Earnings growth of 150% over 1 year hasn't been enough to translate into positive returns for BNP Paribas Bank Polska (WSE:BNP) shareholders

Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Unfortunately the BNP Paribas Bank Polska S.A. (WSE:BNP) share price slid 30% over twelve months. That contrasts poorly with the market decline of 4.2%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 6.6% in three years. Shareholders have had an even rougher run lately, with the share price down 17% in the last 90 days. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

After losing 4.3% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for BNP Paribas Bank Polska

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

BNP Paribas Bank Polska managed to increase earnings per share from a loss to a profit, over the last 12 months.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action. But we may find different metrics more enlightening.

BNP Paribas Bank Polska's revenue is actually up 12% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

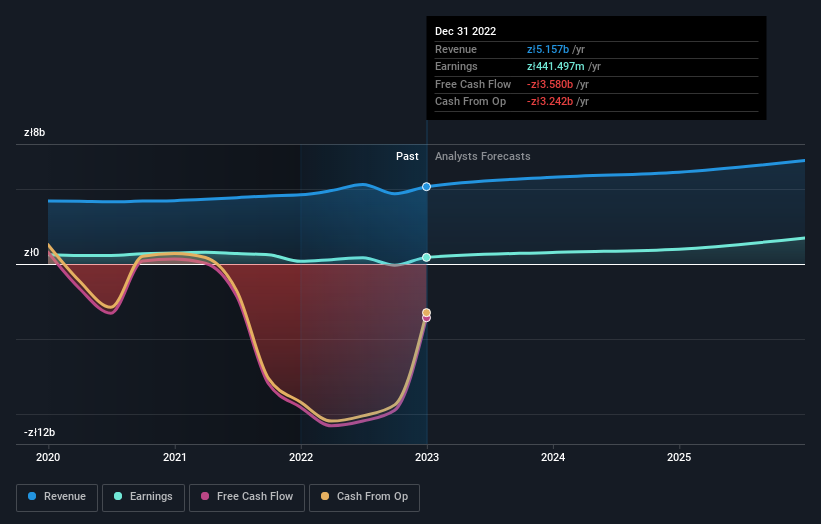

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that BNP Paribas Bank Polska has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling BNP Paribas Bank Polska stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While the broader market lost about 4.2% in the twelve months, BNP Paribas Bank Polska shareholders did even worse, losing 30%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with BNP Paribas Bank Polska , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

Valuation is complex, but we're here to simplify it.

Discover if BNP Paribas Bank Polska might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:BNP

BNP Paribas Bank Polska

Provides a range of banking products and services to individual and institutional clients in Poland.

Very undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives