In recent weeks, the European stock market has experienced mixed results, with the pan-European STOXX Europe 600 Index snapping a 10-week streak of gains amid uncertainties surrounding U.S. trade policies. Despite these challenges, increased spending on defense and infrastructure in Germany and the EU has helped stabilize investor sentiment. In this environment, dividend stocks can offer a measure of stability and income potential for investors seeking to navigate market fluctuations while benefiting from regular payouts.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 4.34% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.21% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.99% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.95% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.80% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.18% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.36% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.16% | ★★★★★★ |

| VERBUND (WBAG:VER) | 5.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.57% | ★★★★★★ |

Click here to see the full list of 235 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Barco (ENXTBR:BAR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Barco NV, with a market cap of €1.04 billion, develops visualization solutions for the entertainment, enterprise, and healthcare markets across the Americas, Europe, Middle East, Africa, and Asia-Pacific.

Operations: Barco NV generates revenue through its development of visualization solutions tailored for the entertainment, enterprise, and healthcare sectors across various global regions.

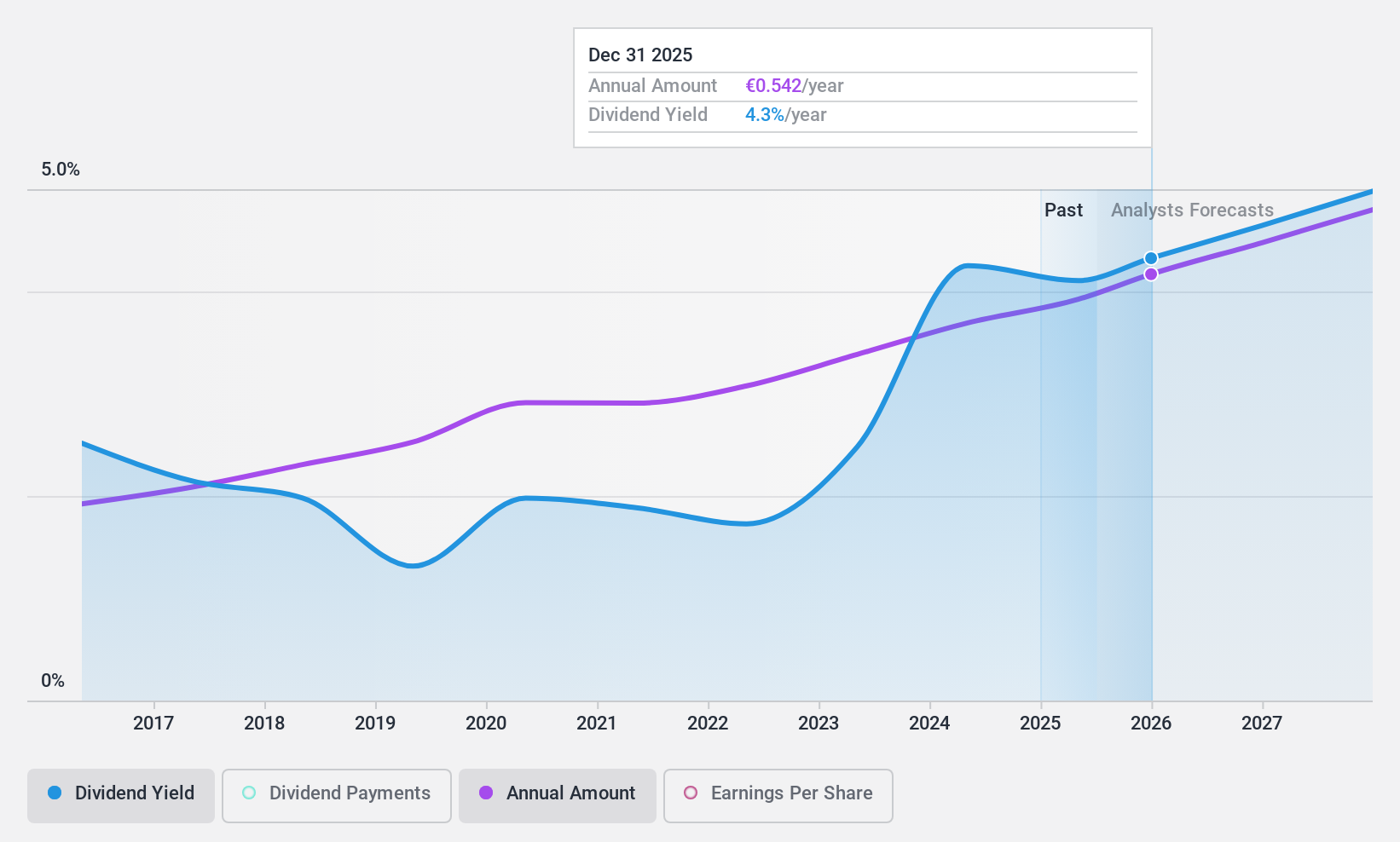

Dividend Yield: 4.3%

Barco offers a stable dividend yield of 4.34%, supported by a reasonable payout ratio of 72.1% and cash payout ratio of 44.9%, indicating dividends are well covered by earnings and cash flows. Despite recent earnings decline, Barco's dividends have been reliable and growing over the past decade. The stock trades at a good value, below its estimated fair value, though it has experienced share price volatility recently. Recent innovations like SmartFocus enhance its product offerings in hybrid meetings, potentially supporting future growth.

- Dive into the specifics of Barco here with our thorough dividend report.

- Upon reviewing our latest valuation report, Barco's share price might be too pessimistic.

Romande Energie Holding (SWX:REHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Romande Energie Holding SA is involved in the production, distribution, and marketing of electrical and thermal energy in Switzerland with a market cap of CHF1.13 billion.

Operations: Romande Energie Holding SA generates revenue through its Grids segment (CHF318.28 million), Energy Solutions (CHF486.76 million), and Romande Energie Services (CHF157.72 million).

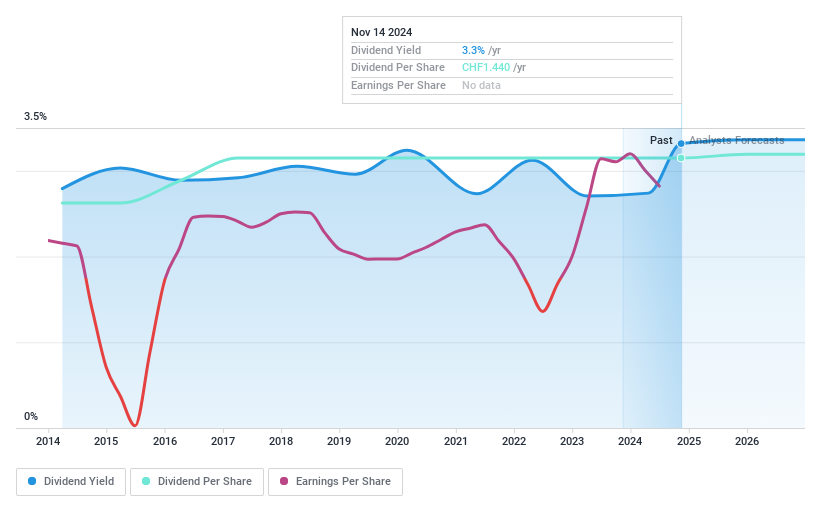

Dividend Yield: 3.3%

Romande Energie Holding's dividend yield of 3.27% is lower than the top 25% of Swiss dividend payers, yet it boasts a low payout ratio of 23.5%, suggesting dividends are well covered by earnings despite no free cash flows. The company's dividends have been stable and growing over the past decade, providing reliability. Trading at a price-to-earnings ratio of 7.2x, REHN offers good value compared to the broader Swiss market average of 19.7x.

- Unlock comprehensive insights into our analysis of Romande Energie Holding stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Romande Energie Holding is priced lower than what may be justified by its financials.

Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna (WSE:PKO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna offers a range of banking products and services in Poland and abroad, with a market cap of PLN87.90 billion.

Operations: Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna generates revenue primarily through its Retail Segment, which accounts for PLN15.35 billion, and its Corporate and Investment Segment, contributing PLN7.53 billion.

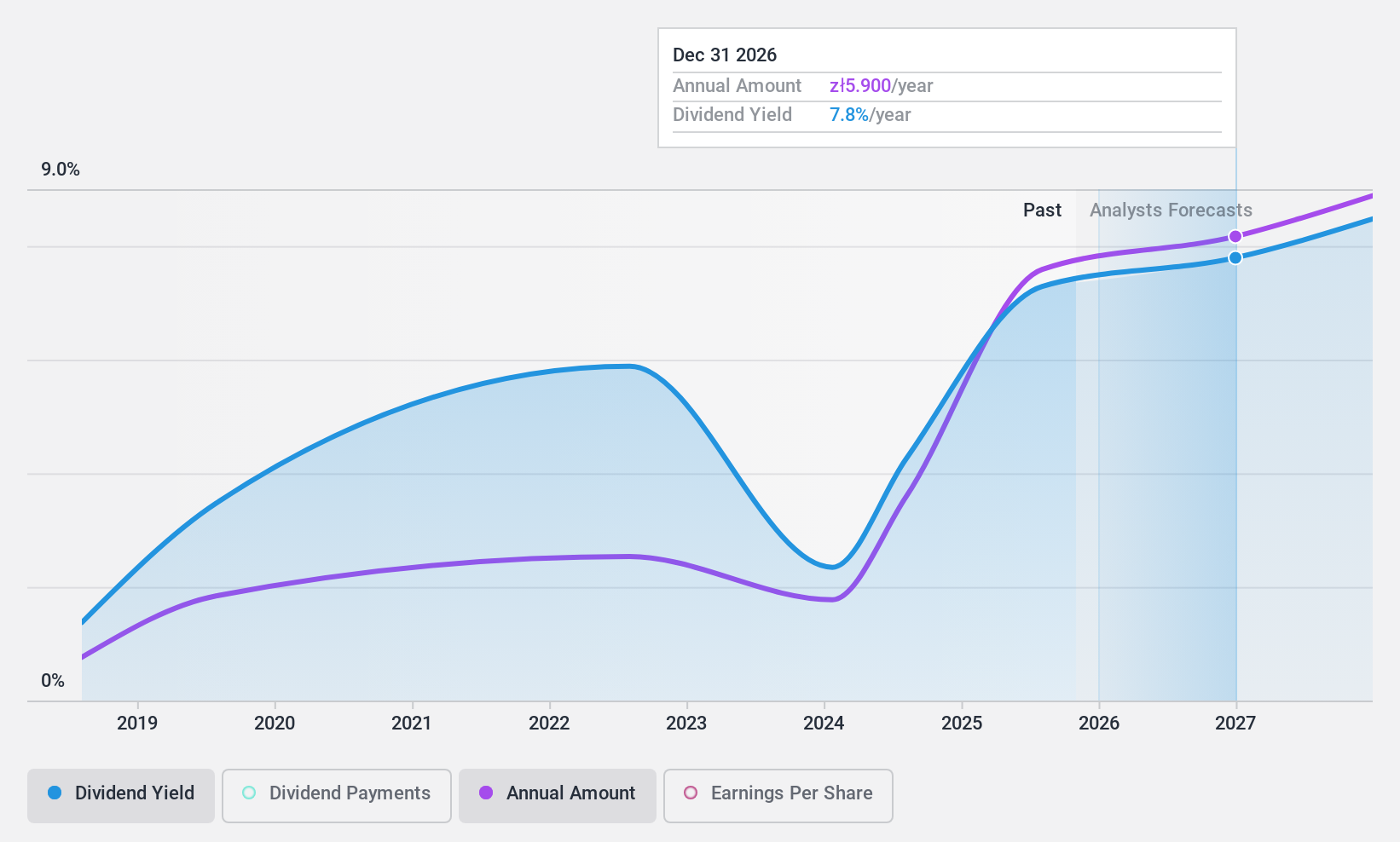

Dividend Yield: 3.7%

Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna's dividend yield of 3.68% is modest compared to the top Polish payers, yet its payout ratio of 42.9% indicates strong earnings coverage. Despite a volatile dividend history, payments have grown over the past decade. The bank trades at 36.3% below estimated fair value but faces challenges with a high bad loans ratio of 3.6%. Earnings are projected to grow annually by 8.97%, supporting future dividends.

- Click to explore a detailed breakdown of our findings in Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna's dividend report.

- The analysis detailed in our Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Get an in-depth perspective on all 235 Top European Dividend Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:PKO

Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna

Provides various banking products and services in Poland and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives