Global markets have recently experienced a surge, with major indices like the Dow Jones Industrial Average and S&P 500 Index reaching record highs, driven by domestic policy developments and geopolitical events. For investors exploring beyond well-known stocks, penny stocks can present intriguing opportunities. While the term 'penny stock' may seem outdated, it still signifies smaller or newer companies that might offer significant potential when backed by solid financials. In this article, we explore three penny stocks that demonstrate balance sheet strength and the potential for growth in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.44B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.725 | £177.65M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

| ME Group International (LSE:MEGP) | £2.20 | £828.88M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.05 | HK$43.61B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.405 | MYR1.11B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.415 | £439.1M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.54 | £67.51M | ★★★★☆☆ |

Click here to see the full list of 5,693 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Nickel Asia (PSE:NIKL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nickel Asia Corporation is involved in the mining and exploration of nickel saprolite, limonite ore, limestone, and quarry materials in the Philippines, with a market cap of ₱42.91 billion.

Operations: The company's revenue is primarily derived from its mining operations, with significant contributions of ₱2.29 billion from CMC, ₱0.81 billion from DMC, ₱2.54 billion from HMC, ₱5.10 billion from RTN, and ₱8.84 billion from TMC; additionally, it earns revenue through power generation (₱1.03 billion EPI and ₱0.21 billion NAC) and services (₱1.61 billion RTN/TMC/CDTN).

Market Cap: ₱42.91B

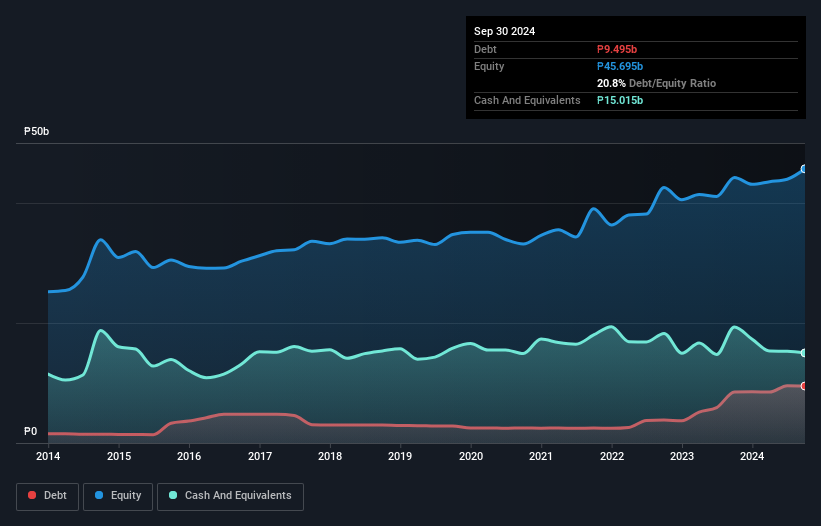

Nickel Asia Corporation's financial position shows resilience with cash exceeding total debt and short-term assets covering both short and long-term liabilities. Despite a decline in net profit margins from 18.8% to 12.3% over the past year, the company maintains high-quality earnings and a stable weekly volatility of 5%. Its price-to-earnings ratio (16.2x) is below the industry average, suggesting potential value for investors. However, recent earnings reports indicate decreased revenue and net income compared to last year, highlighting challenges in growth acceleration. The creation of a Finance Committee aims to strengthen its financial strategies moving forward.

- Jump into the full analysis health report here for a deeper understanding of Nickel Asia.

- Gain insights into Nickel Asia's future direction by reviewing our growth report.

Be Friends Holding (SEHK:1450)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Be Friends Holding Limited, with a market cap of HK$1.14 billion, is an investment holding company that provides all-media services in the People's Republic of China.

Operations: The company's revenue is primarily derived from New Media Services, contributing CN¥1.16 billion, and Television Broadcasting Business, which adds CN¥103.05 million.

