- Poland

- /

- Food and Staples Retail

- /

- WSE:ORG

Revenues Not Telling The Story For ORGANIC Farma Zdrowia S.A. (WSE:ORG) After Shares Rise 27%

Despite an already strong run, ORGANIC Farma Zdrowia S.A. (WSE:ORG) shares have been powering on, with a gain of 27% in the last thirty days. The annual gain comes to 200% following the latest surge, making investors sit up and take notice.

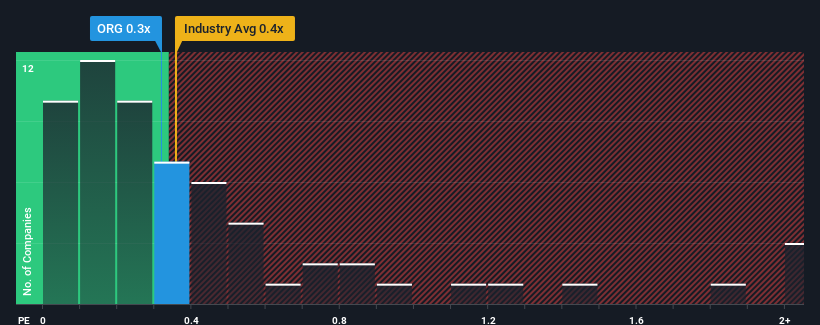

Even after such a large jump in price, it's still not a stretch to say that ORGANIC Farma Zdrowia's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Consumer Retailing industry in Poland, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for ORGANIC Farma Zdrowia

What Does ORGANIC Farma Zdrowia's P/S Mean For Shareholders?

The recent revenue growth at ORGANIC Farma Zdrowia would have to be considered satisfactory if not spectacular. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on ORGANIC Farma Zdrowia's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For ORGANIC Farma Zdrowia?

There's an inherent assumption that a company should be matching the industry for P/S ratios like ORGANIC Farma Zdrowia's to be considered reasonable.

Retrospectively, the last year delivered a decent 6.8% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 7.0% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 5.9% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that ORGANIC Farma Zdrowia's P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What We Can Learn From ORGANIC Farma Zdrowia's P/S?

ORGANIC Farma Zdrowia's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of ORGANIC Farma Zdrowia revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

You should always think about risks. Case in point, we've spotted 4 warning signs for ORGANIC Farma Zdrowia you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:ORG

ORGANIC Farma Zdrowia

Operates a retail chain of organic products in Poland and internationally.

Adequate balance sheet low.

Market Insights

Community Narratives