- Poland

- /

- Consumer Durables

- /

- WSE:FTE

Fabryki Mebli FORTE (WSE:FTE) Takes On Some Risk With Its Use Of Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Fabryki Mebli FORTE S.A. (WSE:FTE) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Fabryki Mebli FORTE

What Is Fabryki Mebli FORTE's Net Debt?

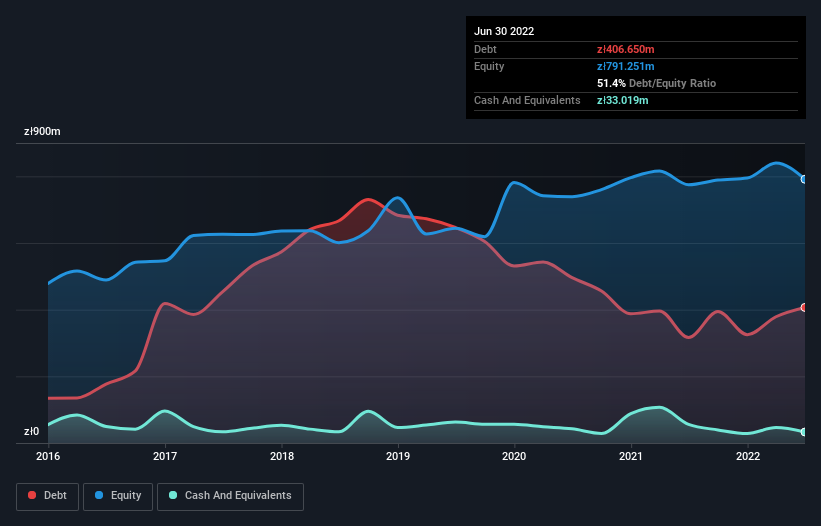

You can click the graphic below for the historical numbers, but it shows that as of June 2022 Fabryki Mebli FORTE had zł406.7m of debt, an increase on zł316.2m, over one year. However, because it has a cash reserve of zł33.0m, its net debt is less, at about zł373.6m.

How Healthy Is Fabryki Mebli FORTE's Balance Sheet?

According to the last reported balance sheet, Fabryki Mebli FORTE had liabilities of zł339.4m due within 12 months, and liabilities of zł410.8m due beyond 12 months. Offsetting this, it had zł33.0m in cash and zł187.0m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by zł530.2m.

This deficit is considerable relative to its market capitalization of zł548.0m, so it does suggest shareholders should keep an eye on Fabryki Mebli FORTE's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Fabryki Mebli FORTE has net debt worth 1.9 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 6.7 times the interest expense. While these numbers do not alarm us, it's worth noting that the cost of the company's debt is having a real impact. Importantly, Fabryki Mebli FORTE's EBIT fell a jaw-dropping 33% in the last twelve months. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Fabryki Mebli FORTE's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the most recent three years, Fabryki Mebli FORTE recorded free cash flow worth 72% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Mulling over Fabryki Mebli FORTE's attempt at (not) growing its EBIT, we're certainly not enthusiastic. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Fabryki Mebli FORTE stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Fabryki Mebli FORTE (2 are significant) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:FTE

Fabryki Mebli FORTE

Designs, manufactures, and exports furniture worldwide.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026