As the U.S. and China have agreed to a temporary pause on tariffs, the easing trade tensions have buoyed Asian markets, with indices such as China's CSI 300 and Hong Kong's Hang Seng Index posting gains. In this environment of cautious optimism, dividend stocks in Asia present an appealing option for investors seeking steady income streams alongside potential capital appreciation.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| en-japan (TSE:4849) | 4.27% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.90% | ★★★★★★ |

| Daicel (TSE:4202) | 5.07% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.93% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.09% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.70% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.11% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.98% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.47% | ★★★★★★ |

Click here to see the full list of 1248 stocks from our Top Asian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Asian Terminals (PSE:ATI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asian Terminals, Inc. operates and manages the South Harbor Port of Manila and the Port of Batangas in Batangas City, Philippines, with a market cap of ₱47.90 billion.

Operations: Asian Terminals, Inc. generates revenue through its operations and management of the South Harbor Port of Manila and the Port of Batangas in the Philippines.

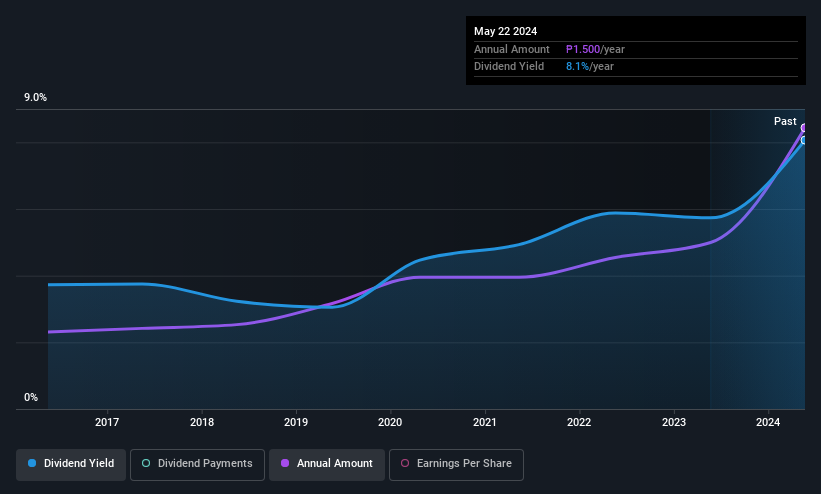

Dividend Yield: 6.2%

Asian Terminals, Inc. demonstrates a stable dividend profile with a consistent history of payouts over the past decade. The company recently declared both regular and special dividends, totaling PHP 3 billion, highlighting its commitment to returning value to shareholders. With a payout ratio of 44.7% and cash flow coverage at 70.3%, dividends are well-supported by earnings and cash flows. Despite offering a reliable yield of 6.25%, it slightly lags behind top-tier dividend payers in the Philippines market (6.33%).

- Get an in-depth perspective on Asian Terminals' performance by reading our dividend report here.

- Our valuation report here indicates Asian Terminals may be overvalued.

Bosideng International Holdings (SEHK:3998)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bosideng International Holdings Limited operates in the apparel industry within the People's Republic of China, with a market capitalization of approximately HK$52.44 billion.

Operations: Bosideng International Holdings Limited generates revenue through its Down Apparels segment (CN¥20.66 billion), Ladieswear Apparels (CN¥735.22 million), Diversified Apparels (CN¥254.12 million), and Original Equipment Manufacturing (OEM) Management (CN¥2.97 billion).

