- Poland

- /

- Trade Distributors

- /

- WSE:EGH

Does Ekopol Górnoslaski Holding (WSE:EGH) Deserve A Spot On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Ekopol Górnoslaski Holding (WSE:EGH). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Ekopol Górnoslaski Holding

Ekopol Górnoslaski Holding's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. Impressively, Ekopol Górnoslaski Holding has grown EPS by 30% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It seems Ekopol Górnoslaski Holding is pretty stable, since revenue and EBIT margins are pretty flat year on year. That's not bad, but it doesn't point to ongoing future growth, either.

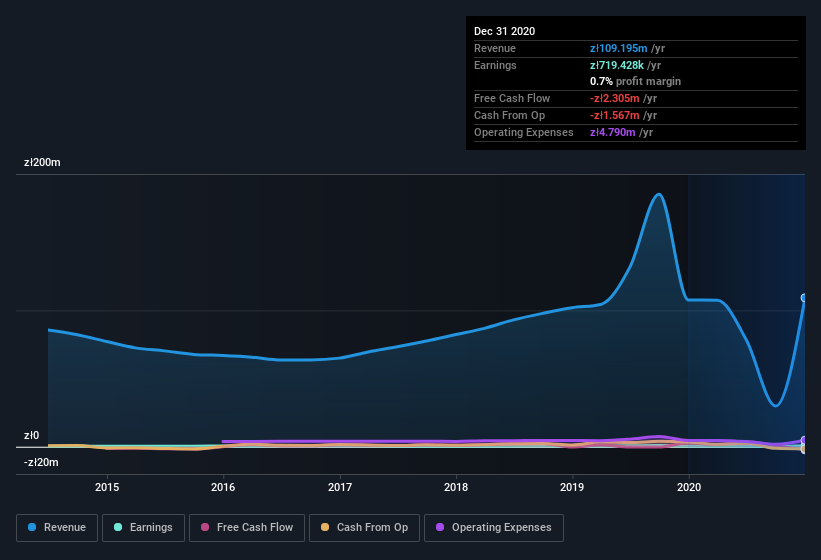

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Ekopol Górnoslaski Holding isn't a huge company, given its market capitalization of zł24m. That makes it extra important to check on its balance sheet strength.

Are Ekopol Górnoslaski Holding Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So we're pleased to report that Ekopol Górnoslaski Holding insiders own a meaningful share of the business. Indeed, with a collective holding of 77%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. Valued at only zł24m Ekopol Górnoslaski Holding is really small for a listed company. That means insiders only have zł19m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Is Ekopol Górnoslaski Holding Worth Keeping An Eye On?

For growth investors like me, Ekopol Górnoslaski Holding's raw rate of earnings growth is a beacon in the night. I think that EPS growth is something to boast of, and it doesn't surprise me that insiders are holding on to a considerable chunk of shares. So this is very likely the kind of business that I like to spend time researching, with a view to discerning its true value. Before you take the next step you should know about the 4 warning signs for Ekopol Górnoslaski Holding (3 are a bit unpleasant!) that we have uncovered.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Ekopol Górnoslaski Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Ekopol Górnoslaski Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ekopol Górnoslaski Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:EGH

Ekopol Górnoslaski Holding

Distributes and sells metallurgical products in Poland.

Excellent balance sheet slight.