- Poland

- /

- Electrical

- /

- WSE:APE

APS Energia SA (WSE:APE) May Have Run Too Fast Too Soon With Recent 28% Price Plummet

The APS Energia SA (WSE:APE) share price has fared very poorly over the last month, falling by a substantial 28%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 15% in that time.

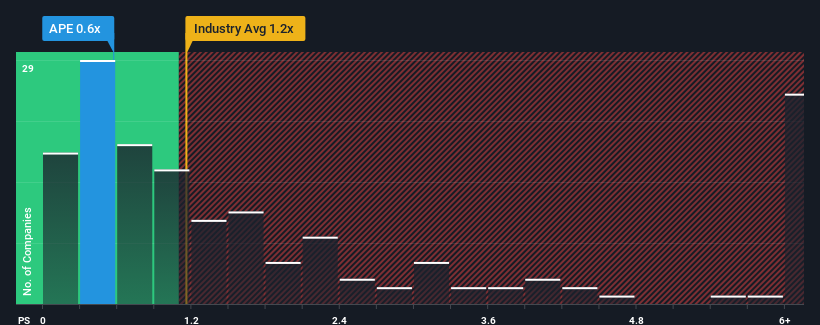

Even after such a large drop in price, there still wouldn't be many who think APS Energia's price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S in Poland's Electrical industry is similar at about 1.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for APS Energia

How Has APS Energia Performed Recently?

For example, consider that APS Energia's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on APS Energia's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like APS Energia's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. Still, the latest three year period has seen an excellent 48% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 16% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that APS Energia is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What We Can Learn From APS Energia's P/S?

With its share price dropping off a cliff, the P/S for APS Energia looks to be in line with the rest of the Electrical industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of APS Energia revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

It is also worth noting that we have found 3 warning signs for APS Energia (1 makes us a bit uncomfortable!) that you need to take into consideration.

If these risks are making you reconsider your opinion on APS Energia, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade APS Energia, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:APE

APS Energia

Designs, produces, and sells uninterruptible power supply systems for the production, heating, industry, telecommunications, medicine, and other sectors worldwide.

Low with imperfect balance sheet.

Market Insights

Community Narratives