- Philippines

- /

- Wireless Telecom

- /

- PSE:TEL

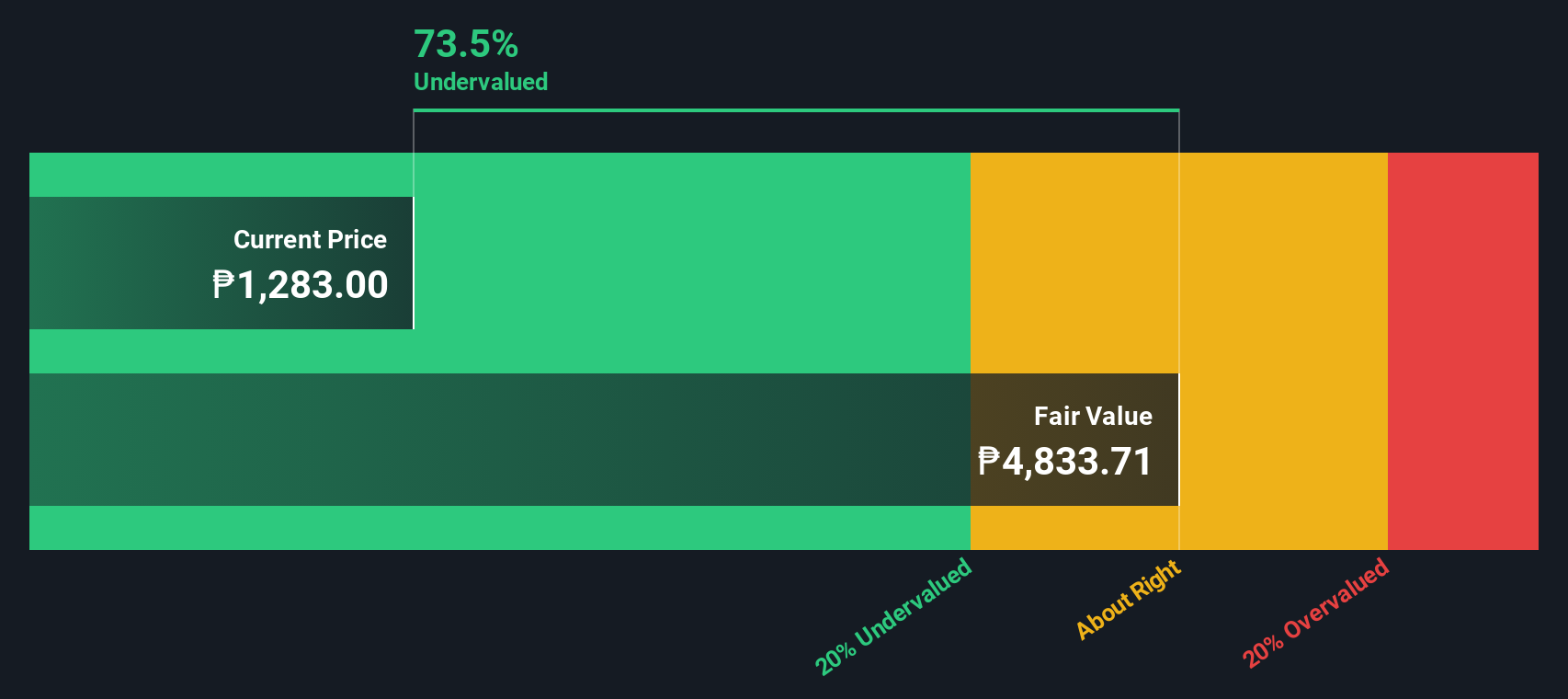

PLDT (PSE:TEL): How Undervalued Is the Stock After Its Recent Price Move?

Reviewed by Simply Wall St

PLDT (PSE:TEL) has turned some heads after a modest uptick in its stock price this week, gaining just under half a percent in the latest session. While there has not been a major headline or company-specific event driving the change, even small moves in a quiet news period can make investors pause and consider whether something under the surface is shifting, particularly after the turbulence seen in the local telecom sector.

The context is important. Over the past month, PLDT shares have risen around 1%, but they remain well below last year’s levels, down about 14% over the past twelve months. That decline stands in contrast to a steadier performance in the previous five years, where returns are positive, suggesting that sentiment might be stabilizing after a turbulent stretch. Short-term momentum appears to be increasing, but for long-term holders, the impact of last year still lingers.

After this year’s choppy ride, some investors might be asking whether they are now looking at a bargain with more upside, or if the market is already signaling that future growth is uncertain and priced in.

Most Popular Narrative: 24.6% Undervalued

According to community narrative, PLDT is currently trading well below its consensus fair value estimate and analysts expect significant upside based on future earnings prospects. This view is grounded in assumptions about the company’s growth drivers and operating environment.

Ongoing expansion of PLDT's data center and advanced enterprise ICT solutions (especially AI, cloud, cybersecurity, and SD-WAN) directly taps into robust growth in digital financial services and rising enterprise demand for secure, high-quality connectivity. This is likely to boost enterprise revenues and margins over the medium-to-long term.

Curious why analysts see so much hidden value in PLDT right now? The secret behind these lofty estimates goes beyond simple growth. There is a bold bet on profit transformation that could surprise even seasoned investors. Wondering how financial targets and future multiples combine to generate such an aggressive fair value? The underlying assumptions might change the way you view PLDT's potential upside.

Result: Fair Value of ₱1,709.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing regulatory uncertainty and intensifying price competition could quickly challenge the bullish case for PLDT’s long-term growth potential.

Find out about the key risks to this PLDT narrative.Another View: SWS DCF Model Offers a Sharper Perspective

While analyst price targets set expectations using future earnings growth and multiples, our DCF model approaches PLDT’s value by projecting its future cash flows. This method currently suggests the company is still undervalued. Which valuation makes more sense for the market ahead?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own PLDT Narrative

If you feel differently or want to dive deeper into the numbers, you have the tools to craft your own story in a matter of minutes. do it your way.

A great starting point for your PLDT research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Why stop with PLDT when the market is full of dynamic opportunities? Give yourself an edge by searching for fast-moving, high-potential stocks matched to your interests. Here are some handpicked strategies that could unlock your next winning move:

- Catch the momentum of healthcare innovation and tap into high-growth companies transforming patient care with AI breakthroughs by checking out healthcare AI stocks.

- Capitalize on stable income streams with companies offering yields above 3 percent by scanning top picks through dividend stocks with yields > 3%.

- Jump ahead in fintech trends by identifying the best-positioned businesses leading blockchain and crypto adoption with cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:TEL

PLDT

Provides telecommunications and digital services in the Philippines.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives