Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like UHY ECA (WSE:ECA). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for UHY ECA

How Fast Is UHY ECA Growing Its Earnings Per Share?

In the last three years UHY ECA's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, UHY ECA's EPS shot from zł0.043 to zł0.087, over the last year. You don't see 105% year-on-year growth like that, very often.

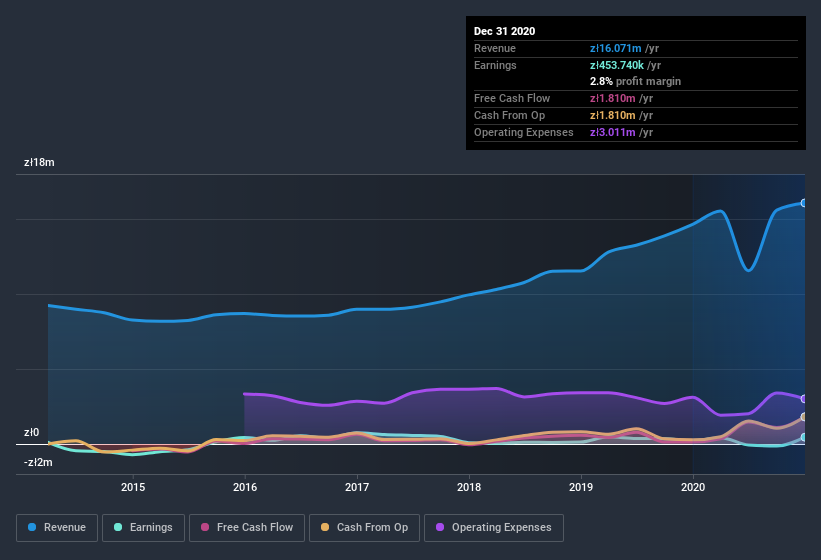

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note UHY ECA's EBIT margins were flat over the last year, revenue grew by a solid 9.7% to zł16m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since UHY ECA is no giant, with a market capitalization of zł5.9m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are UHY ECA Insiders Aligned With All Shareholders?

As a general rule, I think it worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. I discovered that the median total compensation for the CEOs of companies like UHY ECA with market caps under zł776m is about zł555k.

The UHY ECA CEO received zł390k in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Does UHY ECA Deserve A Spot On Your Watchlist?

UHY ECA's earnings per share have taken off like a rocket aimed right at the moon. Such fast EPS growth makes me wonder if the business has hit an inflection point (and I mean the good kind.) Meanwhile, the very reasonable CEO pay reassures me a little, since it points to an absence profligacy. So UHY ECA looks like it could be a good quality growth stock, at first glance. That's worth watching. However, before you get too excited we've discovered 5 warning signs for UHY ECA (2 are potentially serious!) that you should be aware of.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade UHY ECA, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TREX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:TRX

TREX

Engages in the sale of sports equipment under the TREX SPORT brand name in Poland.

Flawless balance sheet with acceptable track record.