- Poland

- /

- Consumer Durables

- /

- WSE:FTE

Don't Race Out To Buy Fabryki Mebli FORTE S.A. (WSE:FTE) Just Because It's Going Ex-Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Fabryki Mebli FORTE S.A. (WSE:FTE) is about to trade ex-dividend in the next two days. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. Meaning, you will need to purchase Fabryki Mebli FORTE's shares before the 22nd of June to receive the dividend, which will be paid on the 5th of July.

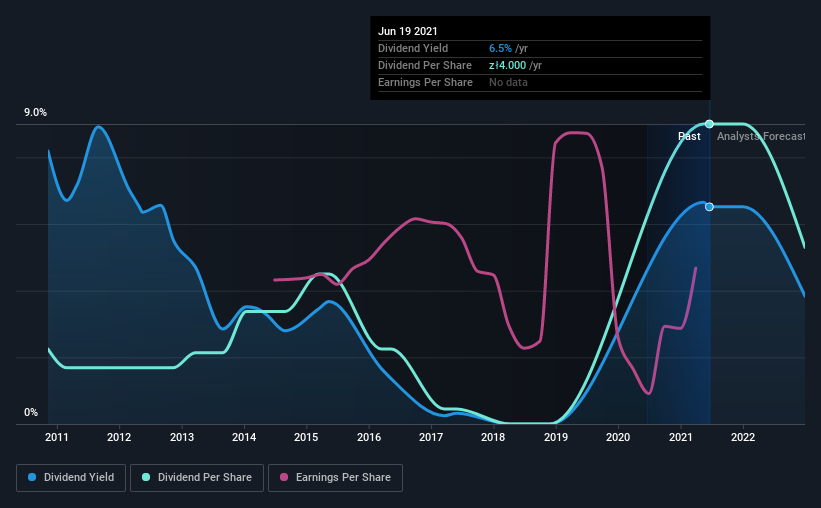

The company's next dividend payment will be zł4.00 per share, on the back of last year when the company paid a total of zł4.00 to shareholders. Last year's total dividend payments show that Fabryki Mebli FORTE has a trailing yield of 6.5% on the current share price of PLN61.4. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for Fabryki Mebli FORTE

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Fabryki Mebli FORTE distributed an unsustainably high 118% of its profit as dividends to shareholders last year. Without extenuating circumstances, we'd consider the dividend at risk of a cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies that aren't growing their earnings can still be valuable, but it is even more important to assess the sustainability of the dividend if it looks like the company will struggle to grow. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. That explains why we're not overly excited about Fabryki Mebli FORTE's flat earnings over the past five years. It's better than seeing them drop, certainly, but over the long term, all of the best dividend stocks are able to meaningfully grow their earnings per share.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Since the start of our data, 10 years ago, Fabryki Mebli FORTE has lifted its dividend by approximately 15% a year on average.

Final Takeaway

From a dividend perspective, should investors buy or avoid Fabryki Mebli FORTE? Earnings per share have not grown at all and Fabryki Mebli FORTE is paying out an uncomfortably high percentage of its profit as dividends. This is not an overtly appealing combination of characteristics, and we're just not that interested in this company's dividend.

With that in mind though, if the poor dividend characteristics of Fabryki Mebli FORTE don't faze you, it's worth being mindful of the risks involved with this business. For example, we've found 2 warning signs for Fabryki Mebli FORTE that we recommend you consider before investing in the business.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Fabryki Mebli FORTE, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:FTE

Fabryki Mebli FORTE

Designs, manufactures, and exports furniture worldwide.

Flawless balance sheet and good value.

Market Insights

Community Narratives