- Philippines

- /

- Water Utilities

- /

- PSE:MWC

3 Undervalued Small Caps With Insider Buying Across Regions

Reviewed by Simply Wall St

In a week marked by volatility, global markets have faced significant challenges, with U.S. stocks experiencing declines amid AI competition concerns and tariff risks, while European indices reached record highs following positive earnings and interest rate cuts by the ECB. Amid these dynamic conditions, small-cap stocks often present unique opportunities for investors seeking growth potential outside of large-cap tech volatility. Identifying promising small-cap companies involves assessing factors such as financial health and insider buying trends, which can signal confidence from those closest to the company’s operations.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 21.5x | 5.5x | 25.82% | ★★★★★★ |

| Collins Foods | 17.5x | 0.6x | 9.81% | ★★★★★☆ |

| Gamma Communications | 23.1x | 2.4x | 36.94% | ★★★★☆☆ |

| Dicker Data | 19.2x | 0.7x | -60.32% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 12.6x | 2.1x | 39.73% | ★★★★☆☆ |

| Logistri Fastighets | 12.5x | 8.9x | 40.30% | ★★★★☆☆ |

| Franchise Brands | 38.2x | 2.0x | 30.42% | ★★★★☆☆ |

| Healius | NA | 0.6x | 8.43% | ★★★★☆☆ |

| Mark Dynamics Indonesia | 13.0x | 4.2x | 6.52% | ★★★☆☆☆ |

| Paradeep Phosphates | 21.9x | 0.7x | -18.61% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

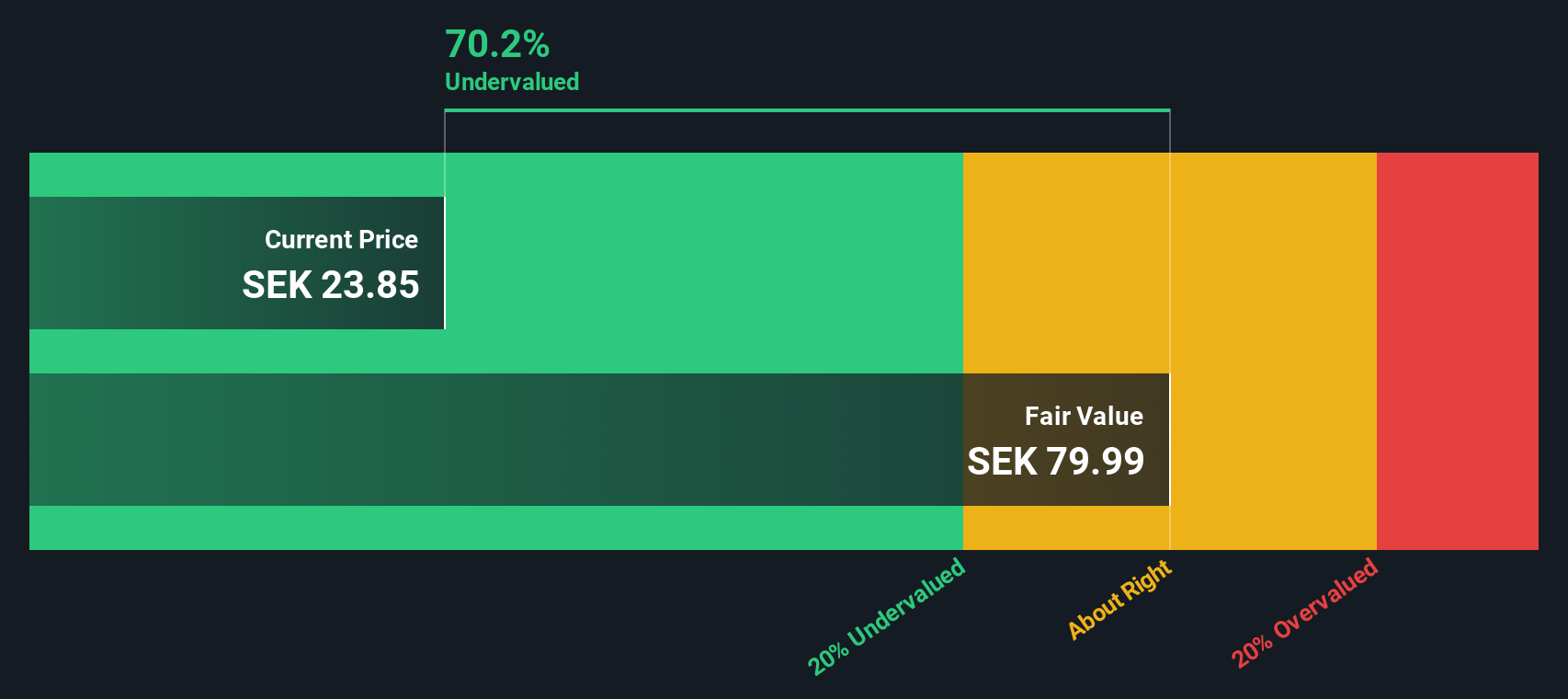

ITAB Shop Concept (OM:ITAB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ITAB Shop Concept specializes in providing retail solutions, including furniture and fixtures, with a market capitalization of approximately SEK 1.50 billion.

Operations: The company generates revenue primarily from its Furniture & Fixtures segment, with recent figures reaching SEK 6.39 billion. The gross profit margin has shown variability over time, most recently recorded at 29.13%. Operating expenses are a significant cost factor, including sales and marketing expenses which have been consistently high. Net income margin has experienced fluctuations, indicating varying profitability levels in different periods.

PE: 14.9x

ITAB Shop Concept, a smaller company in its sector, has caught attention due to insider confidence shown by Vegard Soraunet's purchase of 1.76 million shares valued at approximately SEK 40 million. Despite relying entirely on external borrowing, which poses some risk, the company's earnings are projected to grow by 17.1% annually. This growth potential suggests it may offer opportunities for investors seeking companies with promising future prospects amid its current financial challenges.

- Click here to discover the nuances of ITAB Shop Concept with our detailed analytical valuation report.

Evaluate ITAB Shop Concept's historical performance by accessing our past performance report.

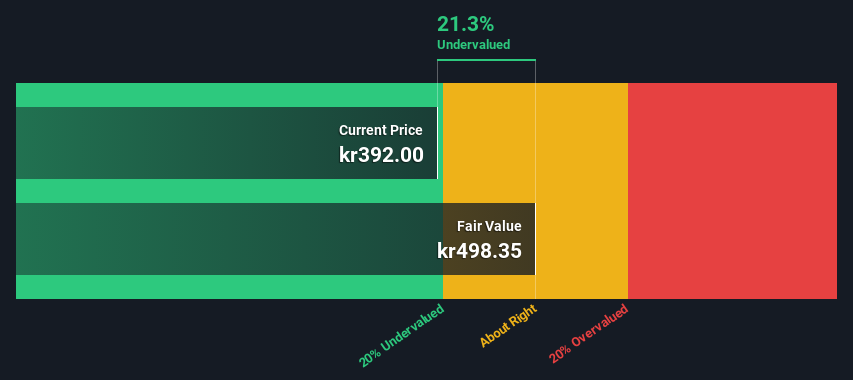

MedCap (OM:MCAP)

Simply Wall St Value Rating: ★★★★★☆

Overview: MedCap is a Swedish investment company focused on acquiring and developing small to medium-sized companies in the life sciences sector, with a market cap of approximately SEK 3.04 billion.

Operations: MedCap's primary revenue stream is derived from its gross profit, which has shown a notable trend with the gross profit margin reaching 59.31% as of December 2024. The company incurs significant costs, primarily in cost of goods sold (COGS) and operating expenses, with general and administrative expenses being a major component. Over recent periods, MedCap's net income margin reached up to 12.66%, indicating an improvement in profitability relative to its revenue growth.

PE: 29.0x

MedCap, operating in the healthcare sector, showcases potential as an undervalued stock with its recent financial performance. For 2024, sales rose to SEK 1.81 billion from SEK 1.59 billion the previous year, while net income increased to SEK 207 million from SEK 172 million. Insider confidence is evident with share purchases over the last quarter of 2024, signaling trust in future growth prospects despite volatile share prices and reliance on external borrowing for funding.

- Take a closer look at MedCap's potential here in our valuation report.

Examine MedCap's past performance report to understand how it has performed in the past.

