- Poland

- /

- Professional Services

- /

- WSE:BFT

Returns On Capital At Benefit Systems (WSE:BFT) Paint A Concerning Picture

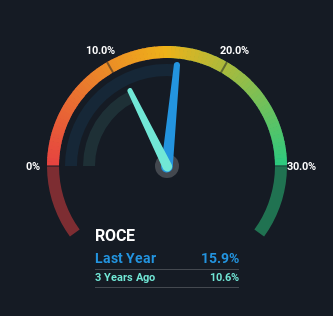

What are the early trends we should look for to identify a stock that could multiply in value over the long term? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Having said that, from a first glance at Benefit Systems (WSE:BFT) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Return On Capital Employed (ROCE): What Is It?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Benefit Systems is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.16 = zł277m ÷ (zł2.4b - zł640m) (Based on the trailing twelve months to March 2023).

So, Benefit Systems has an ROCE of 16%. In absolute terms, that's a satisfactory return, but compared to the Professional Services industry average of 4.7% it's much better.

Check out our latest analysis for Benefit Systems

In the above chart we have measured Benefit Systems' prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

How Are Returns Trending?

When we looked at the ROCE trend at Benefit Systems, we didn't gain much confidence. Over the last five years, returns on capital have decreased to 16% from 31% five years ago. However, given capital employed and revenue have both increased it appears that the business is currently pursuing growth, at the consequence of short term returns. And if the increased capital generates additional returns, the business, and thus shareholders, will benefit in the long run.

On a side note, Benefit Systems has done well to pay down its current liabilities to 27% of total assets. So we could link some of this to the decrease in ROCE. What's more, this can reduce some aspects of risk to the business because now the company's suppliers or short-term creditors are funding less of its operations. Since the business is basically funding more of its operations with it's own money, you could argue this has made the business less efficient at generating ROCE.

The Bottom Line

While returns have fallen for Benefit Systems in recent times, we're encouraged to see that sales are growing and that the business is reinvesting in its operations. And the stock has followed suit returning a meaningful 86% to shareholders over the last five years. So should these growth trends continue, we'd be optimistic on the stock going forward.

Benefit Systems could be trading at an attractive price in other respects, so you might find our free intrinsic value estimation on our platform quite valuable.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if Benefit Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:BFT

Benefit Systems

Provides non-pay employee benefits solutions in Poland, Czech Republic, Slovakia, Bulgaria, Croatia, and Turkey.

High growth potential and good value.

Market Insights

Community Narratives