- Philippines

- /

- Wireless Telecom

- /

- PSE:TEL

Should Investors Revisit PLDT After Stock Rebound and Network Expansion in 2025?

Reviewed by Bailey Pemberton

If you are deciding what to do with your PLDT shares, or thinking about jumping in, you are far from alone. The Philippine telecom giant has had an eventful run lately. With a last closing price of 1119.0, the stock has bounced 2.3% over the past week, reversing some of the recent dip. Still, over the last month it is down 1.8%, and looking at the year-to-date figure, PLDT is trailing by a notable 13.8%. The one-year return paints an even starker picture, down 22.7%. Looking over five years, PLDT has delivered a respectable 21.3% gain, suggesting some enduring value even amid shorter-term volatility.

Much of this movement can be traced back to changing perceptions about the telecom sector and broader market uncertainty, but savvy investors know that volatility sometimes sets the stage for opportunity. That brings us to perhaps the biggest question: is PLDT actually undervalued right now, or are these price swings justified? According to a comprehensive look at six key valuation checks, PLDT scores a perfect 6 out of 6, which may signal that it is in deep value territory.

In the next sections, I will break down how those scores are calculated using different valuation methods. Stay with me to the end, as after we look under the hood, I’ll introduce a perspective on valuation that could change how you view PLDT entirely.

Why PLDT is lagging behind its peers

Approach 1: PLDT Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used approach that estimates a company's intrinsic value by projecting its future cash flows and discounting them back to the present using an appropriate rate. This gives investors a sense of what the business is fundamentally worth today, based on its ability to generate cash over time.

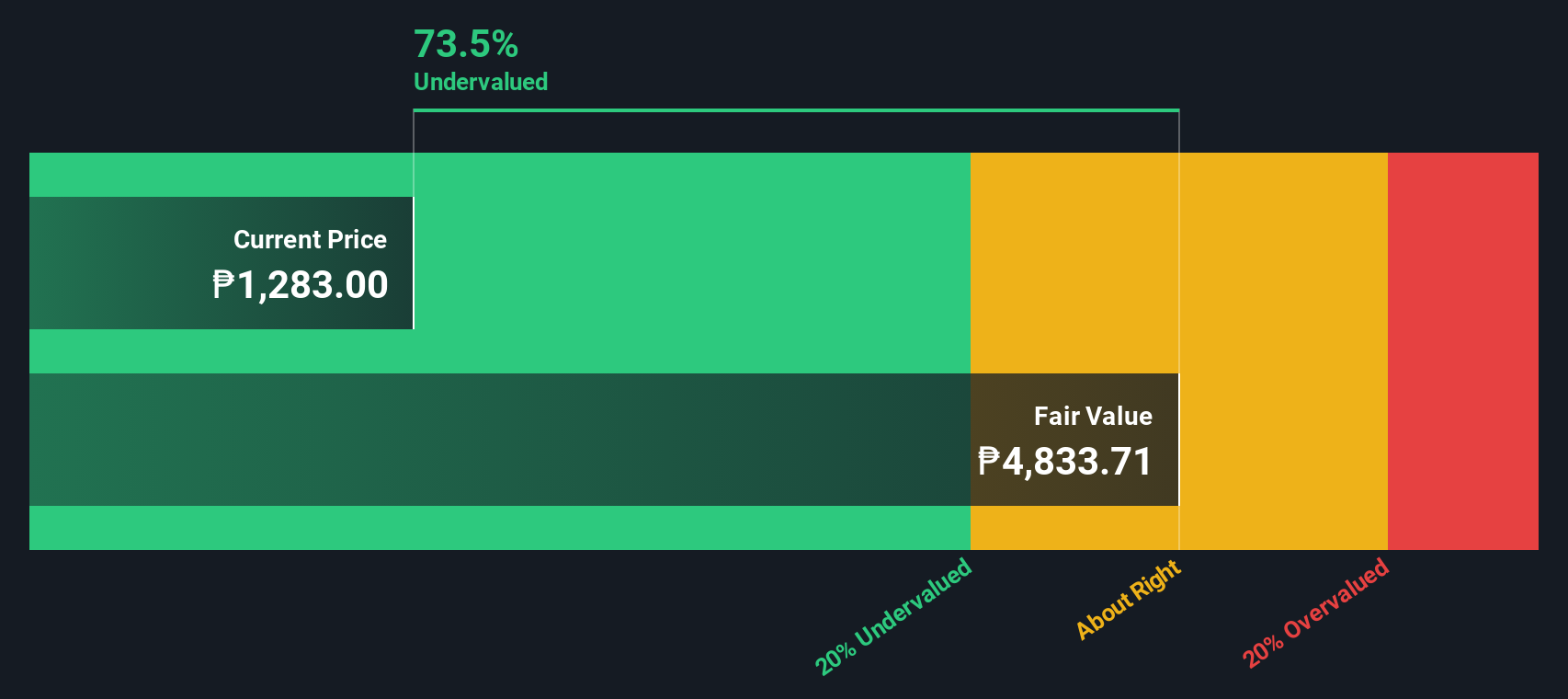

For PLDT, the DCF assessment uses the 2 Stage Free Cash Flow to Equity method. Recent data shows PLDT's latest twelve months of free cash flow stand at a loss of ₱215.6 Million. However, analysts expect a dramatic turnaround, forecasting free cash flow to reach ₱55.9 Billion by 2026 and ₱63.6 Billion by 2027. Looking further out, Simply Wall St’s model projects ten-year free cash flow growing progressively, indicating confidence in PLDT’s capacity to generate increasing amounts of cash.

After discounting these future flows to today's value, the DCF analysis calculates an intrinsic value for PLDT of ₱4,812.93 per share. Compared to its current share price of ₱1,119.00, this valuation implies the stock is trading at a 76.8% discount to its estimated fair value. In other words, the DCF suggests PLDT may be significantly undervalued based on future cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests PLDT is undervalued by 76.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: PLDT Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely trusted valuation metric for profitable companies like PLDT. It offers investors a quick sense of how much they are paying for every peso of earnings, making it especially useful when a company generates consistent profits. Typically, the "right" PE ratio for a business is influenced by expectations for future growth and the risks it faces. Companies with more robust earnings growth or lower risk profiles tend to warrant higher multiples, while those with slower growth or higher risk may trade at lower PE ratios.

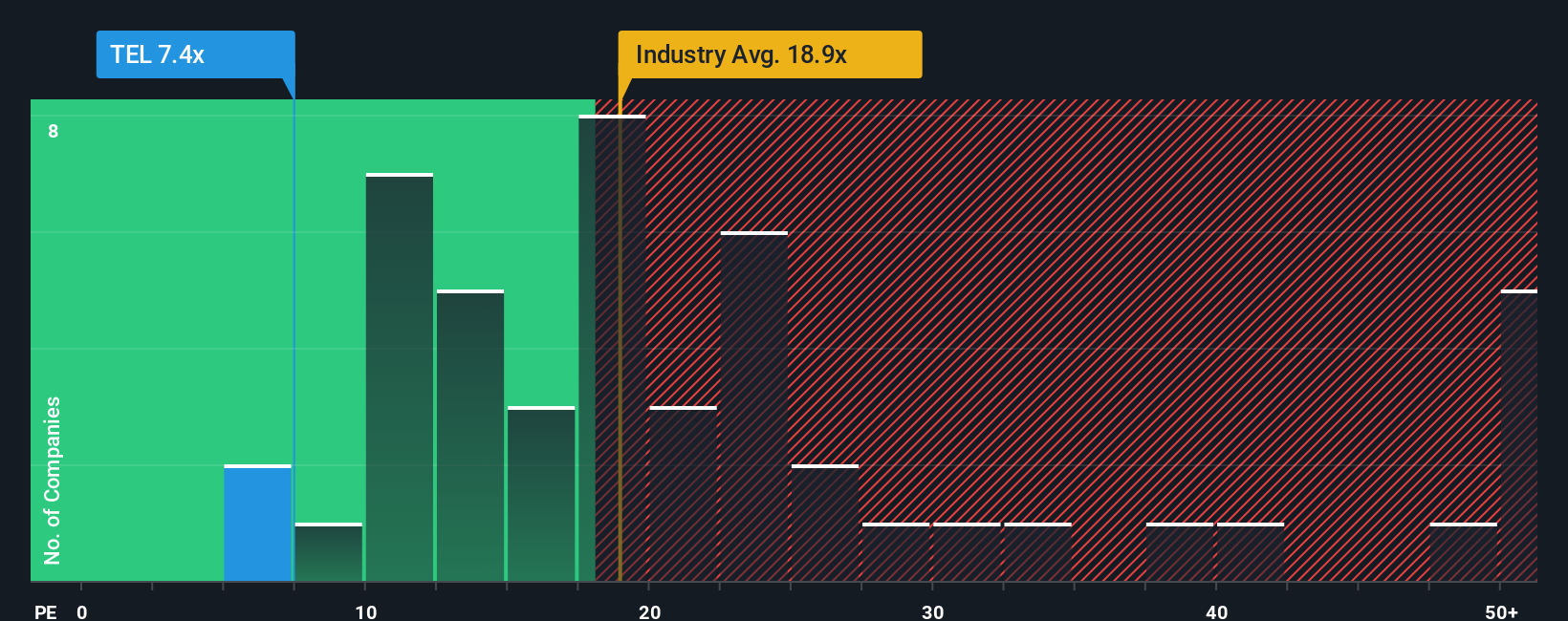

Currently, PLDT trades at a PE ratio of 7.6x, which is notably lower than the Wireless Telecom industry average of 17.8x and the peer average of 15.4x. On the surface, this discount could suggest the market is undervaluing PLDT relative to its sector. However, Simply Wall St’s proprietary Fair Ratio for PLDT stands at 8.1x. This Fair Ratio incorporates a deeper analysis, factoring in specific growth forecasts, profit margins, the company’s risks, and its market cap. It offers a more tailored benchmark than broad industry or peer comparisons.

By weighing PLDT’s actual PE ratio of 7.6x against its Fair Ratio of 8.1x, the valuation appears slightly on the low side, suggesting the shares may be modestly undervalued. Using the Fair Ratio helps move beyond simple peer comparisons and captures a more nuanced view of what PLDT is truly worth in today’s market.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PLDT Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a powerful yet approachable tool that empowers you to define your own story for a company like PLDT by linking the business’s outlook, unique strengths or risks, and your assumptions about its future revenues, profit margins, and fair value.

In simple terms, Narratives connect your perspective about PLDT’s real-world opportunities or challenges with a transparent financial forecast and an estimated fair value. This approach allows you to see how different outlooks map directly to actionable decisions. Narratives are available within the Simply Wall St Community page, accessible to everyone, and are trusted by millions of investors who are looking for a smarter, more dynamic way to decide whether to buy, hold, or sell.

With Narratives, you can instantly compare your calculated Fair Value to PLDT’s current market price, giving you a clear signal of potential upside or downside. Best of all, when key information changes, such as news headlines, earnings results, or updates in industry trends, Narratives automatically update so your decision-making always keeps pace.

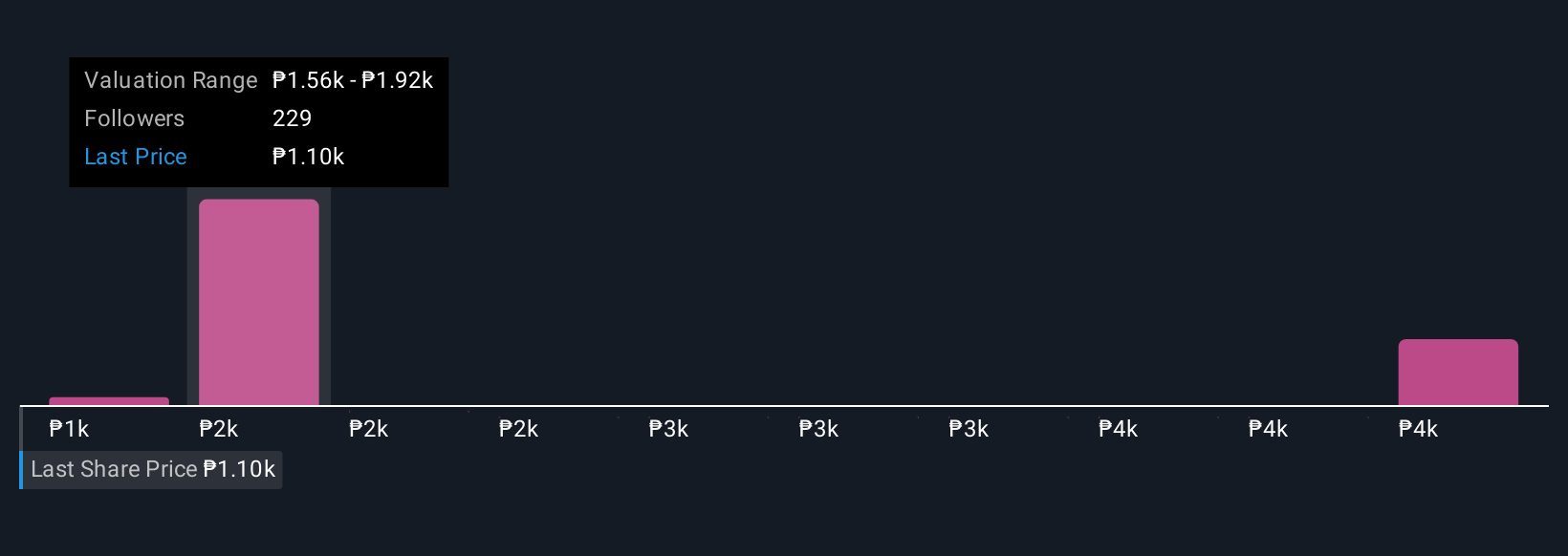

For example, some investors viewing PLDT’s ongoing digital expansion and 5G rollout may believe its fair value could be as high as ₱2,070.00 per share. Others cite rising competition and regulatory risks in support of a more conservative estimate around ₱1,200.00. Narratives let you explore these scenarios, adjust your assumptions, and make informed choices based on the story you believe in most.

Do you think there's more to the story for PLDT? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:TEL

PLDT

Provides telecommunications and digital services in the Philippines.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives