- Sweden

- /

- Commercial Services

- /

- OM:ITAB

Insider Buying Highlights These 3 Undervalued Small Caps Across Regions

Reviewed by Simply Wall St

In recent weeks, global markets have exhibited mixed performances, with major indexes like the S&P 500 and Nasdaq Composite reaching record highs while the Russell 2000 Index faced declines after a period of outperformance. Amidst this backdrop, economic indicators such as job growth in the U.S. and geopolitical events in Europe have shaped investor sentiment, particularly impacting small-cap stocks which often react more sensitively to changes in market conditions. In light of these dynamics, identifying potential opportunities within small-cap stocks involves considering factors such as insider buying trends and regional economic developments that might signal undervaluation or future growth potential.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Maharashtra Seamless | 11.5x | 2.0x | 26.44% | ★★★★★☆ |

| Digital Mediatama Maxima | NA | 1.1x | 20.95% | ★★★★☆☆ |

| Optima Health | NA | 1.2x | 38.44% | ★★★★☆☆ |

| Gooch & Housego | 40.9x | 1.0x | 32.33% | ★★★☆☆☆ |

| Semen Indonesia (Persero) | 19.0x | 0.6x | 34.17% | ★★★☆☆☆ |

| L.G. Balakrishnan & Bros | 15.0x | 1.7x | -50.51% | ★★★☆☆☆ |

| Tai Sin Electric | 12.5x | 0.5x | 12.34% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Safari Investments RSA | 5.0x | 2.9x | 9.92% | ★★★☆☆☆ |

| THG | NA | 0.4x | -1049.48% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

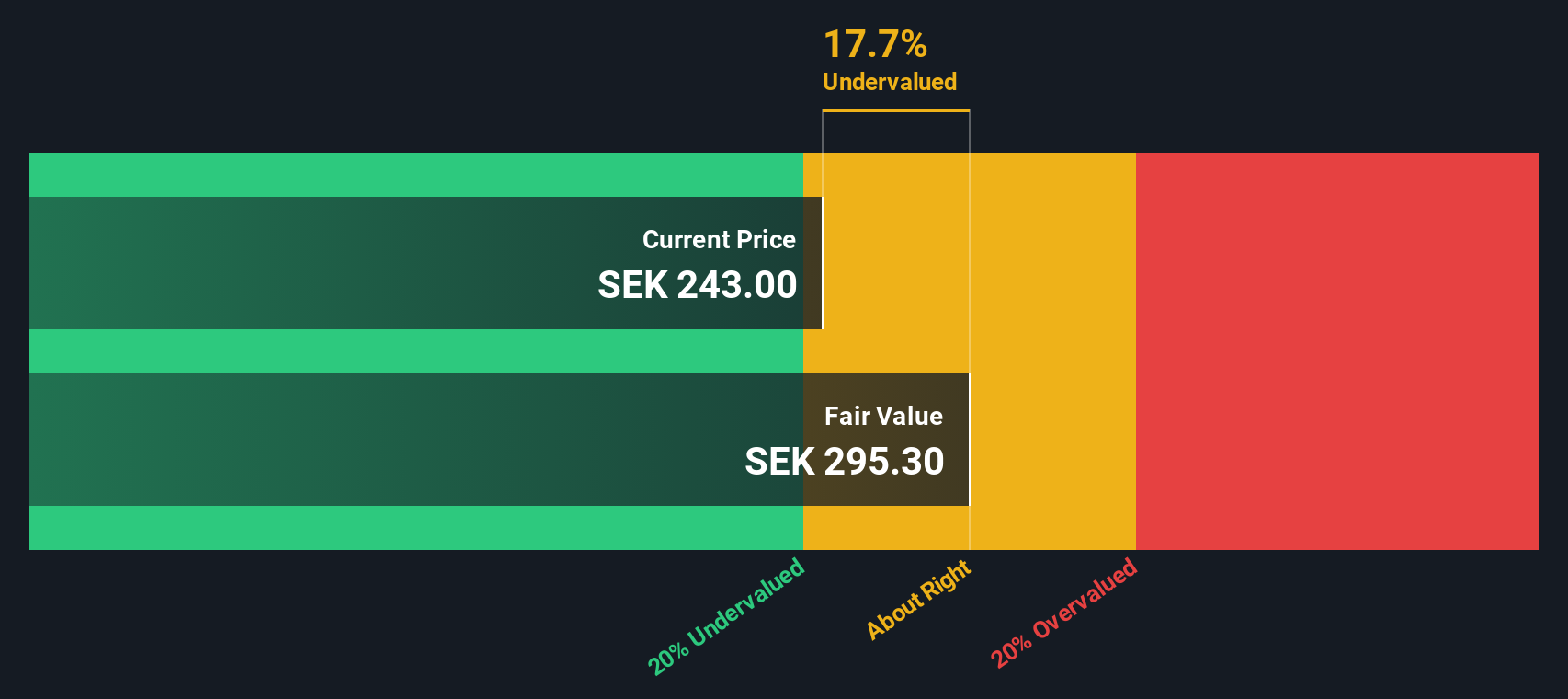

Beijer Alma (OM:BEIA B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Beijer Alma is an industrial group specializing in manufacturing and distributing components and technology solutions, with a market cap of approximately SEK 11.19 billion.

Operations: Lesjöfors and Beijer Tech contribute significantly to the company's revenue, with Lesjöfors generating SEK 4.82 billion and Beijer Tech SEK 2.25 billion. The net income margin shows variability, reaching a peak of 12.23% in June 2021 before declining to around 7.31% by September 2023, indicating fluctuations in profitability over time.

PE: 15.7x

Beijer Alma, a smaller company in the industrial sector, has shown promising financial performance with its recent third-quarter results. Sales reached SEK 1,683 million, slightly up from last year, while net income more than doubled to SEK 303 million. Despite high debt levels and reliance on external borrowing for funding, insider confidence is evident as Oskar Hellstrom purchased 2,500 shares in October for approximately SEK 533K. Earnings are projected to grow at a modest rate of 4.45% annually.

- Click here and access our complete valuation analysis report to understand the dynamics of Beijer Alma.

Explore historical data to track Beijer Alma's performance over time in our Past section.

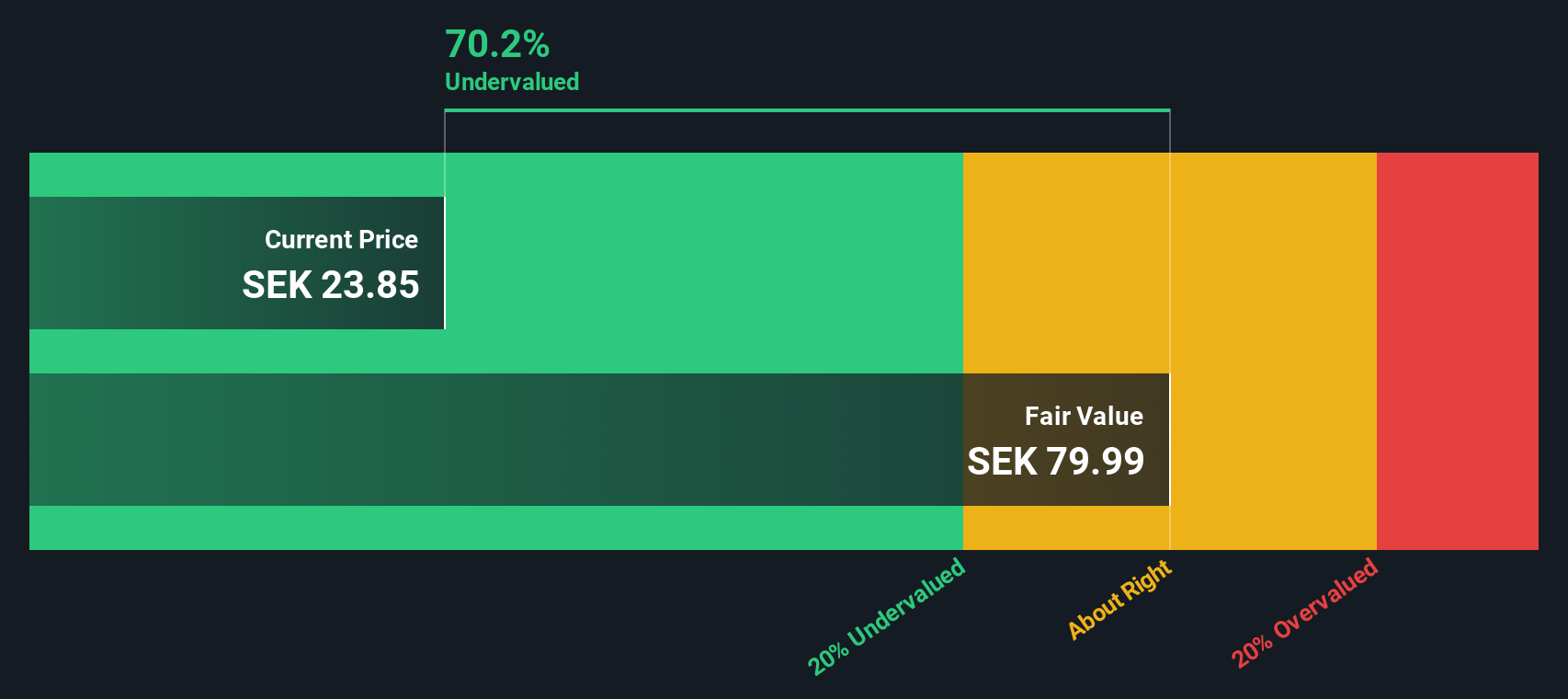

ITAB Shop Concept (OM:ITAB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: ITAB Shop Concept is a company that specializes in providing retail solutions, including furniture and fixtures, with a market capitalization of approximately SEK 1.97 billion.

Operations: The company's revenue primarily stems from its Furniture & Fixtures segment, with cost of goods sold (COGS) being a significant expense. Over recent periods, the gross profit margin has shown an upward trend, reaching 29.13% by September 2024. Operating expenses are largely driven by sales and marketing efforts and general administrative costs.

PE: 16.3x

ITAB Shop Concept, a smaller player in the retail solutions industry, recently reported mixed financial results. For Q3 2024, sales increased to SEK 1,553 million from SEK 1,529 million the previous year; however, net income decreased to SEK 43 million from SEK 70 million. Despite past shareholder dilution and reliance on external borrowing for funding, insider confidence is evident as Vegard Soraunet acquired over 1.7 million shares for approximately SEK 40 million. Earnings are projected to grow by about 17% annually.

- Navigate through the intricacies of ITAB Shop Concept with our comprehensive valuation report here.

Examine ITAB Shop Concept's past performance report to understand how it has performed in the past.

