- Poland

- /

- Electrical

- /

- WSE:APS

Here's Why We Think Automatyka-Pomiary-Sterowanie (WSE:APS) Is Well Worth Watching

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Automatyka-Pomiary-Sterowanie (WSE:APS). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Automatyka-Pomiary-Sterowanie

How Quickly Is Automatyka-Pomiary-Sterowanie Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Automatyka-Pomiary-Sterowanie's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 40%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

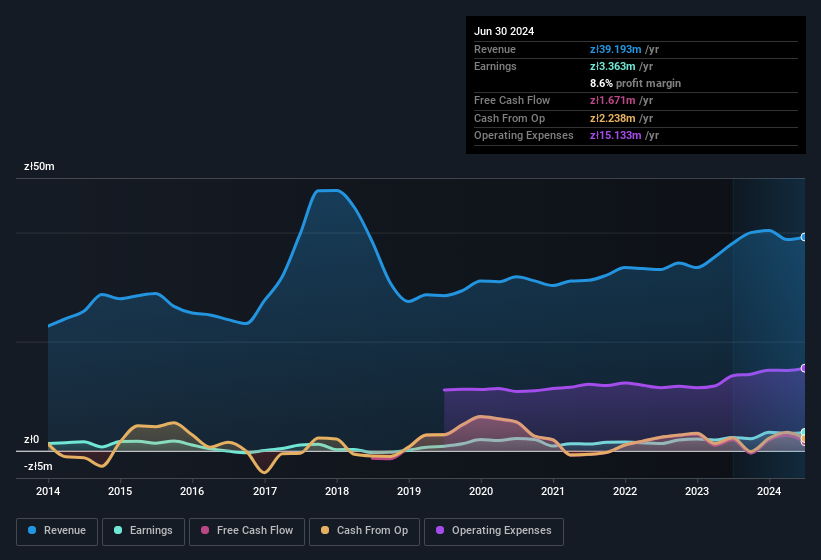

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Automatyka-Pomiary-Sterowanie shareholders can take confidence from the fact that EBIT margins are up from 5.7% to 11%, and revenue is growing. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Automatyka-Pomiary-Sterowanie is no giant, with a market capitalisation of zł27m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Automatyka-Pomiary-Sterowanie Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So those who are interested in Automatyka-Pomiary-Sterowanie will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. In fact, they own 113% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Of course, Automatyka-Pomiary-Sterowanie is a very small company, with a market cap of only zł27m. So this large proportion of shares owned by insiders only amounts to zł30m. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

Does Automatyka-Pomiary-Sterowanie Deserve A Spot On Your Watchlist?

Automatyka-Pomiary-Sterowanie's earnings per share growth have been climbing higher at an appreciable rate. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So at the surface level, Automatyka-Pomiary-Sterowanie is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. However, before you get too excited we've discovered 4 warning signs for Automatyka-Pomiary-Sterowanie (3 are significant!) that you should be aware of.

Although Automatyka-Pomiary-Sterowanie certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Polish companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:APS

Automatyka-Pomiary-Sterowanie

Provides various services in the fields of industrial automation and electrical works in Poland.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026