- Norway

- /

- Real Estate

- /

- OB:PUBLI

Discover 3 Undervalued Small Caps With Insider Buying Across Regions

Reviewed by Simply Wall St

In recent weeks, global markets have experienced significant shifts, with U.S. stocks rallying on growth and tax hopes following a "red sweep" in the elections. Notably, the small-cap Russell 2000 Index led these gains, highlighting renewed investor interest in smaller companies amidst expectations of favorable economic policies. In this dynamic environment, identifying well-positioned small-cap stocks can be crucial for investors seeking opportunities that align with current market trends and economic indicators.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paradeep Phosphates | 23.7x | 0.8x | 29.20% | ★★★★★☆ |

| Maharashtra Seamless | 9.4x | 1.6x | 39.10% | ★★★★★☆ |

| Hanover Bancorp | 11.4x | 2.3x | 42.57% | ★★★★☆☆ |

| NCL Industries | 14.4x | 0.5x | -71.51% | ★★★☆☆☆ |

| Semen Indonesia (Persero) | 20.7x | 0.7x | 29.70% | ★★★☆☆☆ |

| L.G. Balakrishnan & Bros | 13.9x | 1.6x | -39.40% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.4x | -223.95% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| European Residential Real Estate Investment Trust | NA | 2.3x | -199.13% | ★★★☆☆☆ |

| Bajel Projects | 238.8x | 1.9x | 32.46% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Public Property Invest (OB:PUBLI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Public Property Invest is a company that focuses on real estate rental operations, with a market capitalization of NOK 2.45 billion.

Operations: The company generates revenue primarily from real estate rentals, with recent revenues reaching NOK 627 million. Over the periods analyzed, the gross profit margin has shown variability, peaking at 100% and reaching a low of 83.54%. Operating expenses have fluctuated significantly while non-operating expenses have consistently been substantial, impacting net income margins negatively.

PE: -6.3x

Public Property Invest, a small player in the market, has shown a promising turnaround with Q3 2024 earnings of NOK 17 million against a NOK 285 million loss last year. Sales climbed to NOK 173 million from NOK 145 million. Despite relying entirely on external borrowing for funding, their earnings are projected to grow by 64.9% annually. Insider confidence is evident with recent share purchases throughout September and October, suggesting belief in its growth potential despite financial risks.

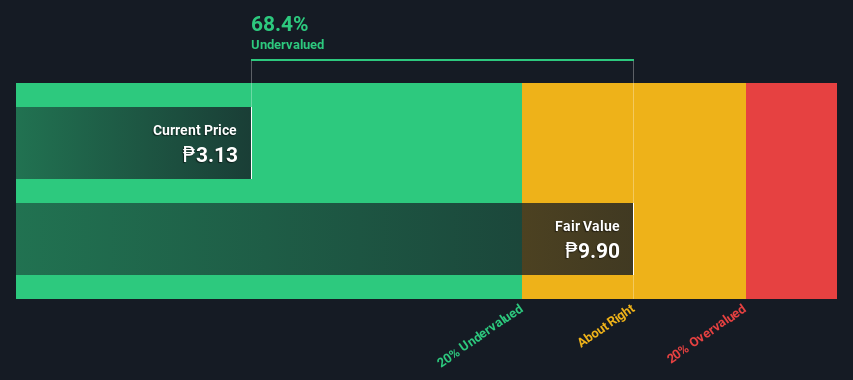

Filinvest REIT (PSE:FILRT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Filinvest REIT is engaged in the leasing of office spaces and properties, with a market capitalization of ₱12.34 billion.

Operations: Filinvest REIT generates revenue primarily through leasing activities, with a recent revenue figure of ₱2.82 billion. The company's gross profit margin has shown variability, most recently recorded at 84.96%. Operating expenses include significant allocations to general and administrative costs, which were ₱646.23 million in the latest period.

PE: 9.5x

Filinvest REIT stands out in the small-cap space with its strategic lease expansions and sustainable infrastructure. Recent insider confidence is evident, as Joseph Del Yap purchased 10 million shares for PHP 26.6 million between September and November 2024, boosting their stake significantly. The company's reliance on external borrowing poses a risk, but its commitment to renewable energy—powering 94% of its portfolio—aligns with global sustainability trends. With consistent dividend declarations and expanding client partnerships like EXLService Holdings Inc., Filinvest REIT continues to attract attention in a competitive market environment.

- Click to explore a detailed breakdown of our findings in Filinvest REIT's valuation report.

Evaluate Filinvest REIT's historical performance by accessing our past performance report.

Megaworld (PSE:MEG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Megaworld is a company engaged in real estate development, rental services, and hotel operations with a market cap of ₱53.44 billion.

Operations: The company generates revenue primarily from real estate sales and rental services, with notable contributions from hotel operations. Its gross profit margin has shown fluctuations, reaching 65.12% in September 2023 and slightly decreasing to 63.31% by September 2024. Operating expenses include significant general and administrative costs, which have been rising over the periods observed.

PE: 3.6x

Megaworld, a company with a focus on innovative real estate development, recently reported strong financial performance for Q3 2024, with sales reaching PHP 6.1 billion and net income at PHP 5.2 billion. This growth is complemented by their upscale Baytown Palawan project, expected to generate PHP 3 billion in sales by 2030. Insider confidence is evident as executives have been purchasing shares throughout the year, signaling belief in the company's future potential amidst its small-cap status and ambitious expansion plans.

- Click here and access our complete valuation analysis report to understand the dynamics of Megaworld.

Gain insights into Megaworld's historical performance by reviewing our past performance report.

Next Steps

- Gain an insight into the universe of 173 Undervalued Small Caps With Insider Buying by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Public Property Invest, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:PUBLI

Public Property Invest

A real estate company, owns, develops, operates, and rents real estate properties in Norway.

Undervalued with limited growth.

Market Insights

Community Narratives