- Taiwan

- /

- Semiconductors

- /

- TWSE:4919

3 Dividend Stocks Offering Yields Up To 9.3%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate cuts in Europe and mixed economic signals from the U.S., investors are increasingly turning their attention to dividend stocks for potential income opportunities. In this environment, where indices like the S&P 500 have shown strong performance, particularly in utilities and real estate sectors, selecting dividend stocks with robust yields can be an appealing strategy for those seeking steady returns amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.80% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.67% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.70% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.17% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.85% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.85% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.84% | ★★★★★★ |

Click here to see the full list of 2051 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

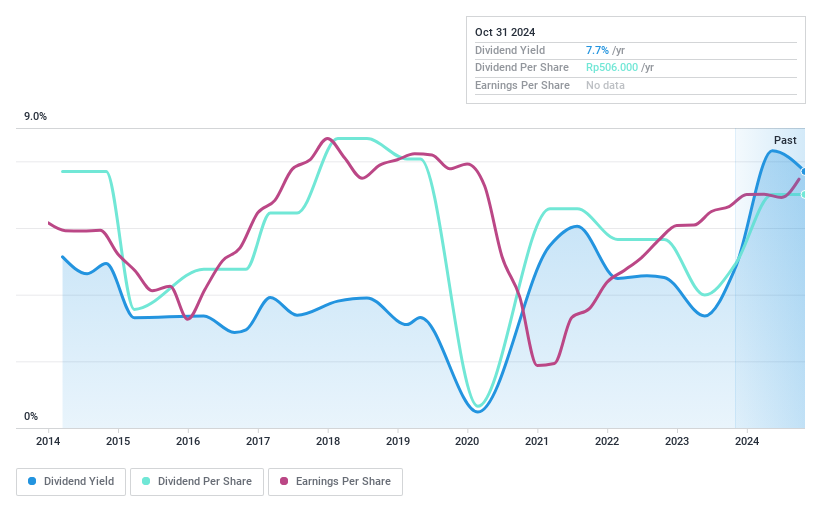

Multi Bintang Indonesia (IDX:MLBI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PT Multi Bintang Indonesia Tbk produces and markets alcoholic and non-alcoholic beverages in Indonesia and internationally, with a market cap of IDR14.49 billion.

Operations: PT Multi Bintang Indonesia Tbk generates revenue primarily from its Beverage Business segment, which accounted for IDR3.38 billion.

Dividend Yield: 7.4%

Multi Bintang Indonesia's dividend yield of 7.36% ranks in the top 25% of Indonesian dividend payers, supported by a payout ratio of 73.4% and cash payout ratio of 76.1%, indicating dividends are covered by earnings and cash flows. However, dividends have been volatile over the past decade without consistent growth, raising concerns about sustainability despite recent earnings improvements with net income reaching IDR 762.57 million for the first nine months of 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of Multi Bintang Indonesia.

- The valuation report we've compiled suggests that Multi Bintang Indonesia's current price could be quite moderate.

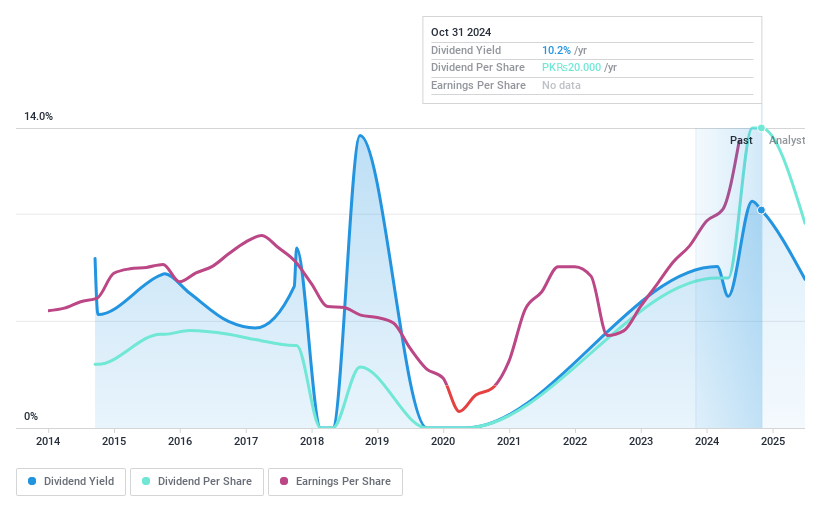

Pioneer Cement (KASE:PIOC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pioneer Cement Limited manufactures, markets, and sells cement and clinker products in Pakistan with a market capitalization of PKR48.65 billion.

Operations: Pioneer Cement Limited generates revenue of PKR35.52 billion from its manufacturing, marketing, and sale of cement segment in Pakistan.

Dividend Yield: 9.3%

Pioneer Cement's dividend yield of 9.34% is below the top 25% in Pakistan, but dividends are well-supported by a payout ratio of 65.8% and cash payout ratio of 41.3%, indicating coverage by earnings and cash flows. Despite recent earnings doubling to PKR 5.18 billion, dividends have been unstable over the past decade with volatility exceeding annual drops of over 20%, raising concerns about reliability despite growth in payments over ten years.

- Delve into the full analysis dividend report here for a deeper understanding of Pioneer Cement.

- According our valuation report, there's an indication that Pioneer Cement's share price might be on the cheaper side.

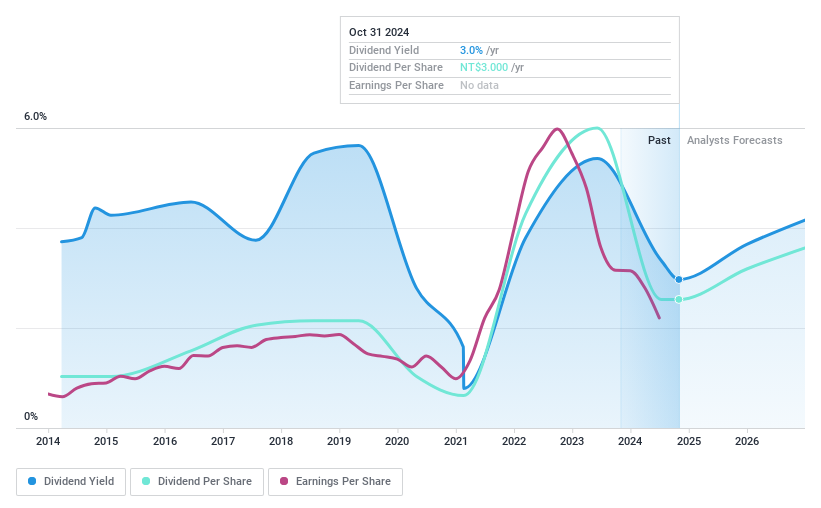

Nuvoton Technology (TWSE:4919)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nuvoton Technology Corporation, along with its subsidiaries, operates as a semiconductor company and has a market cap of NT$39.50 billion.

Operations: Nuvoton Technology Corporation's revenue primarily comes from its General Integrated Circuit Products segment, which generated NT$31.27 billion, and its Wafer Foundry segment, contributing NT$2.22 billion.

Dividend Yield: 3.2%

Nuvoton Technology's dividend yield of 3.19% is lower than the top 25% in Taiwan, but dividends are covered by a payout ratio of 74.3% and cash payout ratio of 66.4%, suggesting coverage by earnings and cash flows. Despite this, dividends have been volatile over the past decade with significant drops, making them unreliable despite some growth over ten years. Recent earnings showed a net loss for Q2, impacting financial stability and dividend reliability.

- Unlock comprehensive insights into our analysis of Nuvoton Technology stock in this dividend report.

- In light of our recent valuation report, it seems possible that Nuvoton Technology is trading beyond its estimated value.

Key Takeaways

- Navigate through the entire inventory of 2051 Top Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuvoton Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4919

Flawless balance sheet and good value.