Share

As European markets navigate the complexities of new U.S. trade tariffs and fluctuating economic indicators, investors remain cautious yet attentive to emerging opportunities. Penny stocks, while a term from past market eras, continue to offer intriguing possibilities for those seeking growth at lower price points. Typically associated with smaller or newer companies, these stocks can present significant potential when paired with strong financials and solid fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK1.97 | SEK1.89B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.50 | SEK230.3M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.71 | SEK278.19M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.90 | SEK237.27M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.58 | PLN121.34M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.50 | €52.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.986 | €33.02M | ✅ 4 ⚠️ 3 View Analysis > |

| High (ENXTPA:HCO) | €3.08 | €60.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Exasol (XTRA:EXL) | €3.17 | €84.27M | ✅ 3 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.145 | €296.15M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 416 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Amido (NGM:AMIDO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amido AB (publ) operates in Sweden and the Nordic region, offering administration and management of access control systems, locks, and other electronic device solutions, with a market cap of approximately SEK125.23 million.

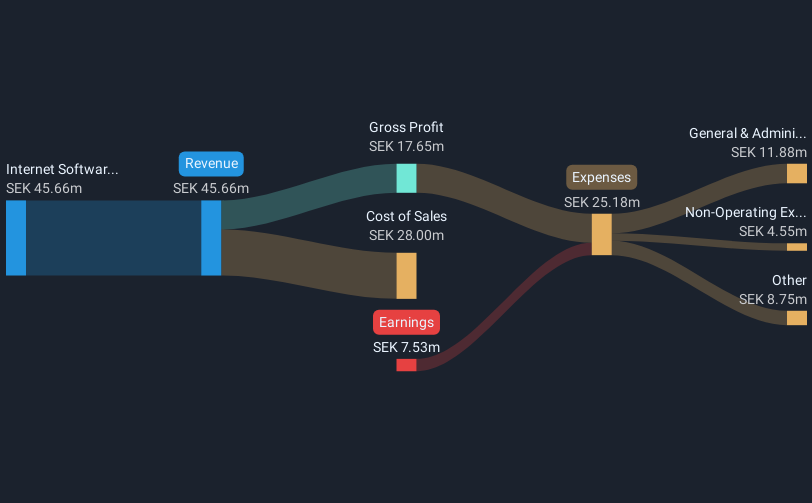

Operations: Amido generates its revenue primarily from the Internet Software & Services segment, amounting to SEK45.66 million.

Market Cap: SEK125.23M

Amido AB, operating in the Nordic region, presents both opportunities and challenges as a penny stock. The company reported annual revenue of SEK45.71 million for 2024, showing growth from the previous year, yet it remains unprofitable with a net loss of SEK7.53 million. Despite being debt-free and having short-term assets exceeding liabilities, Amido's cash runway is less than a year if cash flow declines continue at historical rates. The management team and board are relatively inexperienced, contributing to high share price volatility. Overall financial stability is supported by no long-term liabilities but constrained by limited cash reserves.

- Click here to discover the nuances of Amido with our detailed analytical financial health report.

- Gain insights into Amido's historical outcomes by reviewing our past performance report.

Modus Therapeutics Holding (OM:MODTX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Modus Therapeutics Holding AB is a biotechnology company based in Sweden that focuses on developing treatments for sepsis and septic shock, with a market cap of SEK51.21 million.

Operations: Modus Therapeutics Holding AB has not reported any revenue segments.

Market Cap: SEK51.21M

Modus Therapeutics Holding AB, a biotechnology firm focused on sepsis and septic shock treatments, remains pre-revenue with no significant income streams. The company recently expanded its Phase IIa study of sevuparin for CKD-related anemia by opening a second site in Italy, enhancing patient recruitment efforts. Despite being debt-free and having short-term assets exceeding liabilities, Modus faces financial constraints with only a brief cash runway before recent capital infusion. Its share price is highly volatile compared to most Swedish stocks. The board is experienced but the management team's tenure data is insufficient for evaluation.

- Jump into the full analysis health report here for a deeper understanding of Modus Therapeutics Holding.

- Explore Modus Therapeutics Holding's analyst forecasts in our growth report.

Garin (WSE:GAR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Garin S.A. currently does not have significant operations and has a market capitalization of PLN24.77 million.

Operations: There are no reported revenue segments for Garin (WSE:GAR).

Market Cap: PLN24.77M

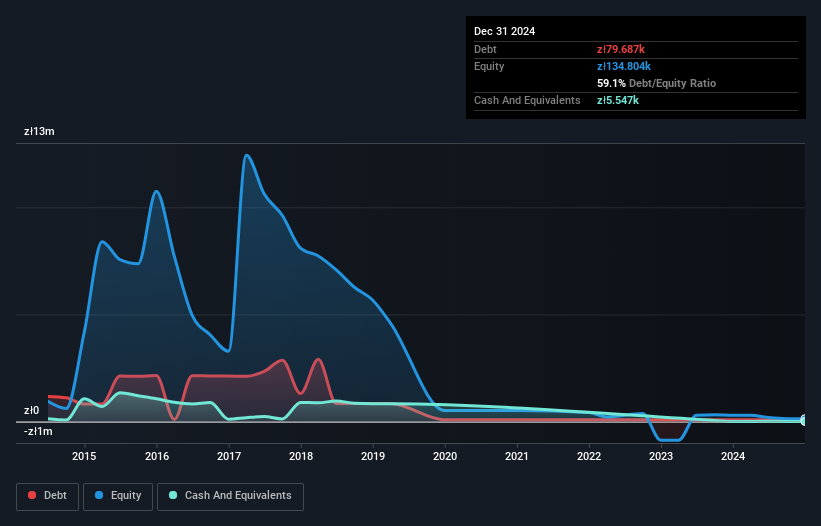

Garin S.A., a pre-revenue entity with a market cap of PLN24.77 million, has been reducing its losses by 60% annually over the past five years despite remaining unprofitable. The company maintains a sufficient cash runway exceeding three years, supported by positive free cash flow. However, Garin's debt to equity ratio has increased significantly to 59.1% over five years, indicating rising financial leverage. Short-term assets of PLN411.6K comfortably cover short-term liabilities of PLN276.8K, but the stock is highly volatile and lacks significant operational activity or revenue streams as it navigates its current financial landscape.

- Click to explore a detailed breakdown of our findings in Garin's financial health report.

- Examine Garin's past performance report to understand how it has performed in prior years.

Where To Now?

- Investigate our full lineup of 416 European Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:GAR

Adequate balance sheet low.

Market Insights

Community Narratives