- Poland

- /

- Electrical

- /

- WSE:APS

Does Automatyka-Pomiary-Sterowanie (WSE:APS) Deserve A Spot On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Automatyka-Pomiary-Sterowanie (WSE:APS). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Automatyka-Pomiary-Sterowanie with the means to add long-term value to shareholders.

View our latest analysis for Automatyka-Pomiary-Sterowanie

Automatyka-Pomiary-Sterowanie's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's no surprise that some investors are more inclined to invest in profitable businesses. In impressive fashion, Automatyka-Pomiary-Sterowanie's EPS grew from zł0.25 to zł0.46, over the previous 12 months. It's not often a company can achieve year-on-year growth of 86%.

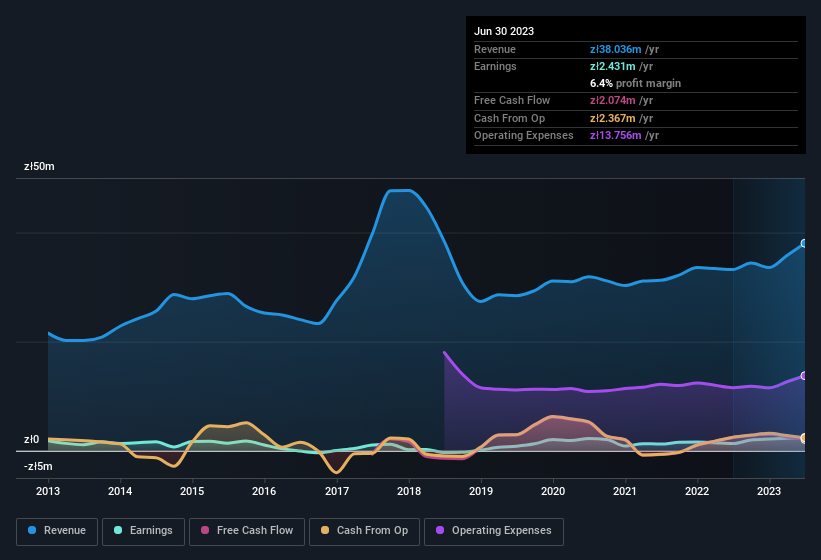

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Automatyka-Pomiary-Sterowanie is growing revenues, and EBIT margins improved by 2.1 percentage points to 5.7%, over the last year. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Automatyka-Pomiary-Sterowanie isn't a huge company, given its market capitalisation of zł21m. That makes it extra important to check on its balance sheet strength.

Are Automatyka-Pomiary-Sterowanie Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So those who are interested in Automatyka-Pomiary-Sterowanie will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. To be exact, company insiders hold 58% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. Valued at only zł21m Automatyka-Pomiary-Sterowanie is really small for a listed company. So despite a large proportional holding, insiders only have zł12m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Does Automatyka-Pomiary-Sterowanie Deserve A Spot On Your Watchlist?

Automatyka-Pomiary-Sterowanie's earnings have taken off in quite an impressive fashion. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. Based on the sum of its parts, we definitely think its worth watching Automatyka-Pomiary-Sterowanie very closely. We should say that we've discovered 3 warning signs for Automatyka-Pomiary-Sterowanie (2 are a bit concerning!) that you should be aware of before investing here.

Although Automatyka-Pomiary-Sterowanie certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:APS

Automatyka-Pomiary-Sterowanie

Provides various services in the fields of industrial automation and electrical works in Poland.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.