- Poland

- /

- Food and Staples Retail

- /

- WSE:ORG

Revenues Not Telling The Story For ORGANIC Farma Zdrowia S.A. (WSE:ORG) After Shares Rise 76%

ORGANIC Farma Zdrowia S.A. (WSE:ORG) shareholders have had their patience rewarded with a 76% share price jump in the last month. The annual gain comes to 153% following the latest surge, making investors sit up and take notice.

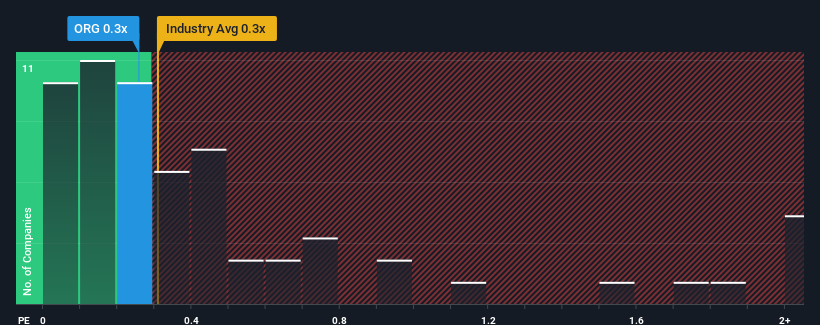

Although its price has surged higher, it's still not a stretch to say that ORGANIC Farma Zdrowia's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Consumer Retailing industry in Poland, where the median P/S ratio is around 0.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for ORGANIC Farma Zdrowia

How Has ORGANIC Farma Zdrowia Performed Recently?

ORGANIC Farma Zdrowia has been doing a decent job lately as it's been growing revenue at a reasonable pace. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for ORGANIC Farma Zdrowia, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is ORGANIC Farma Zdrowia's Revenue Growth Trending?

ORGANIC Farma Zdrowia's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.1% last year. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing that to the industry, which is predicted to deliver 6.0% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that ORGANIC Farma Zdrowia's P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What Does ORGANIC Farma Zdrowia's P/S Mean For Investors?

Its shares have lifted substantially and now ORGANIC Farma Zdrowia's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that ORGANIC Farma Zdrowia's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

Before you settle on your opinion, we've discovered 4 warning signs for ORGANIC Farma Zdrowia that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:ORG

ORGANIC Farma Zdrowia

Operates a retail chain of organic products in Poland and internationally.

Adequate balance sheet low.

Market Insights

Community Narratives