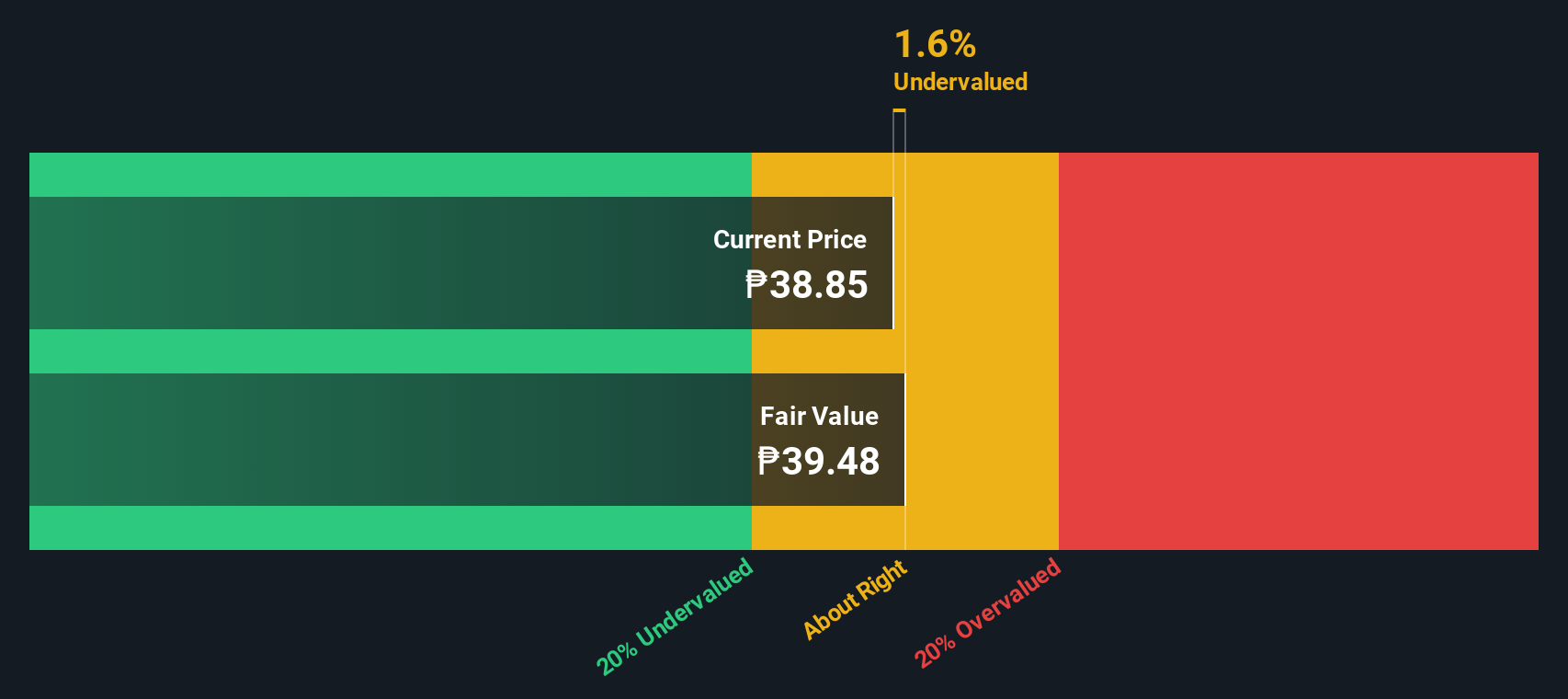

Manila Water Company (PSE:MWC)

Simply Wall St Value Rating: ★★★★★★

Overview: Manila Water Company operates as a provider of water and wastewater services, with a focus on the Manila Concession area and various subsidiaries, holding a market capitalization of ₱55.32 billion.

Operations: The company's primary revenue is driven by the Manila Concession and Head Office, with domestic subsidiaries contributing significantly. Over recent periods, the gross profit margin has shown variability, reaching 79.12% in late 2024. Operating expenses include significant allocations to general and administrative costs as well as depreciation and amortization.

PE: 8.9x

Manila Water Company is navigating its financial landscape with a recent PHP 10 billion loan from China Banking Corporation to bolster capital projects. Despite relying solely on external borrowing, the company shows promising growth, with earnings forecasted to rise by nearly 16% annually. Recent insider confidence is evident as an insider purchased 143,664 shares worth approximately PHP 3.9 million in November, indicating potential optimism about future prospects. For the third quarter of 2024, sales increased to PHP 8.68 billion from the previous year's PHP 7.33 billion, reflecting solid revenue and net income growth year-over-year.

Key Takeaways

- Explore the 187 names from our Undervalued Small Caps With Insider Buying screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ITAB

ITAB Shop Concept

Develops, manufactures, sells, and installs store concepts for retail chain stores.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives