As European markets show signs of recovery, with the STOXX Europe 600 Index gaining 3.93% over a recent week, investor sentiment is buoyed by the European Central Bank's rate cuts and delayed tariff impositions. In this climate of cautious optimism, dividend stocks can offer a compelling opportunity for investors seeking income stability amidst market fluctuations.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 5.07% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.74% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.55% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.49% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.00% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.46% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 5.01% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.27% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.24% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.41% | ★★★★★★ |

Click here to see the full list of 244 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

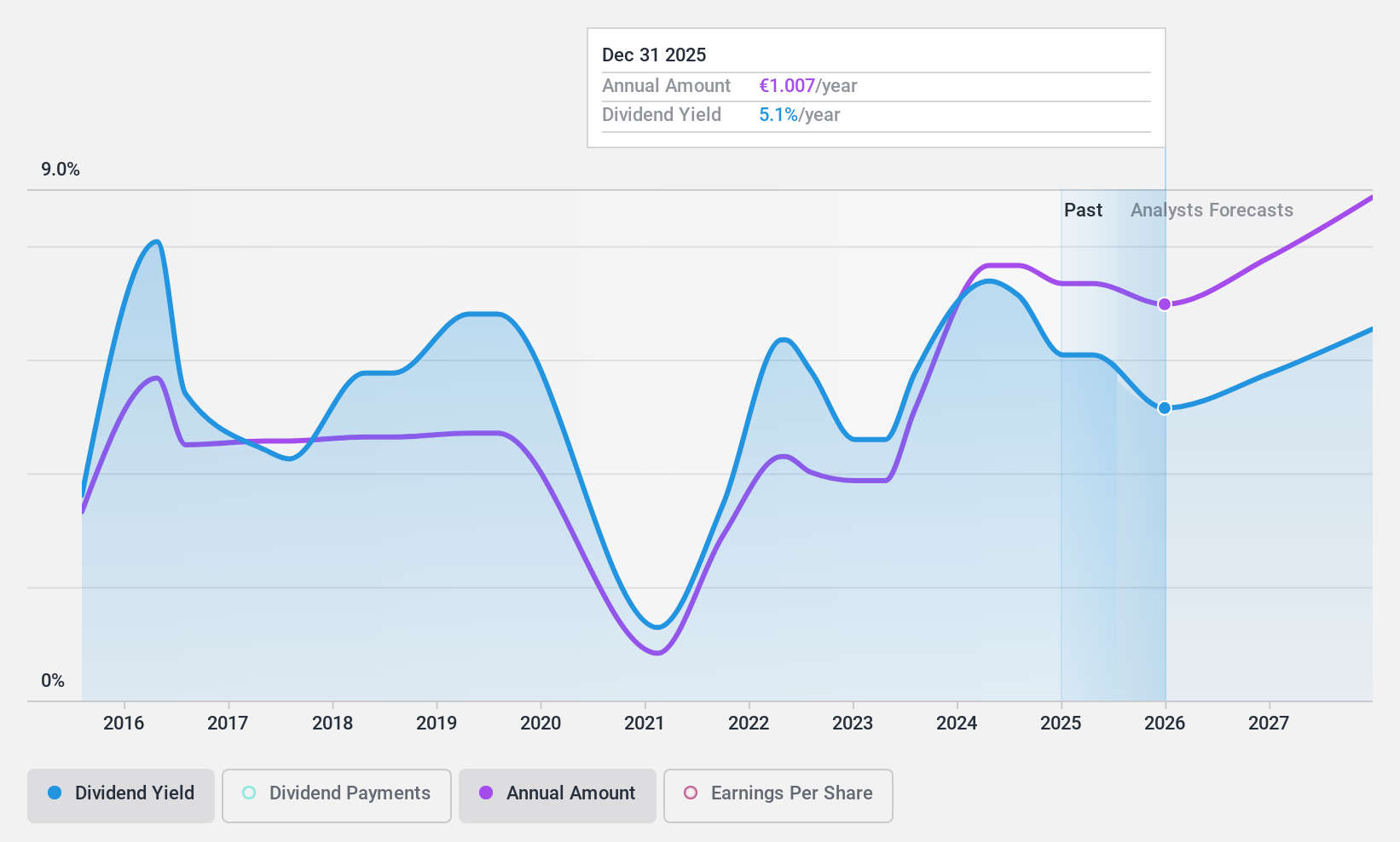

ING Groep (ENXTAM:INGA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ING Groep N.V. is a financial institution offering a range of banking products and services across the Netherlands, Belgium, Germany, other parts of Europe, and internationally with a market cap of €53.12 billion.

Operations: ING Groep's revenue is primarily derived from its Retail Banking segments in the Netherlands (€4.92 billion), Belgium (€2.62 billion), Germany (€2.76 billion), and other regions (€4.40 billion), along with Wholesale Banking which contributes €6.35 billion, and a Corporate Line segment generating €377 million.

Dividend Yield: 6.1%

ING Groep's dividends are covered by earnings, with a payout ratio of 64.2%, and forecasted to improve to 51.1% in three years. Despite a history of volatility, its dividend yield is competitive within the Dutch market at 6.09%. Recent strategic moves include appointing new board members and issuing significant fixed-income offerings totaling $1 billion and $750 million, indicating robust financial maneuvers aimed at supporting growth initiatives across Europe.

- Delve into the full analysis dividend report here for a deeper understanding of ING Groep.

- Our expertly prepared valuation report ING Groep implies its share price may be too high.

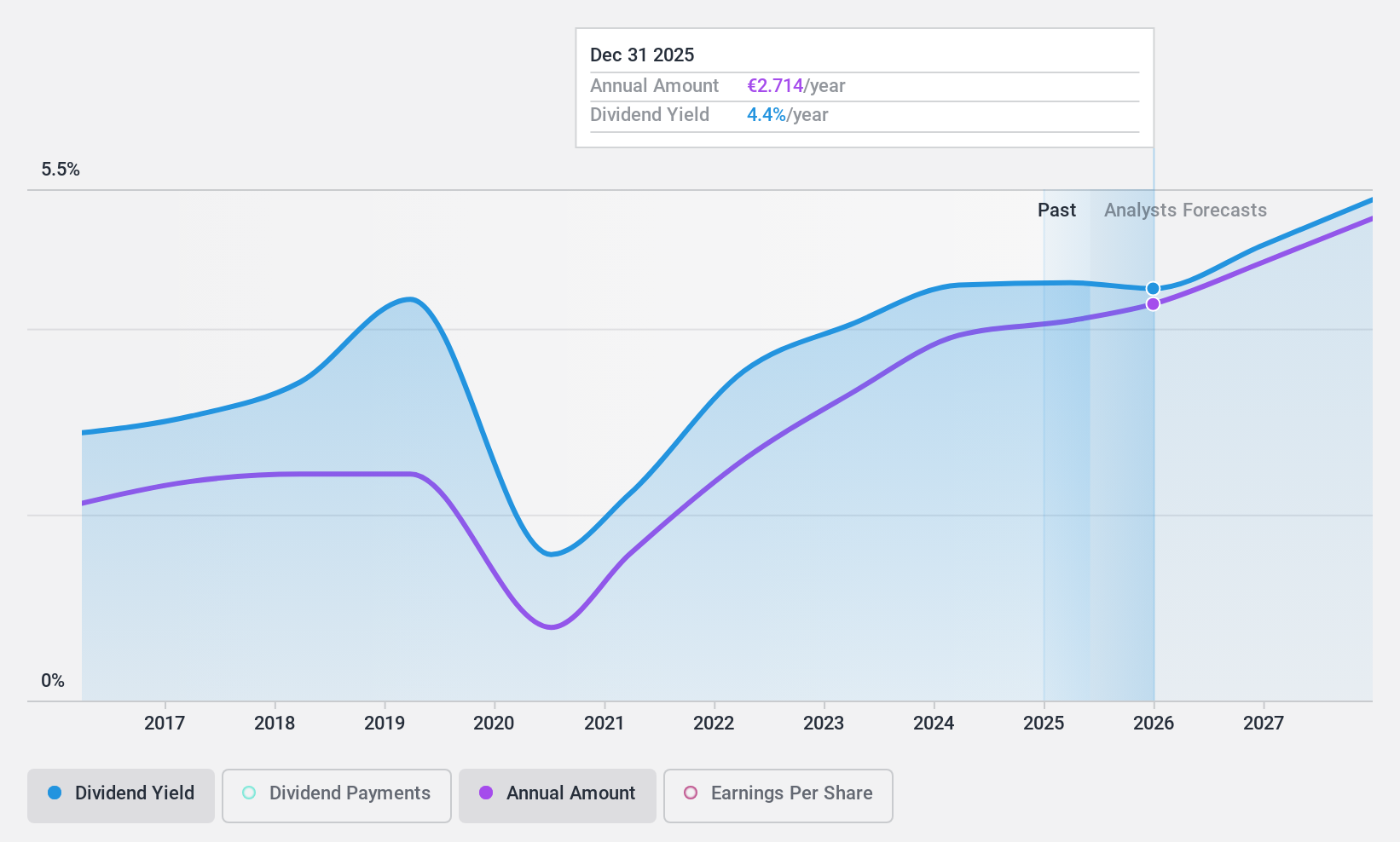

Andritz (WBAG:ANDR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Andritz AG operates as a global supplier of plants, equipment, and services for various industries including pulp and paper, metalworking and steel, hydropower stations, and solid/liquid separation across multiple regions such as Europe, North America, South America, China, Asia, with a market capitalization of approximately €5.46 billion.

Operations: Andritz AG's revenue segments include Metals (€1.81 billion), Hydro Power (€1.54 billion), Pulp & Paper (€3.46 billion), and Environment & Energy (€1.50 billion).

Dividend Yield: 4.6%

Andritz's dividends are supported by earnings and cash flows, with payout ratios of 51.8% and 55.5%, respectively, despite a history of volatility. The recent dividend increase to €2.60 per share reflects growth over the past decade but remains below top-tier yields in Austria. Trading at a substantial discount to estimated fair value, Andritz provides potential capital appreciation alongside dividends. Recent board changes may influence future governance and strategic direction amidst stable earnings performance from 2024.

- Unlock comprehensive insights into our analysis of Andritz stock in this dividend report.

- Upon reviewing our latest valuation report, Andritz's share price might be too pessimistic.

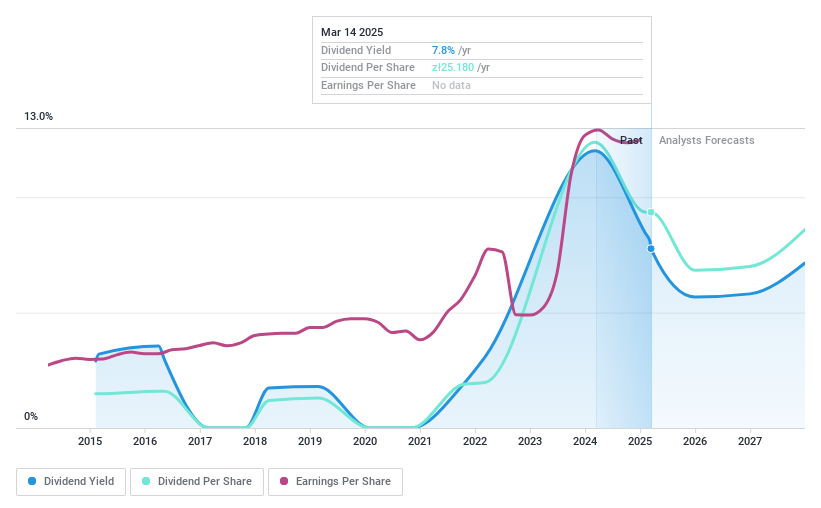

ING Bank Slaski (WSE:ING)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ING Bank Slaski S.A. operates in Poland, offering a range of banking products and services for retail clients and businesses, with a market capitalization of PLN 44.23 billion.

Operations: ING Bank Slaski S.A. generates revenue through its Retail Banking segment, which accounts for PLN 4.74 billion, and its Corporate Banking segment, contributing PLN 5.01 billion.

Dividend Yield: 7.4%

ING Bank Slaski's dividend of PLN 25.18 per share for 2025 highlights its commitment to returning value, although past payments have been volatile and unreliable. Despite a high level of bad loans at 3.4% and low allowance coverage, the dividend payout is currently sustainable with a 75% earnings coverage, forecasted to improve to 57.7%. Trading below estimated fair value provides potential upside, though earnings are expected to decline slightly over the next three years.

- Click here and access our complete dividend analysis report to understand the dynamics of ING Bank Slaski.

- Our comprehensive valuation report raises the possibility that ING Bank Slaski is priced lower than what may be justified by its financials.

Where To Now?

- Access the full spectrum of 244 Top European Dividend Stocks by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:ING

ING Bank Slaski

Together with our subsidiaries, provides various banking products and services for retail clients and businesses in Poland.

Established dividend payer and good value.

Market Insights

Community Narratives