Market Cap: HK$1.14B

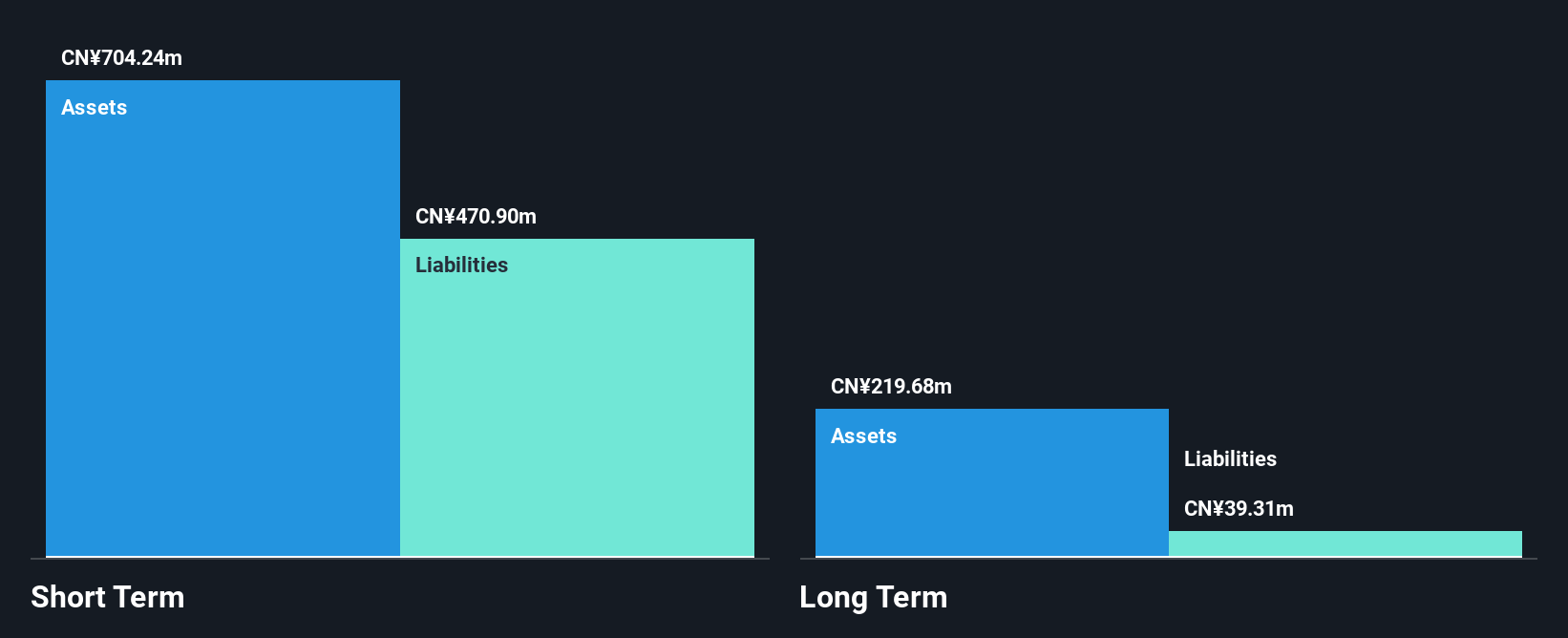

Be Friends Holding Limited demonstrates financial strength with short-term assets of CN¥674.8 million surpassing both short and long-term liabilities, and cash reserves exceeding total debt. The company's earnings have grown significantly by 158.7% over the past year, outpacing the media industry, while maintaining high-quality earnings and a strong return on equity of 37.5%. Recent leadership changes include Mr. Li Liang's appointment as CEO, bringing extensive management experience from New Oriental Education & Technology Group Inc., which may influence strategic direction positively amidst stable weekly volatility at 6%.

- Take a closer look at Be Friends Holding's potential here in our financial health report.

- Explore Be Friends Holding's analyst forecasts in our growth report.

Fufeng Group (SEHK:546)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fufeng Group Limited is an investment holding company that manufactures and sells fermentation-based food additives, as well as biochemical and starch-based products in China and internationally, with a market cap of approximately HK$12.61 billion.

Operations: The company's revenue is primarily derived from its Food Additives segment at CN¥13.85 billion, followed by Animal Nutrition at CN¥9.00 billion, High-End Amino Acid at CN¥2.22 billion, and Colloid products at CN¥2.09 billion.

Market Cap: HK$12.61B

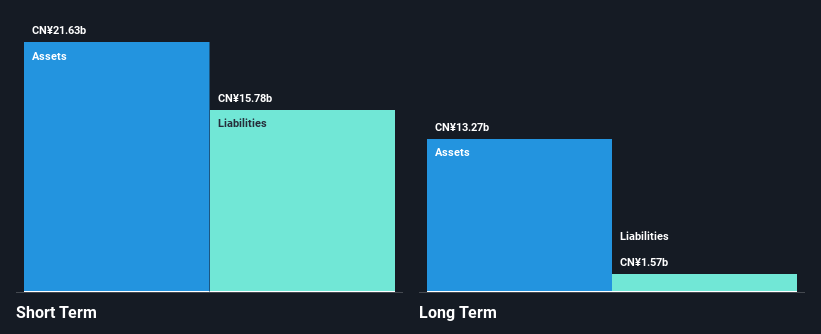

Fufeng Group Limited's financial profile presents a mixed picture, with short-term assets of CN¥21.6 billion comfortably covering both its short and long-term liabilities. Despite negative earnings growth over the past year, the company has maintained significant profit growth of 26% annually over five years. However, net profit margins have declined from 12% to 9.5%, and debt levels have increased, with a debt-to-equity ratio now at 65.5%. The company's recent share buyback activity indicates management's confidence in its valuation, yet concerns remain regarding dividend sustainability due to inadequate free cash flow coverage.

- Unlock comprehensive insights into our analysis of Fufeng Group stock in this financial health report.

- Review our growth performance report to gain insights into Fufeng Group's future.

Turning Ideas Into Actions

- Click this link to deep-dive into the 5,693 companies within our Penny Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:546

Fufeng Group

An investment holding company, engages in the manufacture and sale of fermentation-based food additive, and biochemical and starch-based products in the People’s Republic of China and internationally.

Undervalued with excellent balance sheet and pays a dividend.