- Poland

- /

- Construction

- /

- WSE:EBX

European Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

The European market has recently experienced a mixed performance, with the pan-European STOXX Europe 600 Index seeing gains amid hopes for new trade deals, only to be tempered by concerns over potential U.S. tariffs on European goods. In this context, penny stocks—often representing smaller or newer companies—continue to attract attention due to their potential for growth at lower price points. Despite being an older term, penny stocks can offer substantial opportunities when they are backed by strong financial health and promising business prospects.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €0.91 | €19.82M | ✅ 2 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.42 | €45.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.498 | RON16.57M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.83 | €59.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.75 | €17.76M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.20 | PLN11.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.44 | SEK2.34B | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.16 | €298.22M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.97 | €32.71M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 331 stocks from our European Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Greenland Resources (DB:M0LY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Greenland Resources Inc. is a mining company focused on acquiring, exploring, and developing mineral projects in Greenland with a market cap of €101.91 million.

Operations: Greenland Resources Inc. does not have any reported revenue segments at this time.

Market Cap: €101.91M

Greenland Resources Inc., with a market cap of €101.91 million, is pre-revenue and focuses on developing its Malmbjerg molybdenum project in Greenland. Recent strategic developments include a 30-year exploitation permit for molybdenum and magnesium, enhancing its potential to contribute significantly to the EU's molybdenum supply chain. The company has bolstered its financial strategy by appointing Dr. Jørgen Huno Rasmussen to their advisory board, leveraging his extensive industry experience. Despite high share price volatility and limited cash runway, recent capital raises may provide short-term financial stability as they progress towards operational milestones.

- Click here to discover the nuances of Greenland Resources with our detailed analytical financial health report.

- Learn about Greenland Resources' historical performance here.

Ekobox (WSE:EBX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ekobox S.A. is an engineering company based in Poland with a market capitalization of PLN68.18 million.

Operations: The company generates revenue from its heavy construction segment, amounting to PLN43.40 million.

Market Cap: PLN68.18M

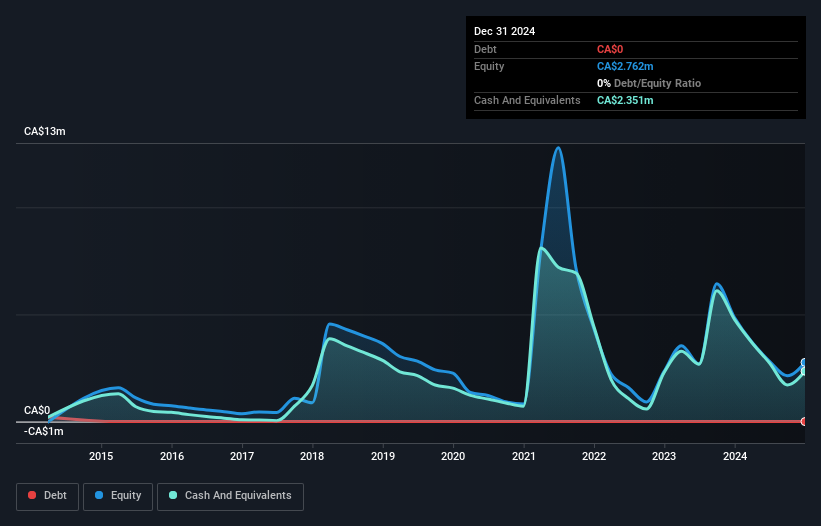

Ekobox S.A., with a market cap of PLN68.18 million, operates in the heavy construction segment, generating PLN43.40 million in revenue. Despite recent earnings challenges, including a net loss of PLN0.35 million for Q1 2025 compared to net income last year, the company maintains financial stability with short-term assets exceeding liabilities and cash surpassing total debt. Ekobox's share price remains highly volatile but trades significantly below estimated fair value. The company has reduced its debt-to-equity ratio over five years and continues to offer dividends, reflecting efforts to balance shareholder returns amid fluctuating performance metrics.

- Navigate through the intricacies of Ekobox with our comprehensive balance sheet health report here.

- Assess Ekobox's previous results with our detailed historical performance reports.

Viscom (XTRA:V6C)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Viscom SE develops, manufactures, and sells inspection systems for industrial production applications across Europe, the Americas, and Asia with a market cap of €41.40 million.

Operations: The company's revenue is primarily derived from its operations in Asia (€28.91 million) and the Americas (€12.26 million).

Market Cap: €41.4M

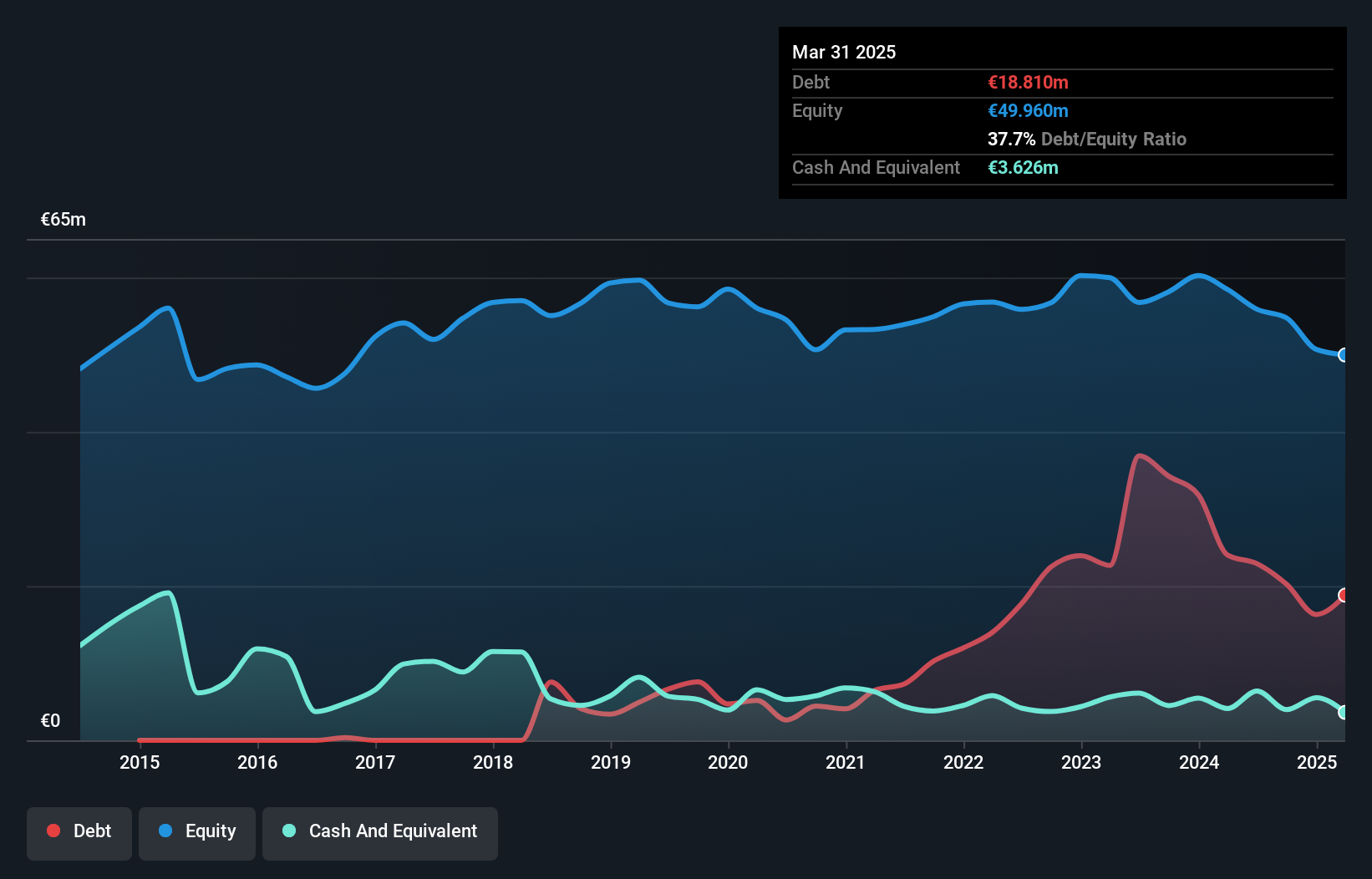

Viscom SE, with a market cap of €41.40 million, operates within the inspection systems sector and has shown resilience despite being unprofitable. The company's revenue for Q1 2025 increased to €20.25 million from €19.02 million year-over-year, reducing its net loss to €0.266 million from €1.96 million previously. Viscom's debt levels are satisfactory, with short-term assets covering both short and long-term liabilities effectively. Although it remains unprofitable with a negative return on equity (-16.05%), earnings are forecasted to grow significantly at over 100% annually, presenting potential upside if growth targets are met amidst its volatile share price environment.

- Unlock comprehensive insights into our analysis of Viscom stock in this financial health report.

- Learn about Viscom's future growth trajectory here.

Summing It All Up

- Explore the 331 names from our European Penny Stocks screener here.

- Ready To Venture Into Other Investment Styles? Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ekobox might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:EBX

Flawless balance sheet and fair value.

Market Insights

Community Narratives