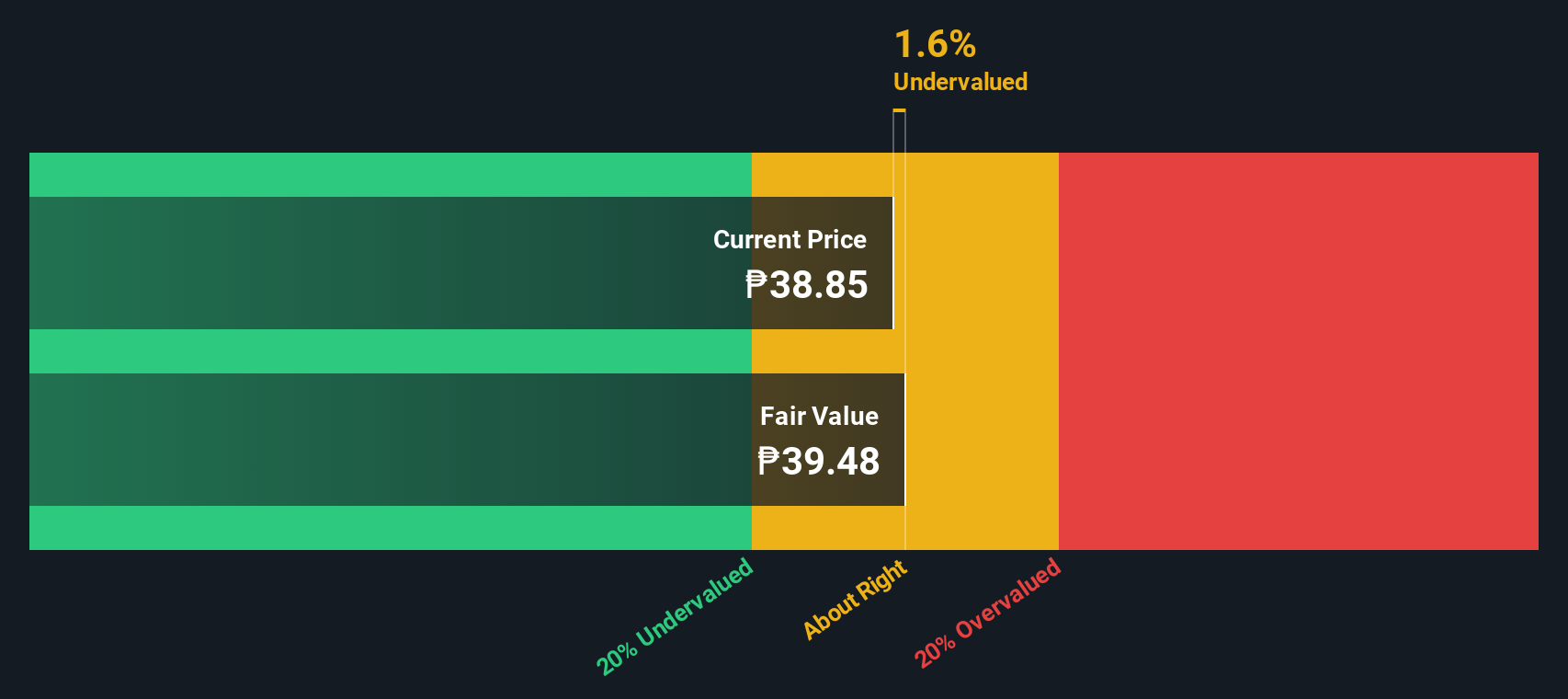

Manila Water Company (PSE:MWC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Manila Water Company operates as a provider of water, wastewater, and related services primarily in the Philippines, with a market capitalization of ₱44.94 billion.

Operations: The company's primary revenue streams are derived from its Manila Concession and Head Office, with significant contributions from domestic subsidiaries. Over the analyzed periods, the gross profit margin showed notable fluctuations, peaking at 79.12% in September 2024. Cost of goods sold (COGS) and operating expenses are major components impacting profitability, with COGS reaching ₱7.50 billion in September 2023 and operating expenses amounting to ₱8.52 billion in September 2024.

PE: 10.2x

Manila Water Company, a smaller player in the market, shows potential for growth with earnings expected to rise by 17.62% annually. Recent insider confidence is evident as an individual acquired 143,664 shares valued at ₱3.88 million, increasing their stake significantly by over 190%. Despite relying solely on external borrowing for funding—evidenced by recent ₱25 billion loans—the company reported strong third-quarter financials with net income rising to ₱3.19 billion from ₱2.21 billion year-on-year, signaling promising prospects amid its capital expansion efforts.

Key Takeaways

- Click through to start exploring the rest of the 178 Undervalued Small Caps With Insider Buying now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:MWC

Manila Water Company

Provides water treatment and distribution, sewerage, and sanitation services in the Philippines and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives