- United Arab Emirates

- /

- Insurance

- /

- DFM:DIN

3 Leading Dividend Stocks Yielding Up To 6.3%

Reviewed by Simply Wall St

In the midst of escalating geopolitical tensions and fluctuating economic indicators, global markets have experienced a mix of volatility and resilience. With oil prices rising due to Middle East conflicts and unexpected job gains in the U.S., investors are seeking stability through dividend stocks, which can offer a reliable income stream even during uncertain times. As market dynamics continue to shift, identifying stocks with strong dividend yields becomes essential for those looking to balance risk with steady returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.55% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.37% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.39% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.00% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.89% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.77% | ★★★★★★ |

| CVB Financial (NasdaqGS:CVBF) | 4.46% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.26% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.67% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.84% | ★★★★★★ |

Click here to see the full list of 2036 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

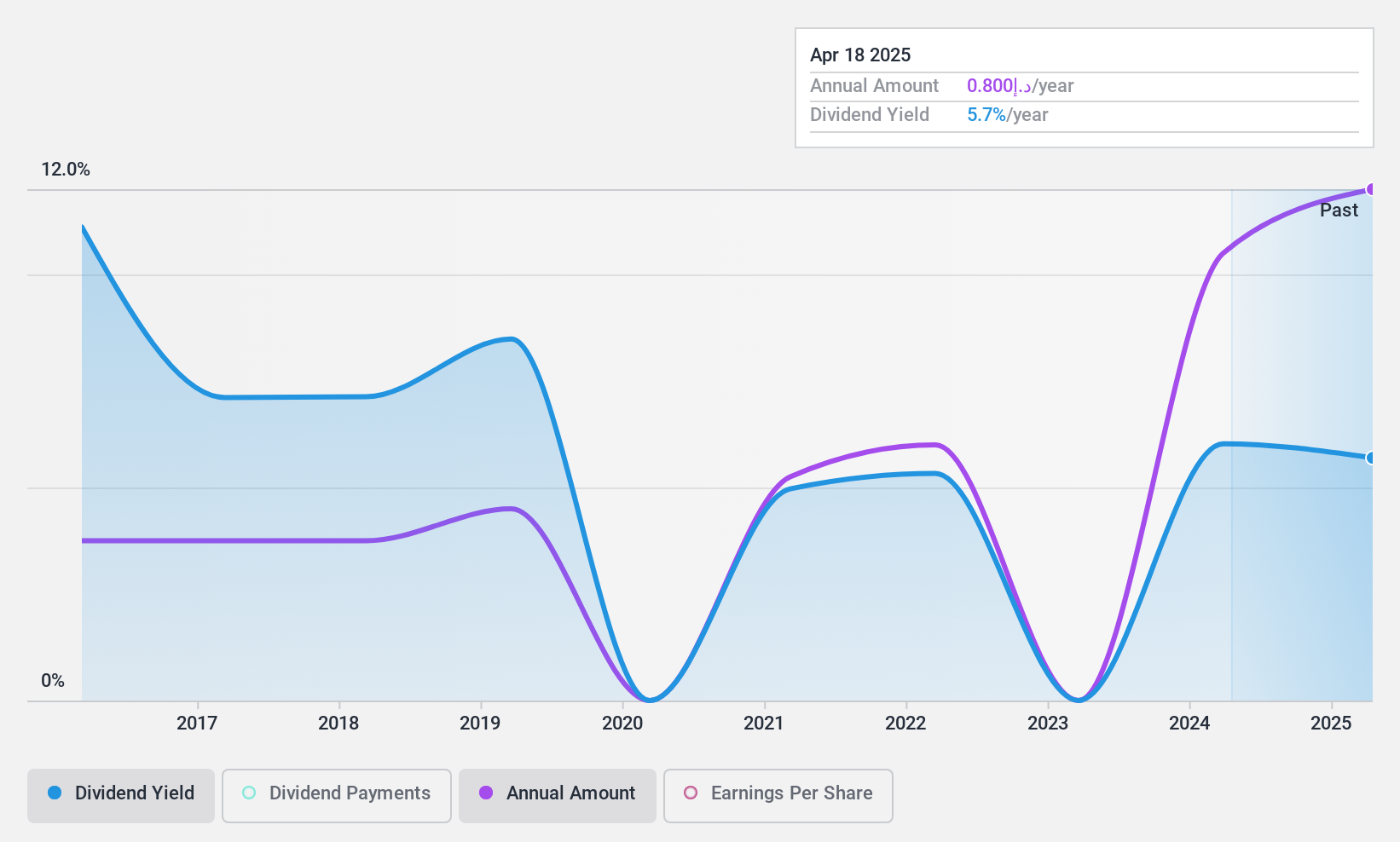

Dubai Insurance Company (P.S.C.) (DFM:DIN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dubai Insurance Company (P.S.C.) offers a range of insurance products for individuals and corporates in the United Arab Emirates, with a market cap of AED960 million.

Operations: Dubai Insurance Company (P.S.C.) generates revenue through its Life and Medical segment, which accounts for AED505.39 million, and its Motor and General segment, contributing AED596.31 million.

Dividend Yield: 6.4%

Dubai Insurance Company (P.S.C.) offers a stable and reliable dividend, with payments growing over the past decade. Despite a lower dividend yield of 6.36% compared to top-tier payers in the AE market, its dividends are well-covered by earnings (payout ratio: 41.3%) and cash flows (cash payout ratio: 80.9%). Recent earnings growth of 65.1% supports dividend sustainability, while its low price-to-earnings ratio of 6.5x suggests good value for investors seeking income stability amidst illiquid shares.

- Click here to discover the nuances of Dubai Insurance Company (P.S.C.) with our detailed analytical dividend report.

- According our valuation report, there's an indication that Dubai Insurance Company (P.S.C.)'s share price might be on the expensive side.

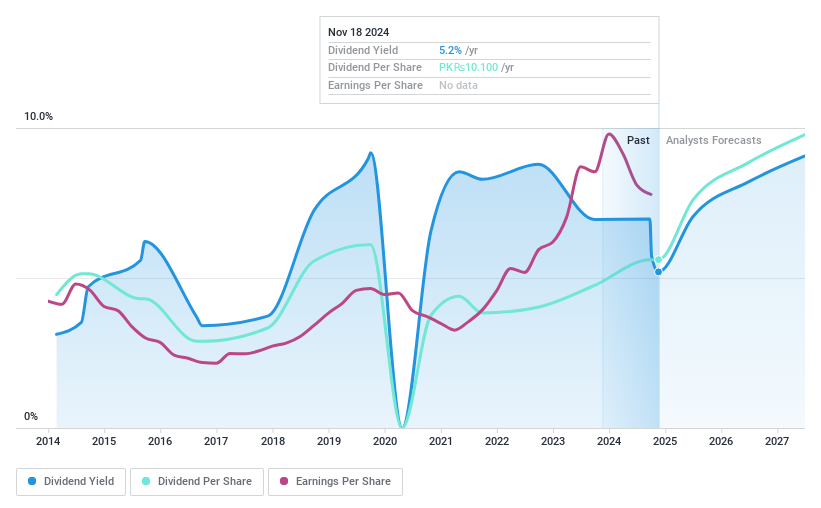

Oil and Gas Development (KASE:OGDC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oil and Gas Development Company Limited explores, develops, produces, and sells oil and gas resources in Pakistan with a market cap of PKR717.91 billion.

Operations: The company's revenue primarily comes from its Oil & Gas - Exploration & Production segment, totaling PKR463.70 billion.

Dividend Yield: 6.1%

Oil and Gas Development Company Limited's dividend payments, while covered by earnings (payout ratio: 20.8%) and cash flows (cash payout ratio: 72.7%), have been historically volatile. The recent PKR 4.00 per share dividend reflects a commitment to shareholder returns despite earnings decline from PKR 224.62 billion to PKR 208.98 billion over the past year. Notably, recent gas discoveries in Pakistan may bolster future revenue streams, potentially stabilizing dividends amidst current market challenges such as its removal from the FTSE All-World Index.

- Click to explore a detailed breakdown of our findings in Oil and Gas Development's dividend report.

- Our valuation report here indicates Oil and Gas Development may be overvalued.

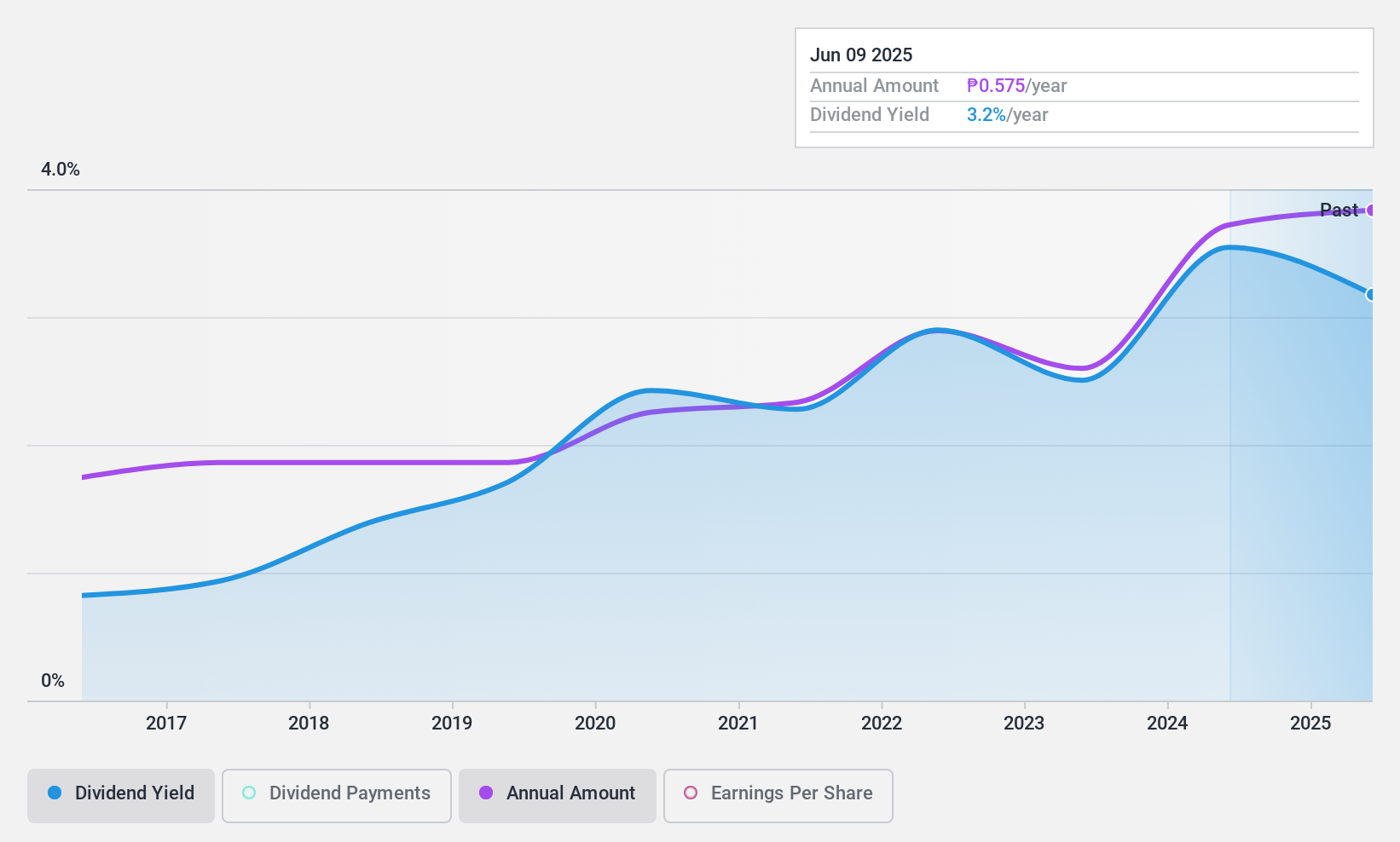

Vivant (PSE:VVT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vivant Corporation, with a market cap of ₱17.40 billion, operates in the Philippines through its subsidiaries by generating, distributing, and retailing electric power.

Operations: Vivant Corporation's revenue segments include generating, distributing, and retailing electric power in the Philippines.

Dividend Yield: 3.3%

Vivant has maintained reliable and stable dividend payments over the past decade, supported by a low payout ratio of 33.7%. However, dividends are not covered by free cash flows, posing sustainability concerns despite a price-to-earnings ratio of 10.3x below industry average. Recent earnings show increased sales (PHP 2.89 billion) but decreased net income (PHP 652.18 million), indicating potential pressure on future dividends amidst volatile share prices and lower profit margins compared to last year.

- Dive into the specifics of Vivant here with our thorough dividend report.

- The analysis detailed in our Vivant valuation report hints at an inflated share price compared to its estimated value.

Taking Advantage

- Investigate our full lineup of 2036 Top Dividend Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:DIN

Dubai Insurance Company (P.S.C.)

Provides various insurance products for individuals and corporates in the United Arab Emirates.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives