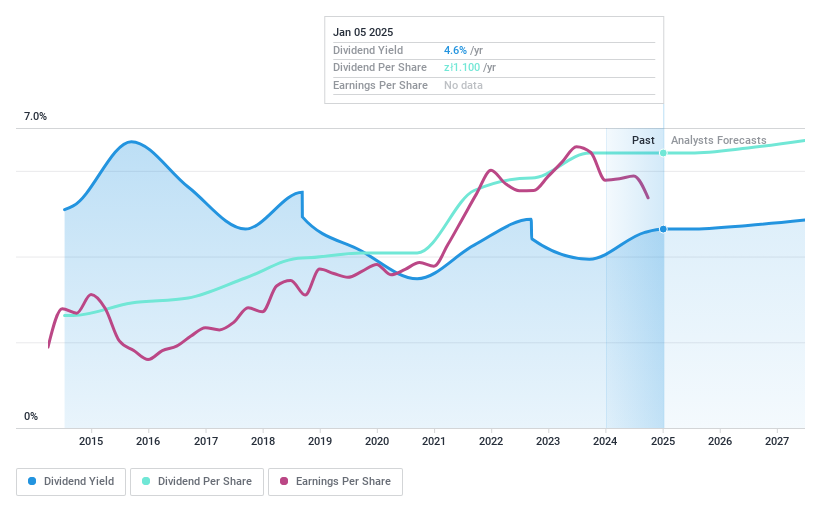

Ambra (WSE:AMB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ambra S.A., along with its subsidiaries, manufactures, imports, and distributes grape wines in Poland, the Czech Republic, Slovakia, and Romania with a market cap of PLN593.62 million.

Operations: Ambra S.A.'s revenue segments include PLN675.85 million from its operations in Poland, PLN176.66 million from Romania, and PLN88.79 million from the Czech Republic and Slovakia.

Dividend Yield: 4.6%

Ambra S.A. provides a stable dividend, having increased payments over the past decade, with current dividends well-covered by earnings and cash flows (payout ratio: 55.1%, cash payout ratio: 44.3%). Despite a lower yield of 4.63% compared to top Polish dividend payers, Ambra's dividends remain reliable and consistent. Recent earnings showed a decline in net income to PLN 4.99 million for Q1 FY2025 from PLN 9.76 million previously, impacting short-term financial performance but not dividend sustainability.

- Get an in-depth perspective on Ambra's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Ambra is priced lower than what may be justified by its financials.

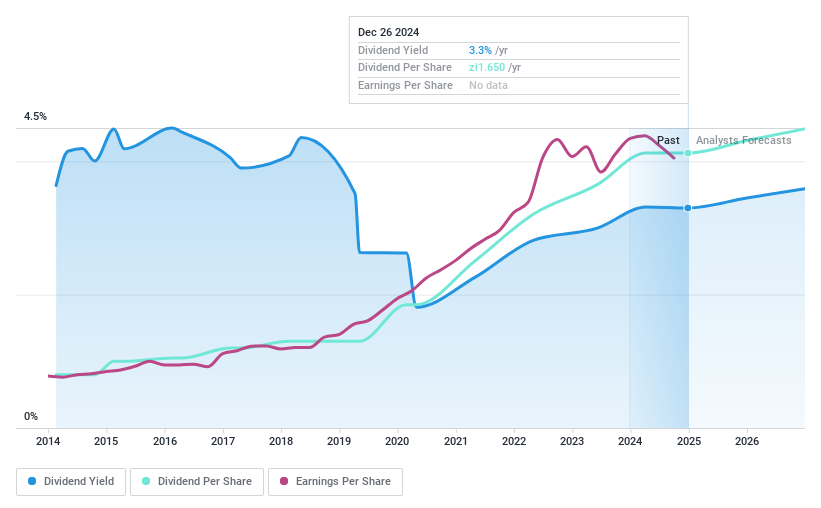

Asseco South Eastern Europe (WSE:ASE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asseco South Eastern Europe S.A., with a market cap of PLN2.53 billion, operates in the sale of its own and third-party software through its subsidiaries.

Operations: Asseco South Eastern Europe S.A. generates revenue from its Banking Solutions (PLN311.90 million), Payment Solutions (PLN854.27 million), and Dedicated Solutions (PLN580.41 million) segments.

Dividend Yield: 3.3%

Asseco South Eastern Europe offers a stable dividend, supported by a payout ratio of 45.8% and cash payout ratio of 58.1%, ensuring coverage by earnings and cash flows. Despite a modest yield of 3.32%, lower than the top Polish dividend payers, its dividends have grown consistently over the past decade with minimal volatility. Recent Q3 results showed increased sales to PLN 444.8 million, though net income declined to PLN 54 million, maintaining dividend reliability despite short-term profit fluctuations.

- Delve into the full analysis dividend report here for a deeper understanding of Asseco South Eastern Europe.

- Insights from our recent valuation report point to the potential overvaluation of Asseco South Eastern Europe shares in the market.

Seize The Opportunity

- Unlock our comprehensive list of 1950 Top Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Rubis, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:RUI

Rubis

Engages in the operation of bulk liquid storage facilities for commercial and industrial customers in Europe, Africa, and the Caribbean.

6 star dividend payer with adequate balance sheet.