- Poland

- /

- Consumer Durables

- /

- WSE:FTE

How Much Did Fabryki Mebli FORTE's(WSE:FTE) Shareholders Earn From Share Price Movements Over The Last Five Years?

While it may not be enough for some shareholders, we think it is good to see the Fabryki Mebli FORTE S.A. (WSE:FTE) share price up 19% in a single quarter. But if you look at the last five years the returns have not been good. In fact, the share price is down 29%, which falls well short of the return you could get by buying an index fund.

Check out our latest analysis for Fabryki Mebli FORTE

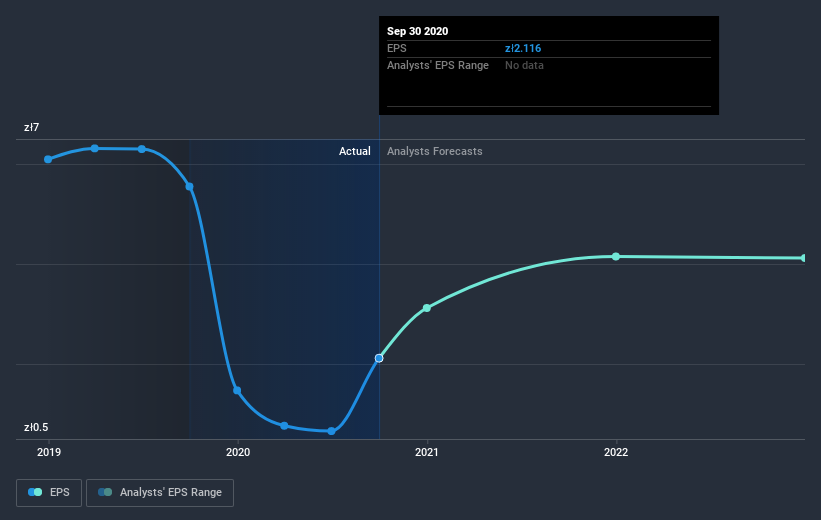

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Looking back five years, both Fabryki Mebli FORTE's share price and EPS declined; the latter at a rate of 8.9% per year. This fall in the EPS is worse than the 7% compound annual share price fall. So investors might expect EPS to bounce back -- or they may have previously foreseen the EPS decline.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Fabryki Mebli FORTE's earnings, revenue and cash flow.

A Different Perspective

It's good to see that Fabryki Mebli FORTE has rewarded shareholders with a total shareholder return of 25% in the last twelve months. That certainly beats the loss of about 5% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Fabryki Mebli FORTE you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

When trading Fabryki Mebli FORTE or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About WSE:FTE

Fabryki Mebli FORTE

Designs, manufactures, and exports furniture worldwide.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026