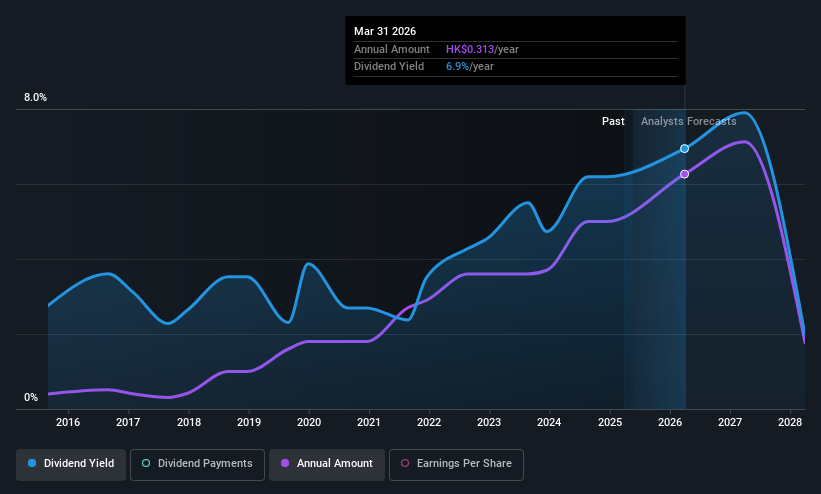

Dividend Yield: 5.3%

Bosideng International Holdings' dividend payments have been volatile over the past decade, with a payout ratio of 78.3% supported by earnings and cash flows. Despite recent earnings growth of CNY 41.4%, its dividend yield of 5.33% is lower than Hong Kong's top-tier payers (7.69%). Trading at 21.6% below estimated fair value, it presents potential for capital gains but requires caution due to its unstable dividend history and upcoming shareholder meeting addressing future agreements.

- Delve into the full analysis dividend report here for a deeper understanding of Bosideng International Holdings.

- According our valuation report, there's an indication that Bosideng International Holdings' share price might be on the cheaper side.

KurimotoLtd (TSE:5602)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kurimoto, Ltd. manufactures and sells ductile iron pipes, valves, industrial equipment and materials, and construction materials both in Japan and internationally, with a market cap of ¥64.64 billion.

Operations: Kurimoto, Ltd.'s revenue is derived from its Lifeline Business segment, which generated ¥61.93 billion; the Mechanical Systems segment, contributing ¥31.15 billion; and the Industrial Construction Materials segment, with revenues of ¥31.94 billion.

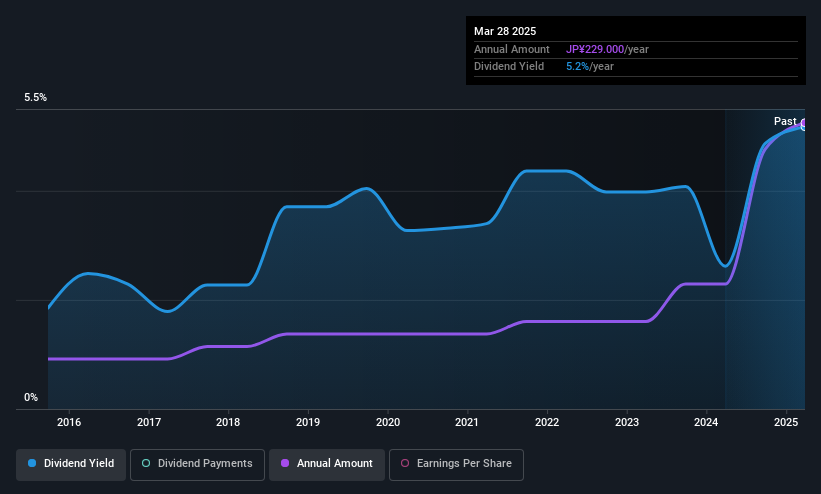

Dividend Yield: 4.3%

Kurimoto Ltd.'s dividend payments have shown stability and growth over the past decade, with a current yield of 4.3%, placing it in the top 25% of JP market payers. Despite recent increases, future dividends are expected to decrease to JPY 144 per share for the year ending March 2026 from JPY 181 previously. The payout ratio is reasonable at 48.1%, though dividends are not supported by free cash flows, indicating potential sustainability concerns.

- Unlock comprehensive insights into our analysis of KurimotoLtd stock in this dividend report.

- Insights from our recent valuation report point to the potential overvaluation of KurimotoLtd shares in the market.

Next Steps

- Gain an insight into the universe of 1248 Top Asian Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bosideng International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3998

Bosideng International Holdings

Engages in the apparel business in the People’s Republic of China.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives