It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Agromep (WSE:AGP). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Agromep

Agromep's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. Who among us would not applaud Agromep's stratospheric annual EPS growth of 56%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

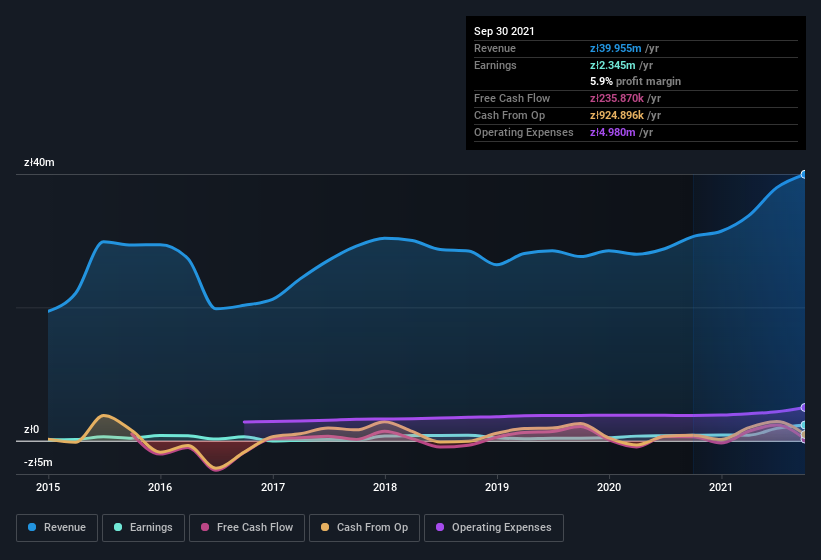

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While we note Agromep's EBIT margins were flat over the last year, revenue grew by a solid 31% to zł40m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Agromep isn't a huge company, given its market capitalization of zł17m. That makes it extra important to check on its balance sheet strength.

Are Agromep Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that Agromep insiders own a significant number of shares certainly appeals to me. In fact, they own 99% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. Of course, Agromep is a very small company, with a market cap of only zł17m. So despite a large proportional holding, insiders only have zł17m worth of stock. That might not be a huge sum but it should be enough to keep insiders motivated!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, I'd say they are indeed. For companies with market capitalizations under zł821m, like Agromep, the median CEO pay is around zł520k.

The CEO of Agromep was paid just zł10k in total compensation for the year ending . You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Agromep Deserve A Spot On Your Watchlist?

Agromep's earnings per share have taken off like a rocket aimed right at the moon. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The sharp increase in earnings could signal good business momentum. Big growth can make big winners, so I do think Agromep is worth considering carefully. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Agromep (at least 2 which don't sit too well with us) , and understanding them should be part of your investment process.

Although Agromep certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:AGP

Agromep

Engages in the distribution of tractors and agricultural machineries in Poland and internationally.

Adequate balance sheet slight.